OPERATING + FINANCIAL REVIEW

BLACKMORES ANNUAL REPORT 2016

BLACKMORES ANNUAL REPORT 2016

18

18

%%

60 60

50 50

40 40

30 30

20 20

10 10

0 0

12 12

13 13

14 14

15 15

16 16

%%

120

120

100

100

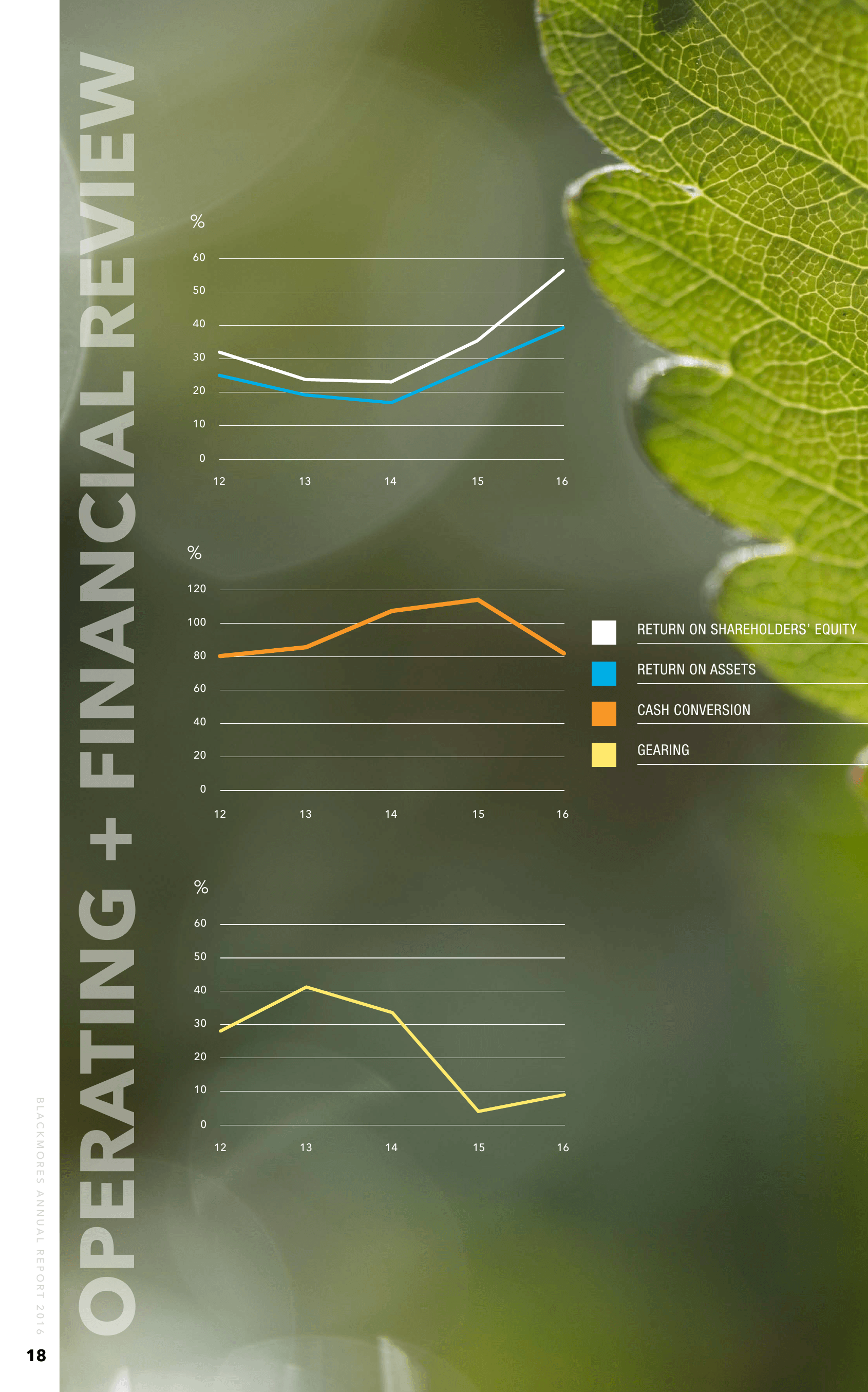

RETURN ONON SHAREHOLDERS’ EQUITY

RETURN SHAREHOLDERS’ EQUITY

80 80

RETURN ONON ASSETS

RETURN ASSETS

60 60

CASH CONVERSION

CASH CONVERSION

40 40

GEARING

GEARING

20 20

0 0

12 12

13 13

14 14

15 15

16 16

13 13

14 14

15 15

16 16

%%

60 60

50 50

40 40

30 30

20 20

10 10

0 0

12 12

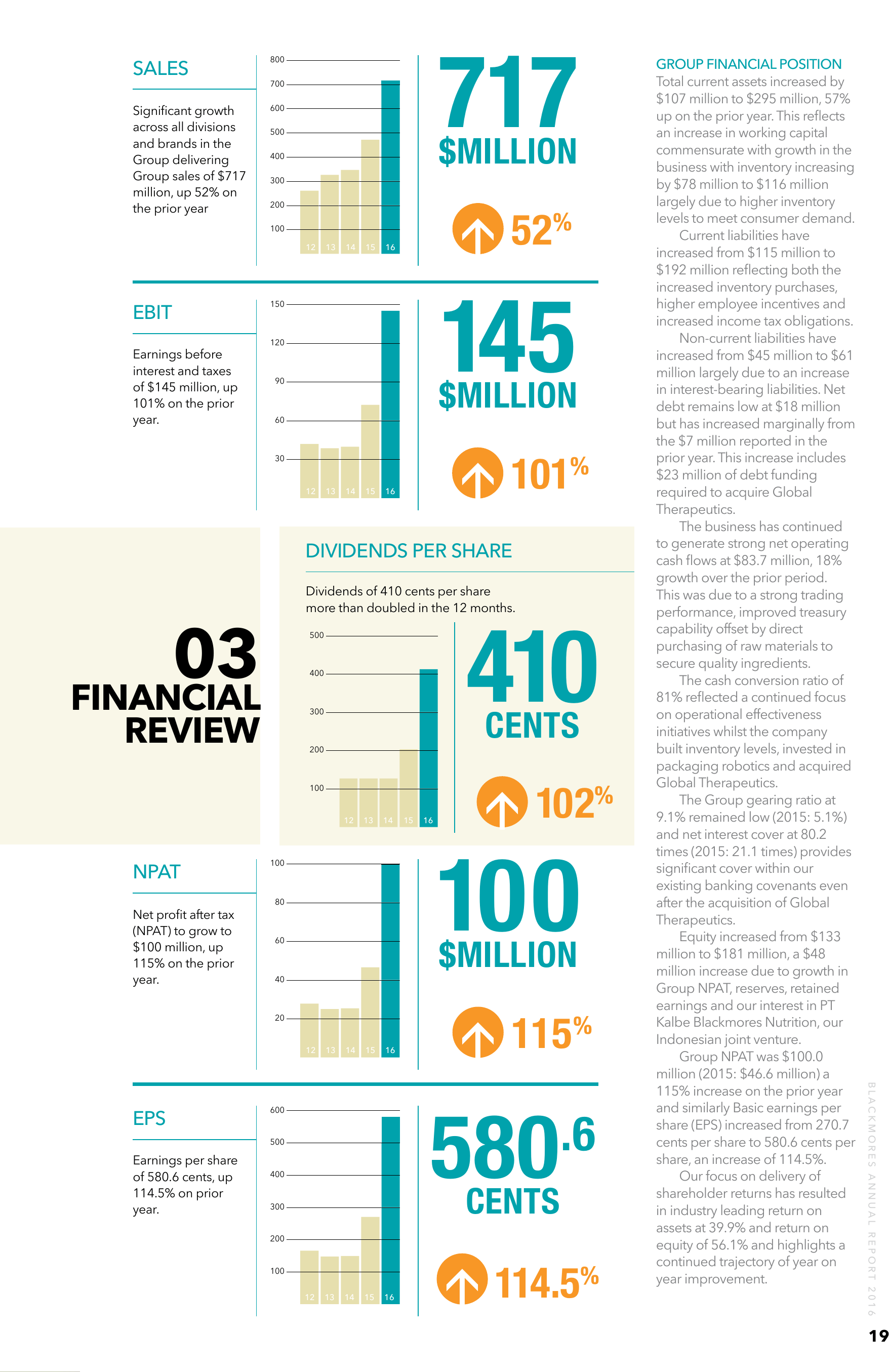

SALES

Significant growth

across all divisions

and brands in the

Group delivering

Group sales of $717

million, up 52% on

the prior year

717

800

600

700

500

$MILLION

400

300

>

200

100

12

EBIT

Earnings before

interest and taxes

of $145 million, up

101% on the prior

year.

13

14

15

16

52%

145

150

120

$MILLION

90

60

12

13

14

15

>

30

16

101%

DIVIDENDS PER SHARE

Dividends of 410 cents per share

more than doubled in the 12 months.

03

FINANCIAL

410

500

400

REVIEW

CENTS

300

100

12

80

102%

$MILLION

60

40

12

13

14

15

16

115%

400

300

.6

200

100

12

13

14

15

16

114.5%

BLACKMORES ANNUAL REPORT 2016

580

CENTS

600

500

Earnings per share

of 580.6 cents, up

114.5% on prior

year.

16

100

100

20

EPS

15

>

Net profit after tax

(NPAT) to grow to

$100 million, up

115% on the prior

year.

14

>

NPAT

13

>

200

GROUP FINANCIAL POSITION

Total current assets increased by

$107 million to $295 million, 57%

up on the prior year. This reflects

an increase in working capital

commensurate with growth in the

business with inventory increasing

by $78 million to $116 million

largely due to higher inventory

levels to meet consumer demand.

Current liabilities have

increased from $115 million to

$192 million reflecting both the

increased inventory purchases,

higher employee incentives and

increased income tax obligations.

Non-current liabilities have

increased from $45 million to $61

million largely due to an increase

in interest-bearing liabilities. Net

debt remains low at $18 million

but has increased marginally from

the $7 million reported in the

prior year. This increase includes

$23 million of debt funding

required to acquire Global

Therapeutics.

The business has continued

to generate strong net operating

cash flows at $83.7 million, 18%

growth over the prior period.

This was due to a strong trading

performance, improved treasury

capability offset by direct

purchasing of raw materials to

secure quality ingredients.

The cash conversion ratio of

81% reflected a continued focus

on operational effectiveness

initiatives whilst the company

built inventory levels, invested in

packaging robotics and acquired

Global Therapeutics.

The Group gearing ratio at

9.1% remained low (2015: 5.1%)

and net interest cover at 80.2

times (2015: 21.1 times) provides

significant cover within our

existing banking covenants even

after the acquisition of Global

Therapeutics.

Equity increased from $133

million to $181 million, a $48

million increase due to growth in

Group NPAT, reserves, retained

earnings and our interest in PT

Kalbe Blackmores Nutrition, our

Indonesian joint venture.

Group NPAT was $100.0

million (2015: $46.6 million) a

115% increase on the prior year

and similarly Basic earnings per

share (EPS) increased from 270.7

cents per share to 580.6 cents per

share, an increase of 114.5%.

Our focus on delivery of

shareholder returns has resulted

in industry leading return on

assets at 39.9% and return on

equity of 56.1% and highlights a

continued trajectory of year on

year improvement.

19