DIRECTORS’ REPORT

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

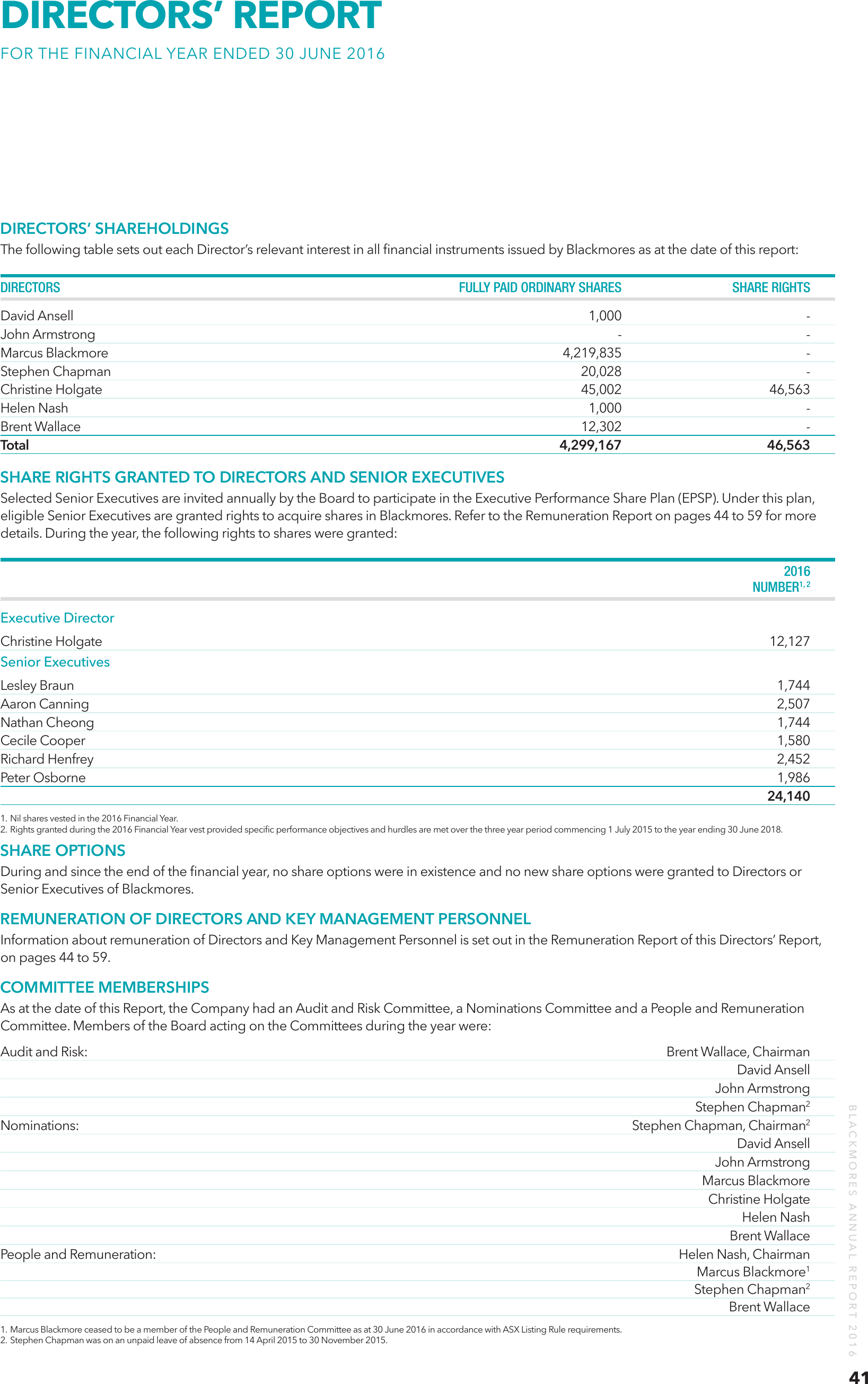

DIRECTORS’ SHAREHOLDINGS

The following table sets out each Director’s relevant interest in all financial instruments issued by Blackmores as at the date of this report:

DIRECTORS

FULLY PAID ORDINARY SHARES

David Ansell

John Armstrong

Marcus Blackmore

Stephen Chapman

Christine Holgate

Helen Nash

Brent Wallace

Total

SHARE RIGHTS

1,000

-

4,219,835

20,028

45,002

46,563

1,000

12,302

4,299,167 46,563

SHARE RIGHTS GRANTED TO DIRECTORS AND SENIOR EXECUTIVES

Selected Senior Executives are invited annually by the Board to participate in the Executive Performance Share Plan (EPSP). Under this plan,

eligible Senior Executives are granted rights to acquire shares in Blackmores. Refer to the Remuneration Report on pages 44 to 59 for more

details. During the year, the following rights to shares were granted:

2016

NUMBER1, 2

Executive Director

Christine Holgate

Senior Executives

12,127

Lesley Braun

1,744

Aaron Canning

2,507

Nathan Cheong

1,744

Cecile Cooper

1,580

Richard Henfrey

2,452

Peter Osborne

1,986

24,140

1. Nil shares vested in the 2016 Financial Year.

2. Rights granted during the 2016 Financial Year vest provided specific performance objectives and hurdles are met over the three year period commencing 1 July 2015 to the year ending 30 June 2018.

SHARE OPTIONS

During and since the end of the financial year, no share options were in existence and no new share options were granted to Directors or

Senior Executives of Blackmores.

REMUNERATION OF DIRECTORS AND KEY MANAGEMENT PERSONNEL

Information about remuneration of Directors and Key Management Personnel is set out in the Remuneration Report of this Directors’ Report,

on pages 44 to 59.

COMMITTEE MEMBERSHIPS

As at the date of this Report, the Company had an Audit and Risk Committee, a Nominations Committee and a People and Remuneration

Committee. Members of the Board acting on the Committees during the year were:

1. Marcus Blackmore ceased to be a member of the People and Remuneration Committee as at 30 June 2016 in accordance with ASX Listing Rule requirements.

2. Stephen Chapman was on an unpaid leave of absence from 14 April 2015 to 30 November 2015.

Brent Wallace, Chairman

David Ansell

John Armstrong

Stephen Chapman2

Stephen Chapman, Chairman2

David Ansell

John Armstrong

Marcus Blackmore

Christine Holgate

Helen Nash

Brent Wallace

Helen Nash, Chairman

Marcus Blackmore1

Stephen Chapman2

Brent Wallace

BLACKMORES ANNUAL REPORT 2016

Audit and Risk:

Nominations:

People and Remuneration:

41

DIRECTORS’ REPORT

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

COMPANY SECRETARIES

Cecile Cooper, BBus, Dip Inv Rel (AIRA), CPA, GAICD. Company Secretary and Director Corporate Affairs. Ms Cooper joined Blackmores in

1991. As Company Secretary, Ms Cooper is responsible for company secretarial and corporate governance support across the Group. She

has held a variety of positions within Blackmores and her experience includes financial and management experience including enterprise

resource planning system implementations, design of business reporting solutions, business management, risk management and compliance.

Ms Cooper is the Chairman of CCNB Ltd.

Aaron Canning, BCom(Hons), FCCA, GAICD. Chief Financial Officer. Mr Canning joined Blackmores in 2014 as Chief Financial Officer. He

has extensive management experience in Asia, New Zealand, the UK, the USA and Australia from ASX listed and multinational organisations

including Goodman Fielder, Westfield and Diageo Plc. His most recent experience was with Goodman Fielder as the Managing Director

Grocery Category. Prior to this he was the Managing Director Asia Pacific and Finance Director Asia Pacific. Mr Canning is a qualified

accountant, Fellow of the Association of Chartered Certified Accountants and a member of the Australian Institute of Company Directors.

PRINCIPAL ACTIVITIES

The principal activity of the Blackmores Group in the course of the financial year was the development, sales and marketing of natural health

products for humans and animals including vitamins, and herbal and mineral nutritional supplements. The Blackmores Group has operations

in Australia, New Zealand and Asia.

RESULTS

The financial report for the years ended 30 June 2016 and 30 June 2015 and the results herein have been prepared in accordance with

Australian Accounting Standards.

The net profit after tax (NPAT) attributable to the shareholders of the Blackmores Group for the financial year was $100.0 million (2015: $46.6

million).

A review of the operations of the Blackmores Group during the financial year and the results of those operations is set out in the Operating

and Financial Review on pages 14 to 23 inclusive.

DIVIDENDS

The amounts paid or declared by way of dividend since the start of the financial year are:

• a final dividend of 135 cents per share fully franked in respect of the year ended 30 June 2015, as detailed in the Directors’ Report for that

financial year, was paid on 22 September 2015

• an interim dividend of 200 cents per share fully franked in respect of the year ended 30 June 2016 was paid on 24 March 2016

• on 24 August 2016, Directors declared a final dividend for the year ended 30 June 2016 of 210 cents per share fully franked, payable on

21 September 2016 to shareholders registered on 7 September 2016.

This will bring total ordinary dividends to 410 cents per share fully franked (2015: 203 cents per share fully franked) for the full year.

CHANGES IN STATE OF AFFAIRS

During the financial year there was no significant change in the state of affairs of the Blackmores Group other than that referred to in the

Consolidated Financial Statements or notes thereto and elsewhere in the Annual Report of the Blackmores Group for the year ended

30 June 2016.

SUBSEQUENT EVENTS

There has not been any matter or circumstance, other than that referred to in the Financial Statements or notes thereto, that has arisen since

the end of the financial year, that has significantly affected, or may significantly affect, the operations of the Blackmores Limited, the results of

those operations, or the state of affairs of the Blackmores Group in future financial years.

CORPORATE GOVERNANCE

In recognising the need for the highest standards of corporate behaviour and accountability, the Board of Blackmores endorses the ASX

Corporate Governance Council’s Corporate Governance Principles and Recommendations. The Company’s Corporate Governance Statement

is available on the Blackmores’ website at blackmores.com.au (Go to ‘Investor Centre’, then click on ‘Corporate Governance’).

BLACKMORES ANNUAL REPORT 2016

42

INDEMNIFICATION OF OFFICERS AND AUDITORS

During the financial year, Blackmores paid a premium in respect of a contract insuring the Directors, the Company Secretary and all Executive

Officers of the Blackmores Group against any liability incurred in their role as Director, Company Secretary or Executive Officer to the extent

permitted by the Corporations Act 2001. The contract of insurance prohibits disclosure of the nature of the liability and the amount of the

premium. Blackmores has not otherwise, during or since the end of the financial year, indemnified or agreed to indemnify an Officer or

auditor of the Blackmores Group against a liability incurred as such an Officer or Auditor.

DIRECTORS’ REPORT

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

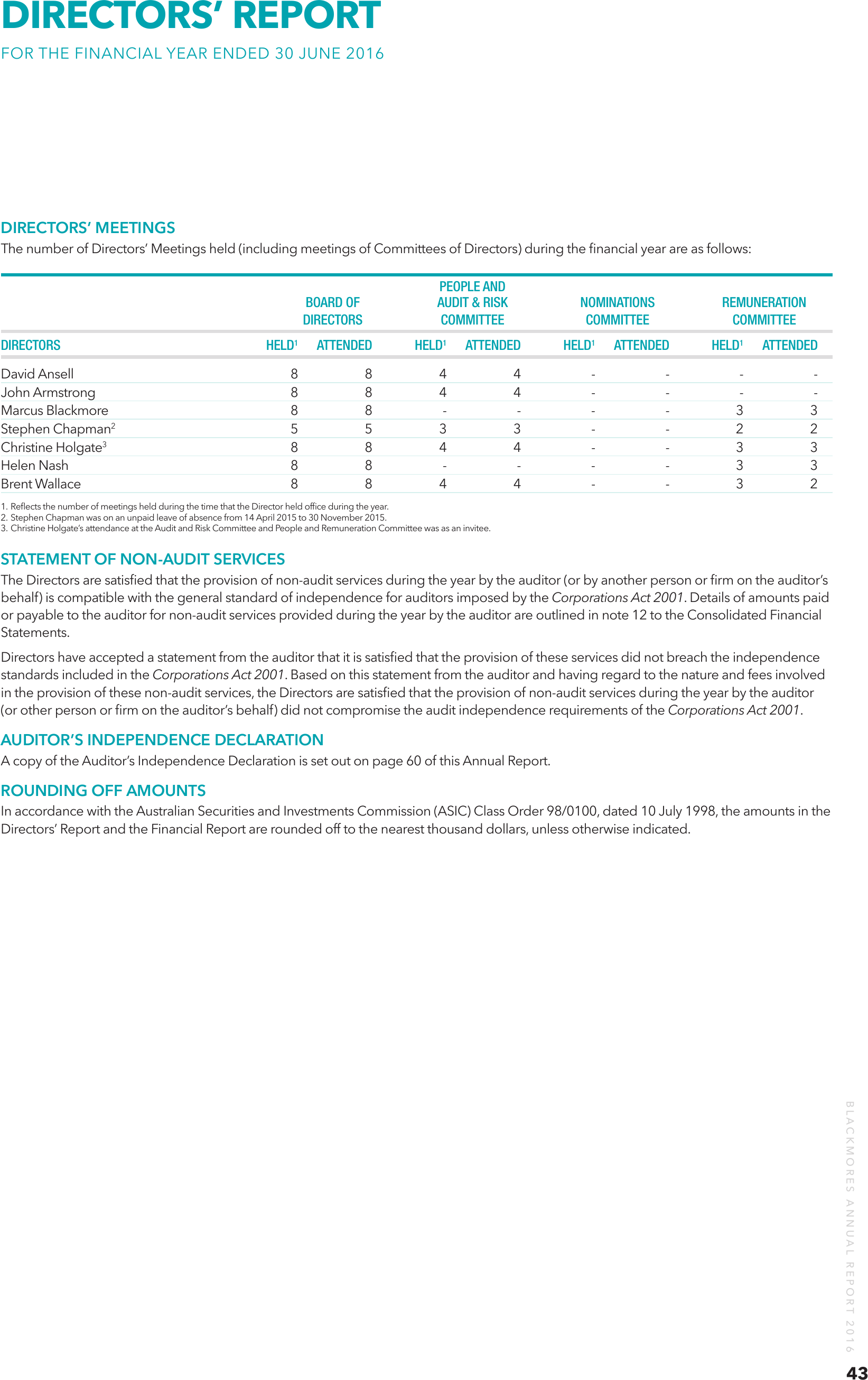

DIRECTORS’ MEETINGS

The number of Directors’ Meetings held (including meetings of Committees of Directors) during the financial year are as follows:

PEOPLE AND

BOARD OF

AUDIT & RISK

NOMINATIONS

REMUNERATION

DIRECTORS COMMITTEE COMMITTEE COMMITTEE

DIRECTORS HELD1 ATTENDED

David Ansell

John Armstrong

Marcus Blackmore

Stephen Chapman2

Christine Holgate3

Helen Nash

Brent Wallace

HELD1 ATTENDED

HELD1 ATTENDED

HELD1 ATTENDED

8 8 4 4 - - - 8 8 4 4 - - - 8

8 - - - -

3

3

5 5 3 3 - - 2 2

8 8 4 4 - - 3 3

8

8 - - - -

3

3

8 8 4 4 - - 3 2

1. Reflects the number of meetings held during the time that the Director held office during the year.

2. Stephen Chapman was on an unpaid leave of absence from 14 April 2015 to 30 November 2015.

3. Christine Holgate’s attendance at the Audit and Risk Committee and People and Remuneration Committee was as an invitee.

STATEMENT OF NON-AUDIT SERVICES

The Directors are satisfied that the provision of non-audit services during the year by the auditor (or by another person or firm on the auditor’s

behalf) is compatible with the general standard of independence for auditors imposed by the Corporations Act 2001. Details of amounts paid

or payable to the auditor for non-audit services provided during the year by the auditor are outlined in note 12 to the Consolidated Financial

Statements.

Directors have accepted a statement from the auditor that it is satisfied that the provision of these services did not breach the independence

standards included in the Corporations Act 2001. Based on this statement from the auditor and having regard to the nature and fees involved

in the provision of these non-audit services, the Directors are satisfied that the provision of non-audit services during the year by the auditor

(or other person or firm on the auditor’s behalf) did not compromise the audit independence requirements of the Corporations Act 2001.

AUDITOR’S INDEPENDENCE DECLARATION

A copy of the Auditor’s Independence Declaration is set out on page 60 of this Annual Report.

ROUNDING OFF AMOUNTS

In accordance with the Australian Securities and Investments Commission (ASIC) Class Order 98/0100, dated 10 July 1998, the amounts in the

Directors’ Report and the Financial Report are rounded off to the nearest thousand dollars, unless otherwise indicated.

BLACKMORES ANNUAL REPORT 2016

43