2016

REMUNERATION

REPORT

Introduction from the Chairman of the People and Remuneration Committee

Dear Shareholder,

I am pleased to present our Remuneration Report for 2016, which is designed to provide a clear summary of the remuneration strategy,

arrangements and outcomes for the Chief Executive Officer (CEO), direct reports to the CEO (Senior Executives) and Non-Executive Directors.

2016 was another exceptional year of sales and profit growth across all areas of the business. These outstanding results are directly attributable

to the dedication and quality of our people.

Throughout the year, management:

• Continued to deliver on the Group strategy to grow the business – sales up 52% and NPAT up 115%.

• Continued to deliver on the Group strategy to grow the Australian business – Australian revenue up 56.5% and EBIT up 100.9%.

• Continued to grow Blackmores’ business in Asia – total Asia sales up 54% and Asian consumers now influence 50% of Group revenue.

• Continued to invest in world class innovation and new product development – launched 117 new products, announced a partnership with

Bega to produce nutritional foods, and acquired Global Therapeutics, a leader in Chinese herbal medicine.

• Delivered responsible financial management resulting in strong net operating cash flows of $83.7 million, net debt of $17.8 million, and

return on shareholders’ equity of 56.1%.

These successes have been recognised in our share price which increased by 75% per cent during the year. We were one of the highest

performing stock of the S&P/ASX 100 companies during 2016.

Blackmores delivered total shareholders’ return (TSR) of 180% for FY16 and EPS accretion of 114.5% and dividend growth of 102%.

ALIGNING REMUNERATION WITH BUSINESS PERFORMANCE AND STRATEGY

Following last year’s record growth across all areas of the business we reviewed our remuneration framework to ensure that it retains our key

executives, rewards and recognises the individual contributions of our people and further inspires them to achieve results aligned to business

strategy and shareholder interests. As part of this review, and with particular note to the growing size and resulting market capitalisation of the

Company, the Committee conducted a thorough external benchmarking review of Senior Executive and Non-Executive Director Remuneration.

KEY OUTCOMES FOR FY16 REMUNERATION

1. Following the external benchmarking review, the Board undertook to increase the Fixed Annual Remuneration (FAR) of some senior

executives. The increases ranged between 3% and 22%. Full details are on page 53.

2. The Board is very pleased with the ongoing performance of the CEO in continuing to deliver against the business strategy and leading the

organisation through a period of unprecedented change and extraordinary growth. With regard to performance, relevant benchmarks and

previous modest increases in FAR, the Board increased the CEO’s FAR by 29%. It is the intention of the Board to conduct another review of

the CEO’s FAR for FY17.

3. In a year in which Blackmores delivered TSR of 180% and NPAT growth of 115%, it was appropriate to see NPAT financial targets for the Group

and for most of Blackmores businesses achieved or exceeded. This triggered the payment of $3,563,981 of short-term incentives (STI) to Key

Management Personnel (KMP) for FY16 which was higher than FY15 STI payments. Additionally, for the first time the FY16 STI maximum potential

incentive was set at 100% FAR and it is very pleasing to see that many senior executives have achieved this outcome. The CEO received $890,098

in STI for FY16 which represented 100% FAR. The STI was based on statutory NPAT and the Board did not exercise discretion in changing the

calculation for purposes of determining the financial achievement of targets. Full details of the STI payments are on page 55.

4. The Board was also very pleased that under the long-standing Profit Share scheme, whereby of 10% of NPAT is paid to employees of

Blackmores, delivered 44 days incremental salary for each employee as a result of the record profit.

5. No executive long-term incentive (LTI) awards were eligible to vest in FY16 as the first three year LTI plan came into effect at the beginning of

FY15. The FY16 LTI plan remains a three year plan. The total remuneration for the financial year, the details of which are shown on page 53,

includes an accounting expense for all unvested performance rights and has been calculated using the value of the maximum number of

rights that could vest over the three year performance period of each LTI plan.

BLACKMORES ANNUAL REPORT 2016

44

6. In line with market capitalisation growth and following a review of relevant external benchmarks, Non-Executive Director fees were increased

by 13.5%. Shareholders approved an increase of $300,000 to the total Directors Fee pool at the FY15 AGM. The total pool is now $1,000,000.

FUTURE CHANGES TO REMUNERATION BEING CONSIDERED

The FY17 LTI achievement hurdles have been increased following a review of market benchmarks and further consultation. The LTI plan will have

an increased threshold hurdle of 5% three year compound annual growth rate (CAGR) in EPS. In order to receive the maximum award under the

plan an achievement of 25% CAGR will be required. These new hurdles will ensure that executive reward is aligned with increasing shareholder

value, a continuous focus on the successful achievement of long-term strategic goals and long-term retention of key executive management.

On behalf of the Board and People and Remuneration Committee, I invite you to read the 2016 Remuneration Report and welcome your

feedback on our approach to and disclosure of Blackmores’ remuneration arrangements.

Helen Nash

Chairman, People and Remuneration Committee

CONTENTS

2016

REMUNERATION

REPORT

1. Introduction

2. Senior Executive Remuneration Table – Non-statutory

3. Remuneration Governance and Framework

4. Senior Executive Remuneration Structure

5. Performance and Remuneration Outcomes

6. Senior Executive Remuneration Tables – Statutory

7. Employment Contracts

8. Non-Executive Directors’ Remuneration

9. Non-Executive Directors and Senior Executive Transactions

1. INTRODUCTION

The Directors of Blackmores Limited present the Remuneration Report (the ‘Report‘) for the Blackmores Group. The Report outlines

Blackmores’ remuneration framework and the outcomes for the year ended 30 June 2016 (FY16) for Blackmores Key Management Personnel.

The Report has been prepared in accordance with the requirements of section 300A of the Corporations Act 2001.

In this Report the following terms and phrases have the meanings indicated below:

Executive Directors – Chairman and the Chief Executive Officer and Managing Director.

Directors – Executive Directors and Non-Executive Directors.

Key Management Personnel – Non-Executive Directors and Senior Executives

Senior Executives – Executive Directors and the other company executives who have authority and responsibility for planning, directing and

controlling the activities of the Blackmores Group, directly or indirectly.

Exercised – Owned.

Granted – Assigned to, but not yet vested.

Vested – Met performance criteria and available to be exercised, but not yet owned.

Key Management Personnel

The following table lists all the current Key Management Personnel (KMP) referred to in this Report:

Non-Executive Directors

David Ansell

Non-Executive Director and member of the Audit and Risk Committee and Nominations Committee

John Armstrong

Non-Executive Director and member of the Audit and Risk Committee and Nominations Committee

Stephen Chapman

Non-Executive Director, Deputy Chairman, Chairman of the Nominations Committee, member of the Audit and Risk

Committee and People and Remuneration Committee

Helen Nash

Non-Executive Director, Chairman of the People and Remuneration Committee and member of the Nominations

Committee

Brent Wallace

Non-Executive Director, Chairman of the Audit and Risk Committee, member of the People and Remuneration

Committee and Nominations Committee

Executive Directors

Marcus Blackmore

Chairman of the Board, member of the People and Remuneration Committee and Nominations Committee

Christine Holgate

Chief Executive Officer, Managing Director and member of the Nominations Committee

Senior Executives

Lesley Braun

Director Blackmores Institute

Aaron Canning

Chief Financial Officer

Nathan Cheong

Managing Director BioCeuticals

Cecile Cooper

Company Secretary and Director of Corporate Affairs

David Fenlon

Managing Director Australia and New Zealand

Richard Henfrey

Chief Operating Officer

Peter Osborne

Managing Director Asia

BLACKMORES ANNUAL REPORT 2016

45

2016

REMUNERATION

REPORT

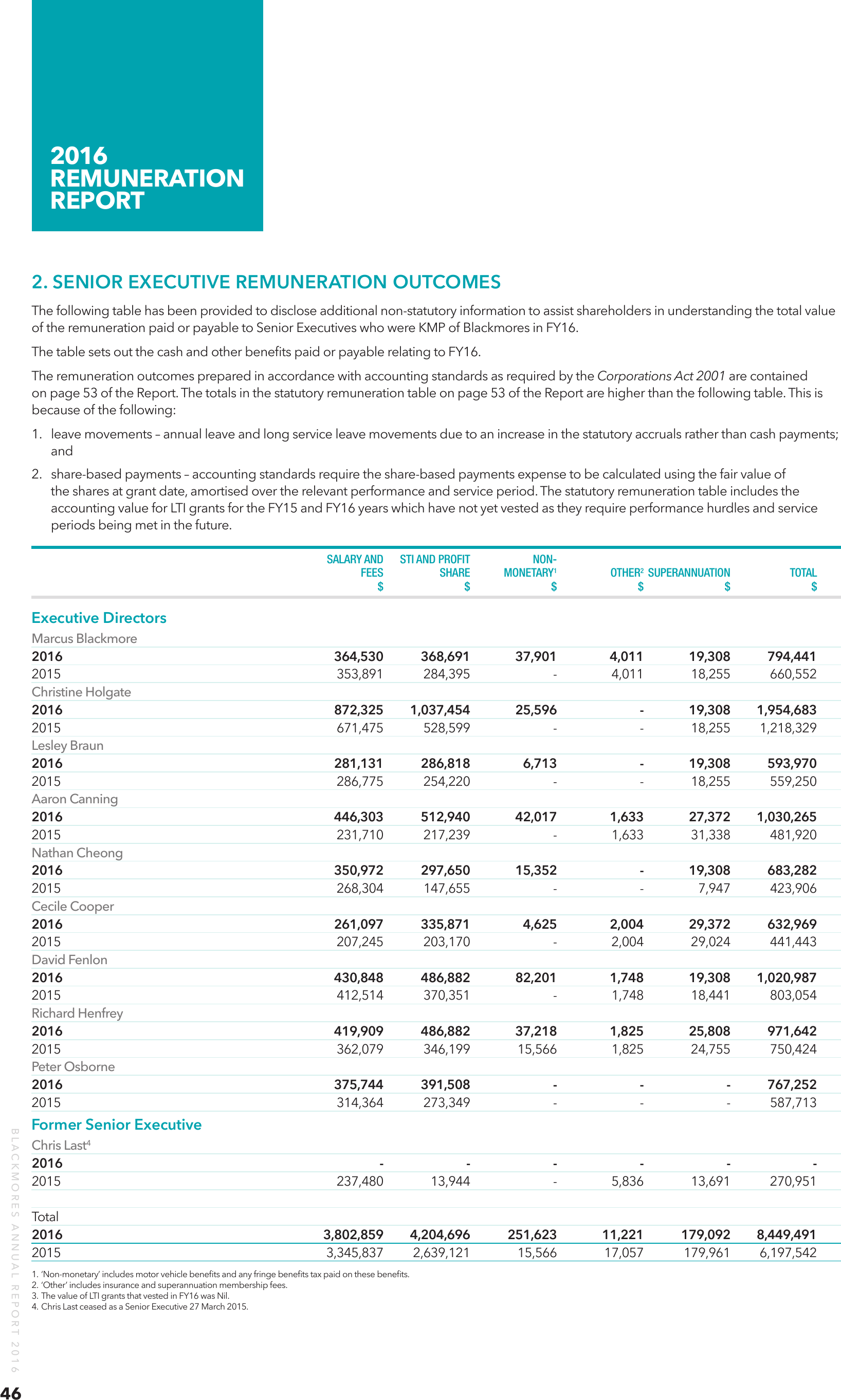

2. SENIOR EXECUTIVE REMUNERATION OUTCOMES

The following table has been provided to disclose additional non-statutory information to assist shareholders in understanding the total value

of the remuneration paid or payable to Senior Executives who were KMP of Blackmores in FY16.

The table sets out the cash and other benefits paid or payable relating to FY16.

The remuneration outcomes prepared in accordance with accounting standards as required by the Corporations Act 2001 are contained

on page 53 of the Report. The totals in the statutory remuneration table on page 53 of the Report are higher than the following table. This is

because of the following:

1. leave movements – annual leave and long service leave movements due to an increase in the statutory accruals rather than cash payments;

and

2. share-based payments – accounting standards require the share-based payments expense to be calculated using the fair value of

the shares at grant date, amortised over the relevant performance and service period. The statutory remuneration table includes the

accounting value for LTI grants for the FY15 and FY16 years which have not yet vested as they require performance hurdles and service

periods being met in the future.

SALARY AND STI AND PROFIT

NON-

FEES

SHARE MONETARY1

OTHER2 SUPERANNUATION

TOTAL

$ $ $ $ $ $

Executive Directors

Marcus Blackmore

2016

364,530

368,691

37,901

4,011

19,308

794,441

2015

353,891

284,395

-

4,011

18,255

660,552

Christine Holgate

2016

872,325

1,037,454

25,596

-

19,308

1,954,683

2015

671,475

528,599

-

-

18,255

1,218,329

Lesley Braun

2016

281,131

286,818

6,713

-

19,308

593,970

2015

286,775

254,220

-

-

18,255

559,250

Aaron Canning

2016

446,303

512,940

42,017

1,633

27,372

1,030,265

2015

231,710

217,239

-

1,633

31,338

481,920

Nathan Cheong

2016

350,972

297,650

15,352

-

19,308

683,282

2015

268,304

147,655

-

-

7,947

423,906

Cecile Cooper

2016

261,097

335,871

4,625

2,004

29,372

632,969

2015

207,245

203,170

-

2,004

29,024

441,443

David Fenlon

2016

430,848

486,882

82,201

1,748

19,308

1,020,987

2015

412,514

370,351

-

1,748

18,441

803,054

Richard Henfrey

2016

419,909

486,882

37,218

1,825

25,808

971,642

2015

362,079

346,199

15,566

1,825

24,755

750,424

Peter Osborne

2016

375,744

391,508

- - -

767,252

2015

314,364

273,349

- - -

587,713

BLACKMORES ANNUAL REPORT 2016

46

Former Senior Executive

Chris Last4

2016

- - - - - 2015

237,480

13,944

-

5,836

13,691

270,951

Total

2016

3,802,859

4,204,696 251,623 11,221 179,092

8,449,491

2015

3,345,837

2,639,121 15,566 17,057

179,961

6,197,542

1. ‘Non-monetary’ includes motor vehicle benefits and any fringe benefits tax paid on these benefits.

2. ‘Other’ includes insurance and superannuation membership fees.

3. The value of LTI grants that vested in FY16 was Nil.

4. Chris Last ceased as a Senior Executive 27 March 2015.

2016

REMUNERATION

REPORT

3. REMUNERATION GOVERNANCE AND FRAMEWORK

Remuneration Governance

People and Remuneration Committee

The primary responsibility of the People and Remuneration Committee (the ‘Committee‘) is to make recommendations to the Board on

remuneration strategy and policy for KMP and other executives of Blackmores that are in the best interests of Blackmores and its shareholders.

This includes recommendations related to Non-Executive Directors Fees, executive remuneration and Short-term Incentives (STI ) and

Long-term Incentive (LTI) schemes. The Committee also advises the Board on remuneration policies and practices for the Company. The

responsibilities of the People and Remuneration Committee are set out in the Committee’s charter which can be viewed or downloaded from

the Company’s website at blackmores.com.au (go to ‘Investor Centre’, then click on ‘Corporate Governance’). The charter is reviewed annually

by the Committee and the Board.

The People and Remuneration Committee comprises three independent Non-Executive Directors and the Executive Chairman who have

experience in both remuneration governance and the Blackmores business. The members during FY16 were Helen Nash (Committee

Chairman), Marcus Blackmore (Executive Chairman), Stephen Chapman and Brent Wallace.

Marcus Blackmore will cease be a member of the Committee in FY17 in accordance with ASX Listing Rule requirements.

Advisors to the Committee

The People and Remuneration Committee has established protocols for engaging and dealing with external advisors and this is included

in the Committee’s charter. The Committee obtains specialist external advice about remuneration structure and levels. The advice is used to

support its assessment of the market to ensure that Senior Executives and Non-Executive Directors are being rewarded appropriately, given

their responsibilities and experience. Executive remuneration packages are also reviewed annually against suitable benchmarks to ensure that

an appropriate balance between fixed and incentive pay is achieved.

The Committee did not use a remuneration consultant in the current financial year. Benchmarking of KMPs was conducted by utilising various

independent published remuneration surveys.

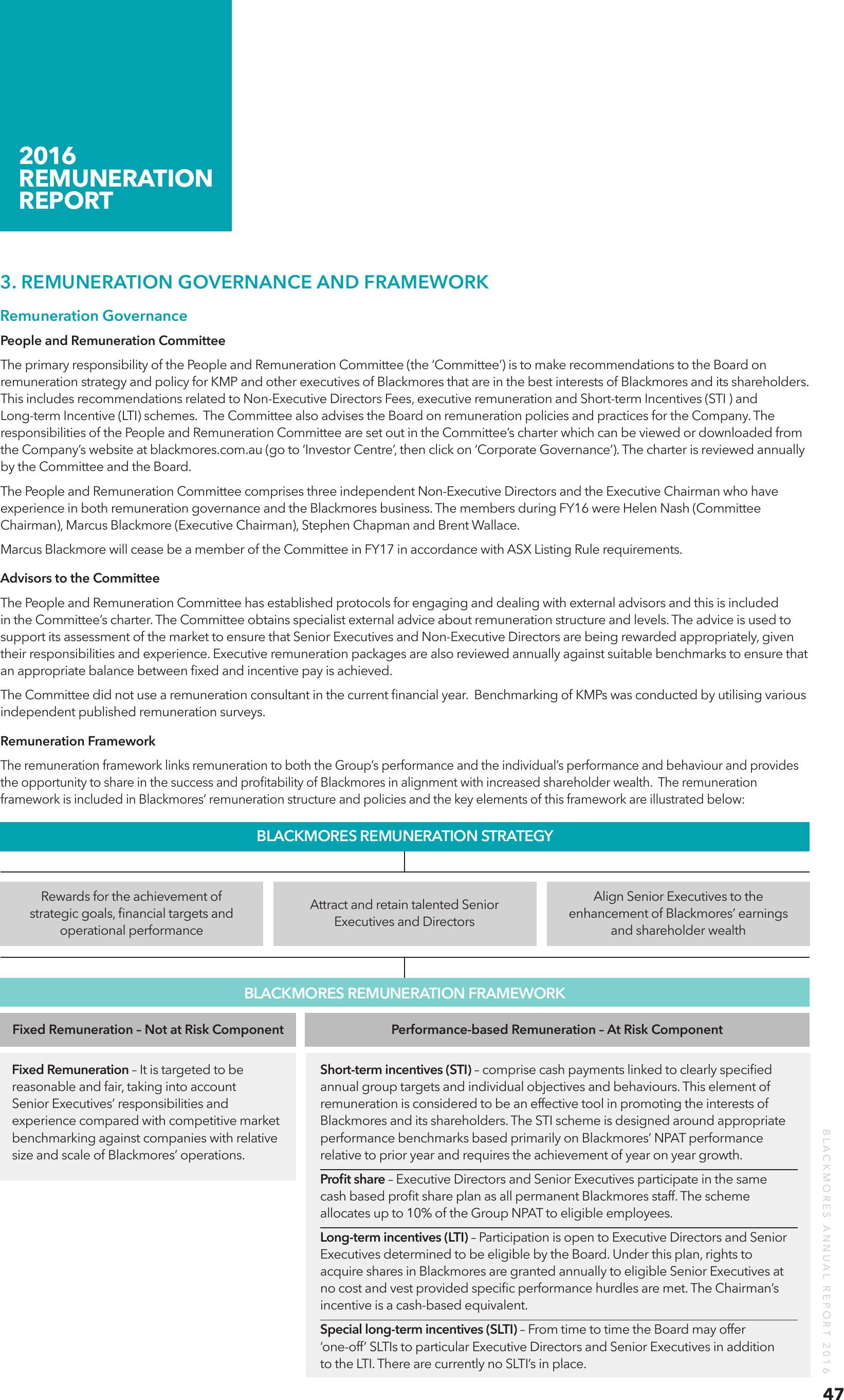

Remuneration Framework

The remuneration framework links remuneration to both the Group’s performance and the individual’s performance and behaviour and provides

the opportunity to share in the success and profitability of Blackmores in alignment with increased shareholder wealth. The remuneration

framework is included in Blackmores’ remuneration structure and policies and the key elements of this framework are illustrated below:

BLACKMORES REMUNERATION STRATEGY

Rewards for the achievement of

strategic goals, financial targets and

operational performance

Attract and retain talented Senior

Executives and Directors

Align Senior Executives to the

enhancement of Blackmores’ earnings

and shareholder wealth

BLACKMORES REMUNERATION FRAMEWORK

Fixed Remuneration – Not at Risk Component

Short-term incentives (STI) – comprise cash payments linked to clearly specified

annual group targets and individual objectives and behaviours. This element of

remuneration is considered to be an effective tool in promoting the interests of

Blackmores and its shareholders. The STI scheme is designed around appropriate

performance benchmarks based primarily on Blackmores’ NPAT performance

relative to prior year and requires the achievement of year on year growth.

Profit share – Executive Directors and Senior Executives participate in the same

cash based profit share plan as all permanent Blackmores staff. The scheme

allocates up to 10% of the Group NPAT to eligible employees.

Long-term incentives (LTI) – Participation is open to Executive Directors and Senior

Executives determined to be eligible by the Board. Under this plan, rights to

acquire shares in Blackmores are granted annually to eligible Senior Executives at

no cost and vest provided specific performance hurdles are met. The Chairman’s

incentive is a cash-based equivalent.

Special long-term incentives (SLTI) – From time to time the Board may offer

‘one-off’ SLTIs to particular Executive Directors and Senior Executives in addition

to the LTI. There are currently no SLTI’s in place.

BLACKMORES ANNUAL REPORT 2016

Fixed Remuneration – It is targeted to be

reasonable and fair, taking into account

Senior Executives’ responsibilities and

experience compared with competitive market

benchmarking against companies with relative

size and scale of Blackmores’ operations.

Performance-based Remuneration – At Risk Component

47

2016

REMUNERATION

REPORT

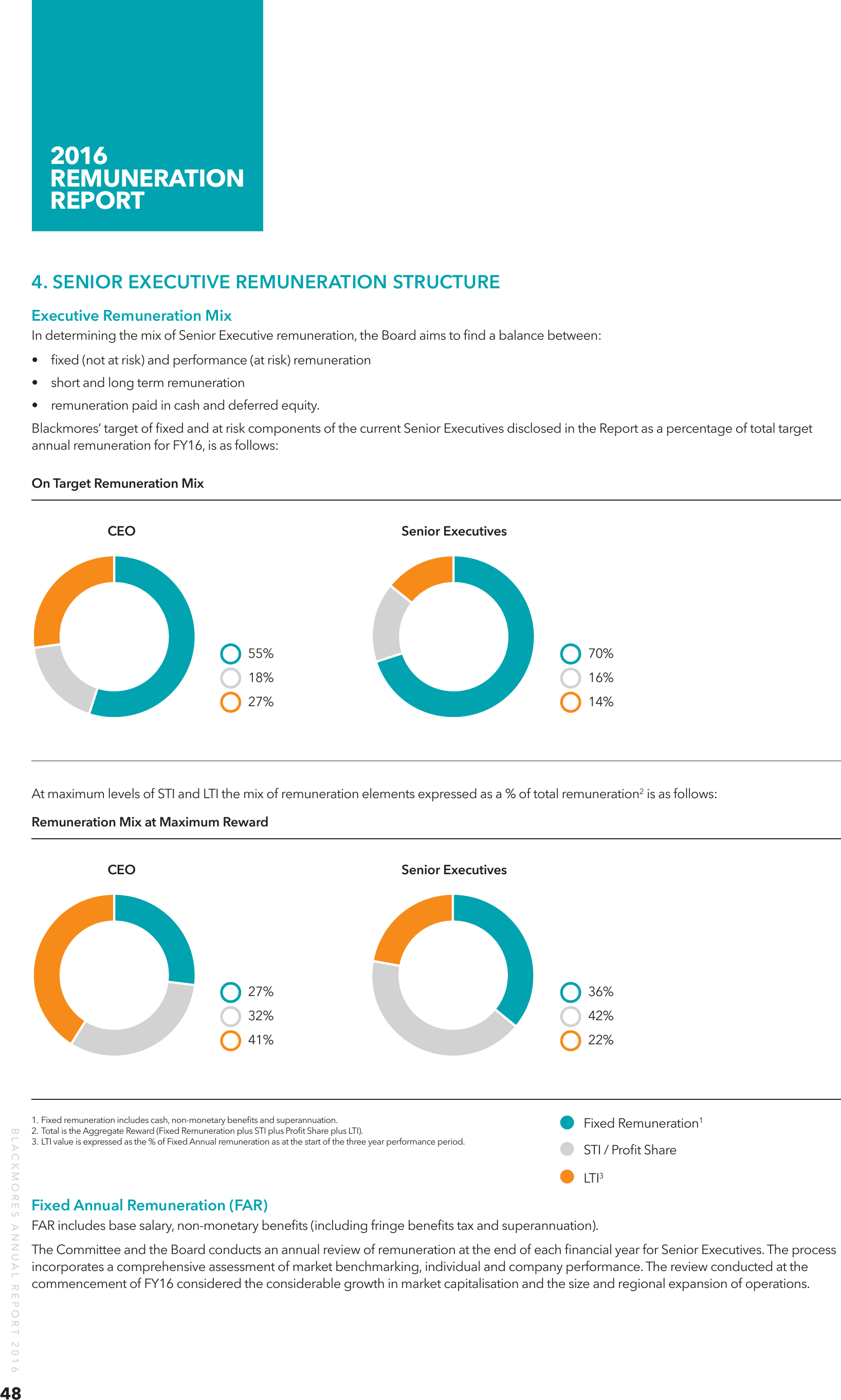

4. SENIOR EXECUTIVE REMUNERATION STRUCTURE

Executive Remuneration Mix

In determining the mix of Senior Executive remuneration, the Board aims to find a balance between:

• fixed (not at risk) and performance (at risk) remuneration

• short and long term remuneration

• remuneration paid in cash and deferred equity.

Blackmores’ target of fixed and at risk components of the current Senior Executives disclosed in the Report as a percentage of total target

annual remuneration for FY16, is as follows:

On Target Remuneration Mix

CEO

Senior Executives

55%

70%

18%

16%

27%

14%

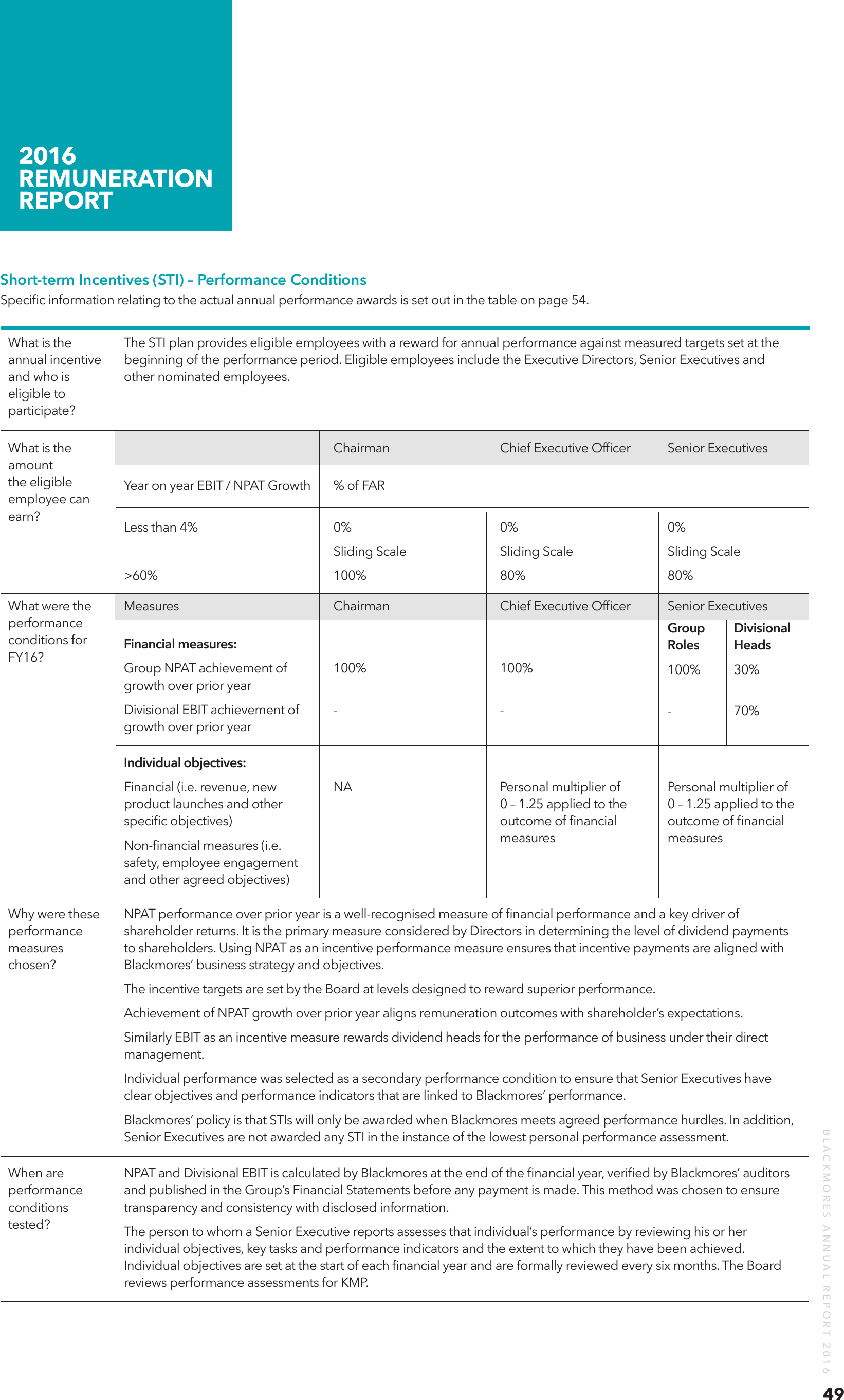

At maximum levels of STI and LTI the mix of remuneration elements expressed as a % of total remuneration2 is as follows:

Remuneration Mix at Maximum Reward

CEO

Senior Executives

27%

32%

42%

41%

BLACKMORES ANNUAL REPORT 2016

48

36%

22%

1. Fixed remuneration includes cash, non-monetary benefits and superannuation.

2. Total is the Aggregate Reward (Fixed Remuneration plus STI plus Profit Share plus LTI).

3. LTI value is expressed as the % of Fixed Annual remuneration as at the start of the three year performance period.

Fixed Remuneration1

STI / Profit Share

LTI3

Fixed Annual Remuneration (FAR)

FAR includes base salary, non-monetary benefits (including fringe benefits tax and superannuation).

The Committee and the Board conducts an annual review of remuneration at the end of each financial year for Senior Executives. The process

incorporates a comprehensive assessment of market benchmarking, individual and company performance. The review conducted at the

commencement of FY16 considered the considerable growth in market capitalisation and the size and regional expansion of operations.

2016

REMUNERATION

REPORT

Short-term Incentives (STI) – Performance Conditions

Specific information relating to the actual annual performance awards is set out in the table on page 54.

What is the

annual incentive

and who is

eligible to

participate?

What is the

amount

the eligible

employee can

earn?

The STI plan provides eligible employees with a reward for annual performance against measured targets set at the

beginning of the performance period. Eligible employees include the Executive Directors, Senior Executives and

other nominated employees.

Chairman

Chief Executive Officer

Senior Executives

% of FAR

Less than 4%

0%

0%

0%

Sliding Scale

Sliding Scale

Sliding Scale

>60%

What were the

performance

conditions for

FY16?

Year on year EBIT / NPAT Growth

100%

80%

80%

Measures

Chairman

Chief Executive Officer

Senior Executives

Group

Divisional

Roles Heads

Financial measures:

Group NPAT achievement of

growth over prior year

100%

100%

100% 30%

Divisional EBIT achievement of

growth over prior year

-

-

- 70%

NA

Personal multiplier of

0 – 1.25 applied to the

outcome of financial

measures

Personal multiplier of

0 – 1.25 applied to the

outcome of financial

measures

Individual objectives:

Financial (i.e. revenue, new

product launches and other

specific objectives)

Non-financial measures (i.e.

safety, employee engagement

and other agreed objectives)

Why were these

performance

measures

chosen?

NPAT performance over prior year is a well-recognised measure of financial performance and a key driver of

shareholder returns. It is the primary measure considered by Directors in determining the level of dividend payments

to shareholders. Using NPAT as an incentive performance measure ensures that incentive payments are aligned with

Blackmores’ business strategy and objectives.

The incentive targets are set by the Board at levels designed to reward superior performance.

Achievement of NPAT growth over prior year aligns remuneration outcomes with shareholder’s expectations.

Similarly EBIT as an incentive measure rewards dividend heads for the performance of business under their direct

management.

Individual performance was selected as a secondary performance condition to ensure that Senior Executives have

clear objectives and performance indicators that are linked to Blackmores’ performance.

When are

performance

conditions

tested?

NPAT and Divisional EBIT is calculated by Blackmores at the end of the financial year, verified by Blackmores’ auditors

and published in the Group’s Financial Statements before any payment is made. This method was chosen to ensure

transparency and consistency with disclosed information.

The person to whom a Senior Executive reports assesses that individual’s performance by reviewing his or her

individual objectives, key tasks and performance indicators and the extent to which they have been achieved.

Individual objectives are set at the start of each financial year and are formally reviewed every six months. The Board

reviews performance assessments for KMP.

BLACKMORES ANNUAL REPORT 2016

Blackmores’ policy is that STIs will only be awarded when Blackmores meets agreed performance hurdles. In addition,

Senior Executives are not awarded any STI in the instance of the lowest personal performance assessment.

49

2016

REMUNERATION

REPORT

Profit Share – Performance Conditions and Operation

Specific information relating to the actual annual performance awards is set out in the table on page 54.

What is the annual

incentive and who is

eligible to participate?

Senior Executives participate in a profit share plan, whereby up to 10% of the Group NPAT is allocated to

all eligible permanent Group staff on a pro-rata basis by reference to their fixed annual remuneration. The

profit share plan is in addition to the STI award.

What is the amount the

executive can earn?

The amount distributed is a percentage of Group NPAT. As the amount is distributed on a pro-rata basis,

the amount earned in any year depends on both the Group NPAT achievement and the total number of

employees and salaries in the calculation. The approximate maximum amount of fixed annual remuneration

that can be earned is 17%.

What were the

performance conditions

for FY16?

Under the Company’s Collective Agreement, 7.5% of Group NPAT is allocated and an additional 2.5% of

Group NPAT is allocated conditional on the achievement of Group NPAT growth on the prior financial year.

Why were these

performance measures

chosen?

NPAT is a well-recognised measure of financial performance and a key driver of shareholder returns. Using

NPAT as an incentive performance measure ensures that incentive payments are aligned with Blackmores’

business strategy and objectives.

When are performance

conditions tested?

Profit share is paid twice a year based on Blackmores’ NPAT calculation.

All employees, including Senior Executives, may purchase up to $1,000 of Blackmores shares each year

under the Staff Share Acquisition Plan with money that would have otherwise been received under the

profit share plan.

Long-term Incentives (LTI) – Performance Conditions

Specific information relating to the actual annual performance awards is set out in the table on page 54.

What is the annual

incentive and who is

eligible to participate?

Eligible employees are invited annually by the Board to participate in the Executive Performance Share Plan

(EPSP). Under this plan, eligible employees are granted rights to acquire shares in Blackmores.

What is the amount the

eligible employee can

earn?

Chief Executive Officer

% of target performance

% of FAR

Less than 3.9%

3.9%

3.9% to 7.8%

7.8%

7.8% to 17.9%

17.9%

0%

25%

Sliding scale

50%

Sliding scale

150%

Eligible employees include the Executive Directors, Senior Executives and other nominated employees.

Chairman and Senior Executives

0%

10%

Sliding Scale

20%

Sliding scale

60%

What was the performance

condition for FY16?

Why were these

performance measures

chosen?

BLACKMORES ANNUAL REPORT 2016

50

The performance condition is the three-year compound annual growth rate in EPS. The performance period

for measuring EPS growth is three years (FY16 to FY18).

In determining the performance conditions for Blackmores’ LTI plan, the Board has recognised EPS growth

to be the key driver of shareholder value, influencing both share price and the capacity to pay increased

dividends.

Growth in EPS is simple to calculate and basing the vesting of rights on EPS growth encourages Senior

Executives to improve Blackmores’ financial performance. As Senior Executives increase their shareholding

in Blackmores through awards received under the EPSP, their interests become more directly aligned with

those of Blackmores’ other shareholders.

2016

REMUNERATION

REPORT

Long-term Incentives (LTI) – Performance Conditions

How does the EPSP

operate?

The value of rights granted to eligible employees is equivalent to a percentage of their base remuneration

at the time of grant.

The number of rights granted equals the value of rights divided by:

•

the weighted average price of Blackmores shares for the five day trading period commencing seven

days after Blackmores’ results in respect of the prior financial year (year ended 30 June 2015) are

announced to the ASX, less

•

the amount of any final dividend per share declared as payable in respect of the prior financial year

(year ended 30 June 2015).

Rights are automatically exercised following vesting, audit clearance of the 2018 Financial Statements, Board

approval and the first trading window. These Blackmores shares are issued to participants at zero cost.

The number of shares issued is identical to the number of rights exercised.

In the case of the Chairman, a cash equivalent is paid in lieu of shares. Where regulations prohibit an equity

based plan, a cash equivalent is awarded.

When are performance

conditions tested?

Compounded annual growth in EPS is calculated at the end of the three year performance period and

verified with reference to Blackmores’ audited Financial Statements prior to determining the number of

rights that will vest. This method was chosen as it is an objective test that is easy to calculate and ensures

transparency and consistency with public disclosures.

What happens if the

eligible employee ceases

employment during the

performance period?

If an executive ceases employment during the three year performance period the rights lapse. In certain

circumstances the board has discretion to allow a portion of rights to vest for a ‘good leaver‘.

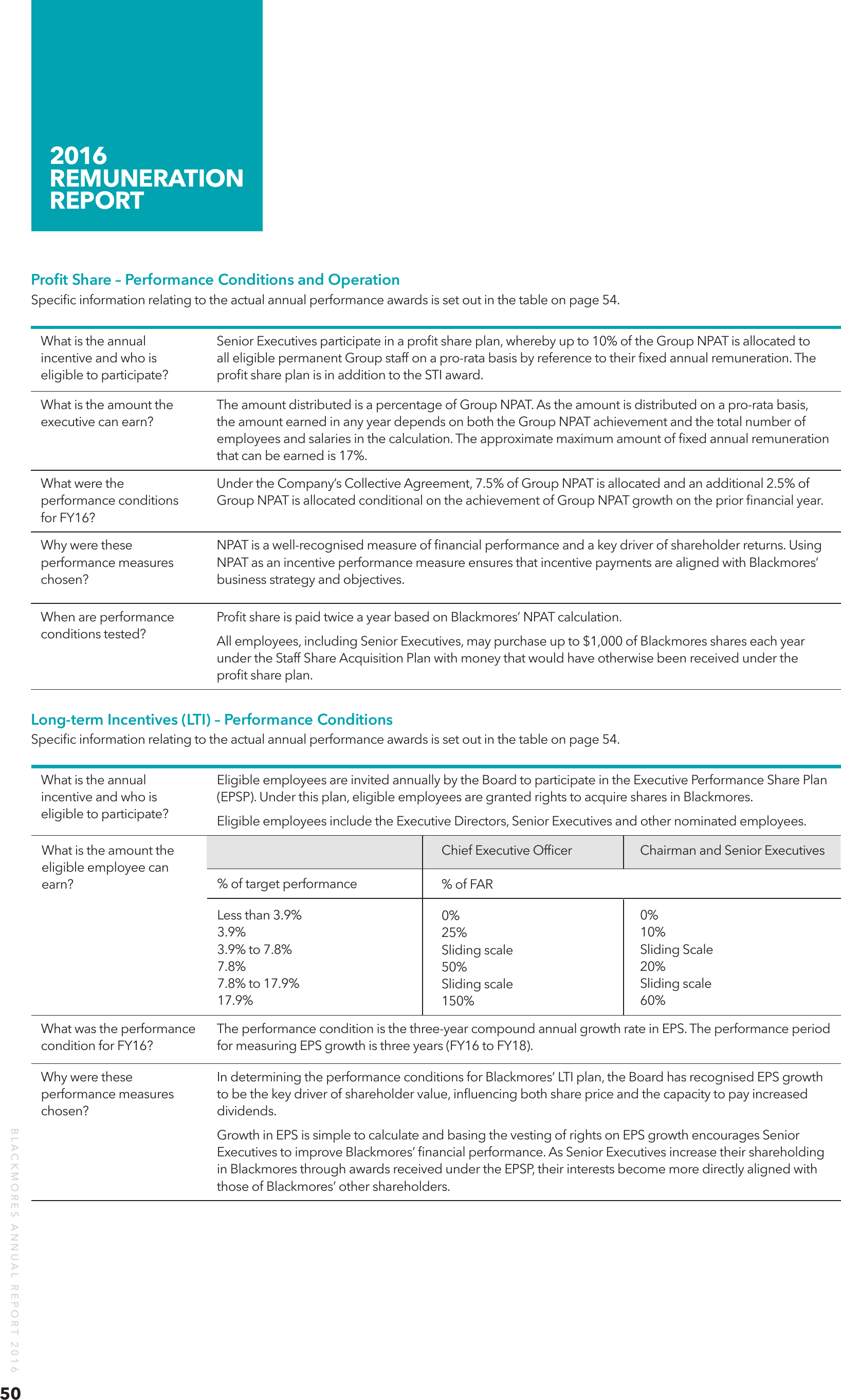

5. PERFORMANCE AND REMUNERATION OUTCOMES

Performance Incentives – Actual Performance 2016 Financial Year

A continued focus on delivering against the strategic priorities and unprecedented growth over the past two years is reflected in improved

returns that are illustrated in the charts below:

500

60

DIVIDEND PER SHARE (CENTS)

400

410

RETURN ON EQUITY (%)

56%

50

300

40

200

30

100

0

2012

2013

2014

2015

2016

20

2012

2013

2015

SHARE PRICE ($)

131.4

120

Investors who bought a

Blackmores share five years

ago would have multiplied

their investment five times.

2016

90

60

30

0

2012

2013

2014

2015

2016

BLACKMORES ANNUAL REPORT 2016

150

2014

51

2016

REMUNERATION

REPORT

100

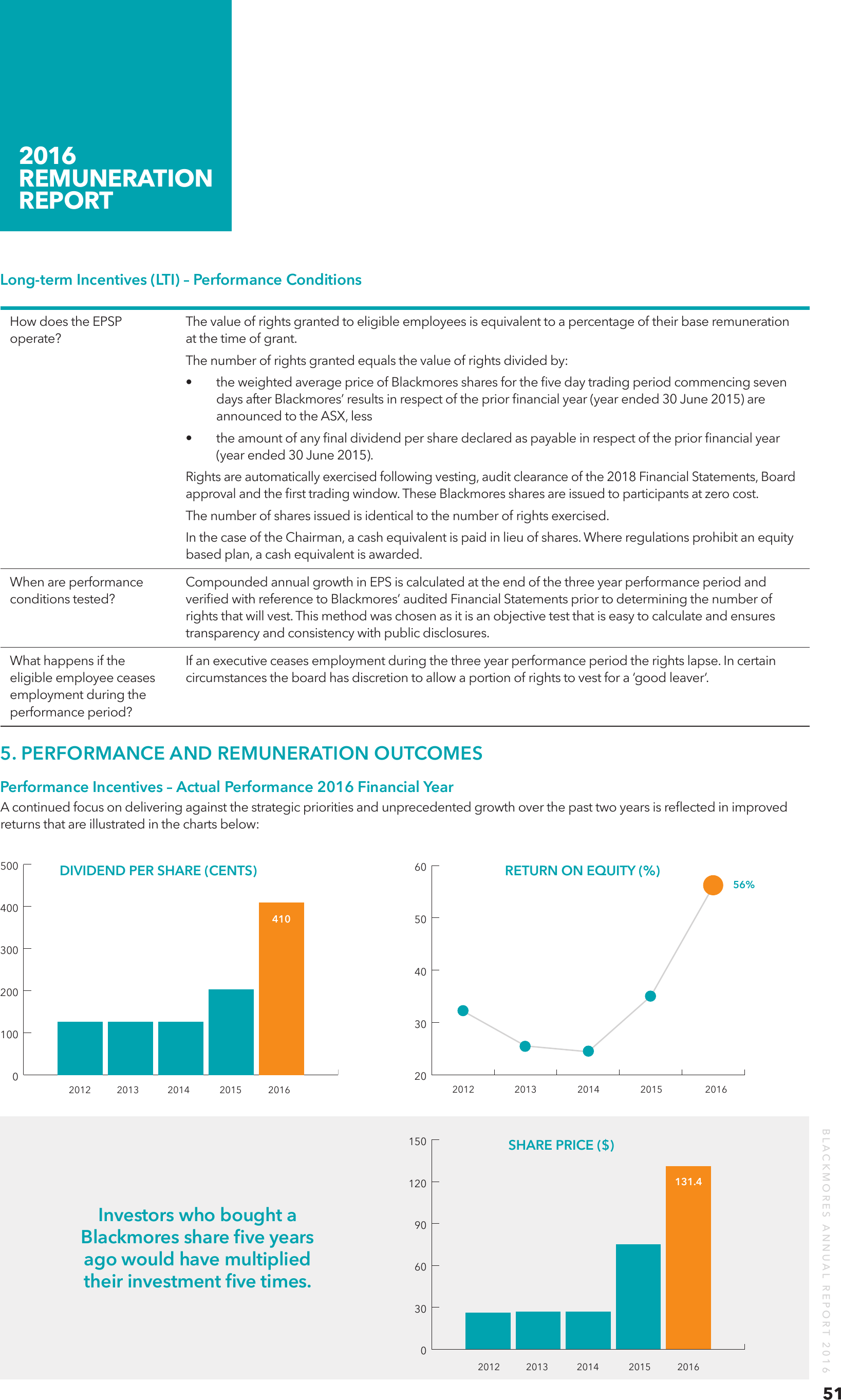

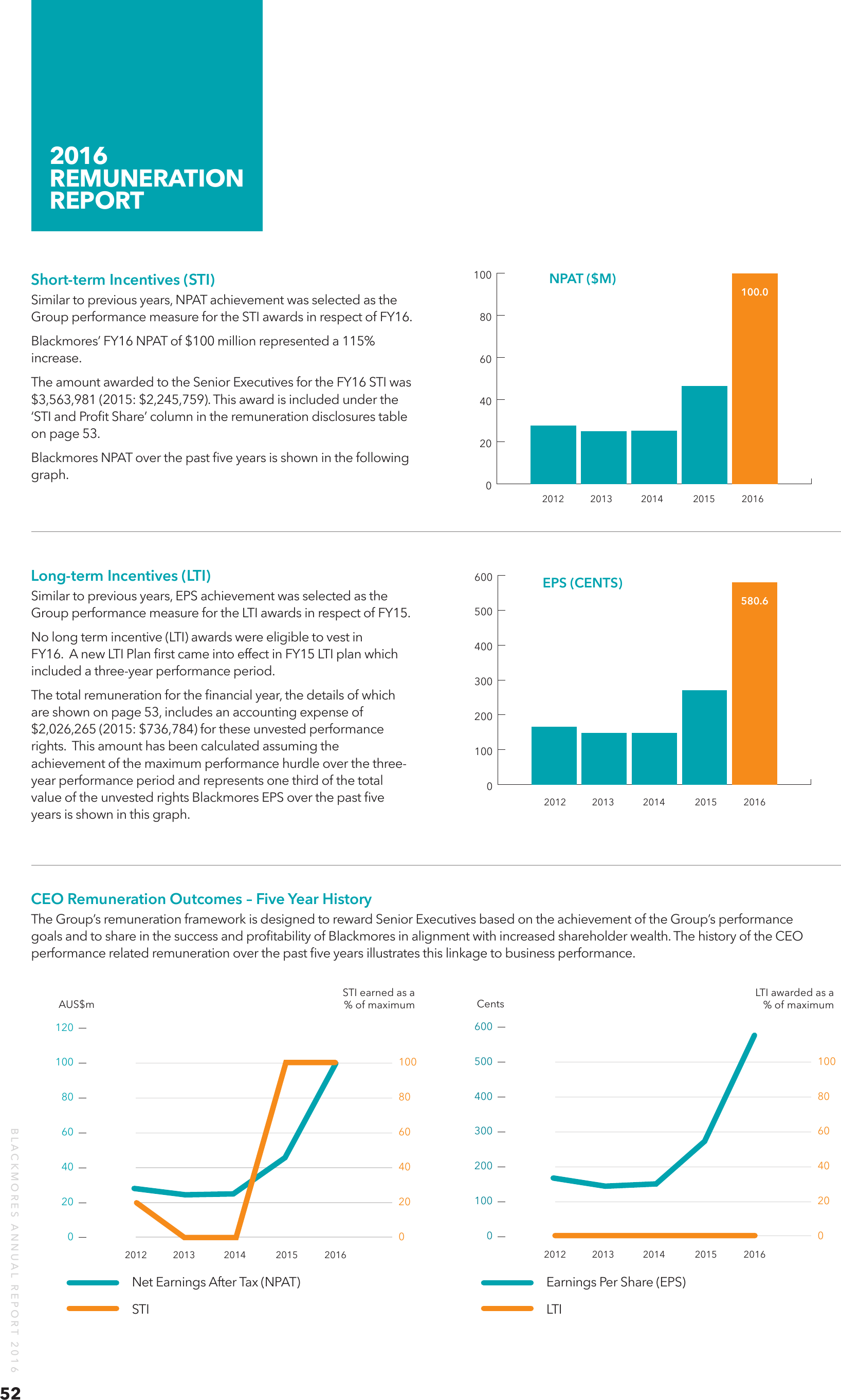

Short-term Incentives (STI)

Similar to previous years, NPAT achievement was selected as the

Group performance measure for the STI awards in respect of FY16.

100.0

80

Blackmores’ FY16 NPAT of $100 million represented a 115%

increase.

NPAT ($M)

60

The amount awarded to the Senior Executives for the FY16 STI was

$3,563,981 (2015: $2,245,759). This award is included under the

‘STI and Profit Share’ column in the remuneration disclosures table

on page 53.

Blackmores NPAT over the past five years is shown in the following

graph.

Long-term Incentives (LTI)

Similar to previous years, EPS achievement was selected as the

Group performance measure for the LTI awards in respect of FY15.

No long term incentive (LTI) awards were eligible to vest in

FY16. A new LTI Plan first came into effect in FY15 LTI plan which

included a three-year performance period.

40

20

0

600

2012

2013

2014

2015

EPS (CENTS)

2016

580.6

500

400

The total remuneration for the financial year, the details of which

are shown on page 53, includes an accounting expense of

$2,026,265 (2015: $736,784) for these unvested performance

rights. This amount has been calculated assuming the

achievement of the maximum performance hurdle over the threeyear performance period and represents one third of the total

value of the unvested rights Blackmores EPS over the past five

years is shown in this graph.

300

200

100

0

2012

2013

2014

2015

2016

CEO Remuneration Outcomes – Five Year History

The Group’s remuneration framework is designed to reward Senior Executives based on the achievement of the Group’s performance

goals and to share in the success and profitability of Blackmores in alignment with increased shareholder wealth. The history of the CEO

performance related remuneration over the past five years illustrates this linkage to business performance.

STI earned as a

% of maximum

AUS$m

LTI awarded as a

% of maximum

Cents

600

120

52

100

500

100

80

BLACKMORES ANNUAL REPORT 2016

100

80

400

80

60

60

300

60

40

40

200

40

20

20

100

20

0

0

2012

2013

2014

2015

2016

0

0

2012

2013

2014

Net Earnings After Tax (NPAT)

Earnings Per Share (EPS)

STI

LTI

2015

2016

2016

REMUNERATION

REPORT

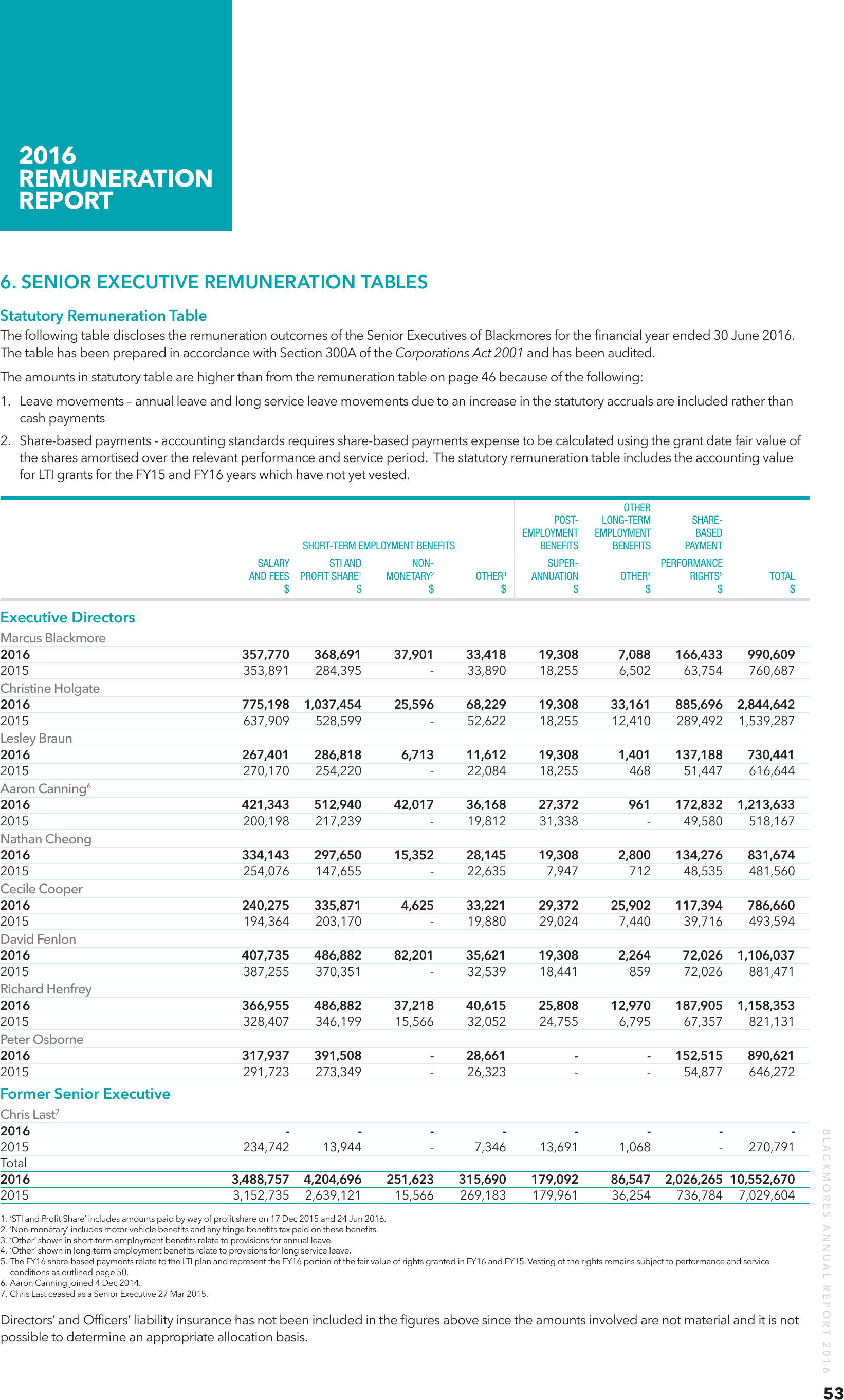

6. SENIOR EXECUTIVE REMUNERATION TABLES

Statutory Remuneration Table

The following table discloses the remuneration outcomes of the Senior Executives of Blackmores for the financial year ended 30 June 2016.

The table has been prepared in accordance with Section 300A of the Corporations Act 2001 and has been audited.

The amounts in statutory table are higher than from the remuneration table on page 46 because of the following:

1. Leave movements – annual leave and long service leave movements due to an increase in the statutory accruals are included rather than

cash payments

2. Share-based payments - accounting standards requires share-based payments expense to be calculated using the grant date fair value of

the shares amortised over the relevant performance and service period. The statutory remuneration table includes the accounting value

for LTI grants for the FY15 and FY16 years which have not yet vested.

OTHER

POST-

LONG-TERM

SHARE EMPLOYMENT EMPLOYMENT

BASED

SHORT-TERM EMPLOYMENT BENEFITS

BENEFITS

BENEFITS

PAYMENT

SALARY

STI AND

NON-

SUPER-

PERFORMANCE

AND FEES PROFIT SHARE1 MONETARY2 OTHER3 ANNUATION OTHER4 RIGHTS5

TOTAL

$ $ $ $ $ $ $ $

Executive Directors

Marcus Blackmore

2016

357,770

368,691

37,901

33,418

19,308

7,088 166,433 990,609

2015

353,891

284,395

-

33,890

18,255

6,502

63,754

760,687

Christine Holgate

2016

775,198 1,037,454

25,596

68,229

19,308

33,161 885,696 2,844,642

2015

637,909

528,599

- 52,622 18,255 12,410

289,492

1,539,287

Lesley Braun

2016

267,401

286,818

6,713

11,612

19,308

1,401 137,188 730,441

2015

270,170

254,220

-

22,084

18,255

468

51,447

616,644

Aaron Canning6

2016

421,343

512,940

42,017

36,168

27,372

961 172,832 1,213,633

2015

200,198

217,239

-

19,812

31,338

-

49,580

518,167

Nathan Cheong

2016

334,143

297,650

15,352

28,145

19,308

2,800 134,276 831,674

2015

254,076

147,655

-

22,635

7,947

712

48,535

481,560

Cecile Cooper

2016

240,275

335,871

4,625

33,221

29,372

25,902 117,394 786,660

2015

194,364

203,170

-

19,880

29,024

7,440

39,716

493,594

David Fenlon

2016

407,735

486,882

82,201

35,621

19,308

2,264

72,026 1,106,037

2015

387,255

370,351

-

32,539

18,441

859

72,026

881,471

Richard Henfrey

2016

366,955

486,882

37,218

40,615

25,808

12,970 187,905 1,158,353

2015

328,407

346,199

15,566

32,052

24,755

6,795

67,357

821,131

Peter Osborne

2016

317,937

391,508

-

28,661

-

-

152,515 890,621

2015

291,723

273,349

-

26,323

-

-

54,877

646,272

Former Senior Executive

1. ‘STI and Profit Share’ includes amounts paid by way of profit share on 17 Dec 2015 and 24 Jun 2016.

2. ‘Non-monetary’ includes motor vehicle benefits and any fringe benefits tax paid on these benefits.

3. ‘Other’ shown in short-term employment benefits relate to provisions for annual leave.

4. ‘Other’ shown in long-term employment benefits relate to provisions for long service leave.

5. The FY16 share-based payments relate to the LTI plan and represent the FY16 portion of the fair value of rights granted in FY16 and FY15. Vesting of the rights remains subject to performance and service

conditions as outlined page 50.

6. Aaron Canning joined 4 Dec 2014.

7. Chris Last ceased as a Senior Executive 27 Mar 2015.

Directors’ and Officers’ liability insurance has not been included in the figures above since the amounts involved are not material and it is not

possible to determine an appropriate allocation basis.

BLACKMORES ANNUAL REPORT 2016

Chris Last7

2016

- - - - - - - 2015

234,742

13,944

-

7,346

13,691

1,068

-

270,791

Total

2016

3,488,757

4,204,696 251,623 315,690 179,092 86,547

2,026,265

10,552,670

2015

3,152,735

2,639,121 15,566 269,183 179,961 36,254 736,784

7,029,604

53

2016

REMUNERATION

REPORT

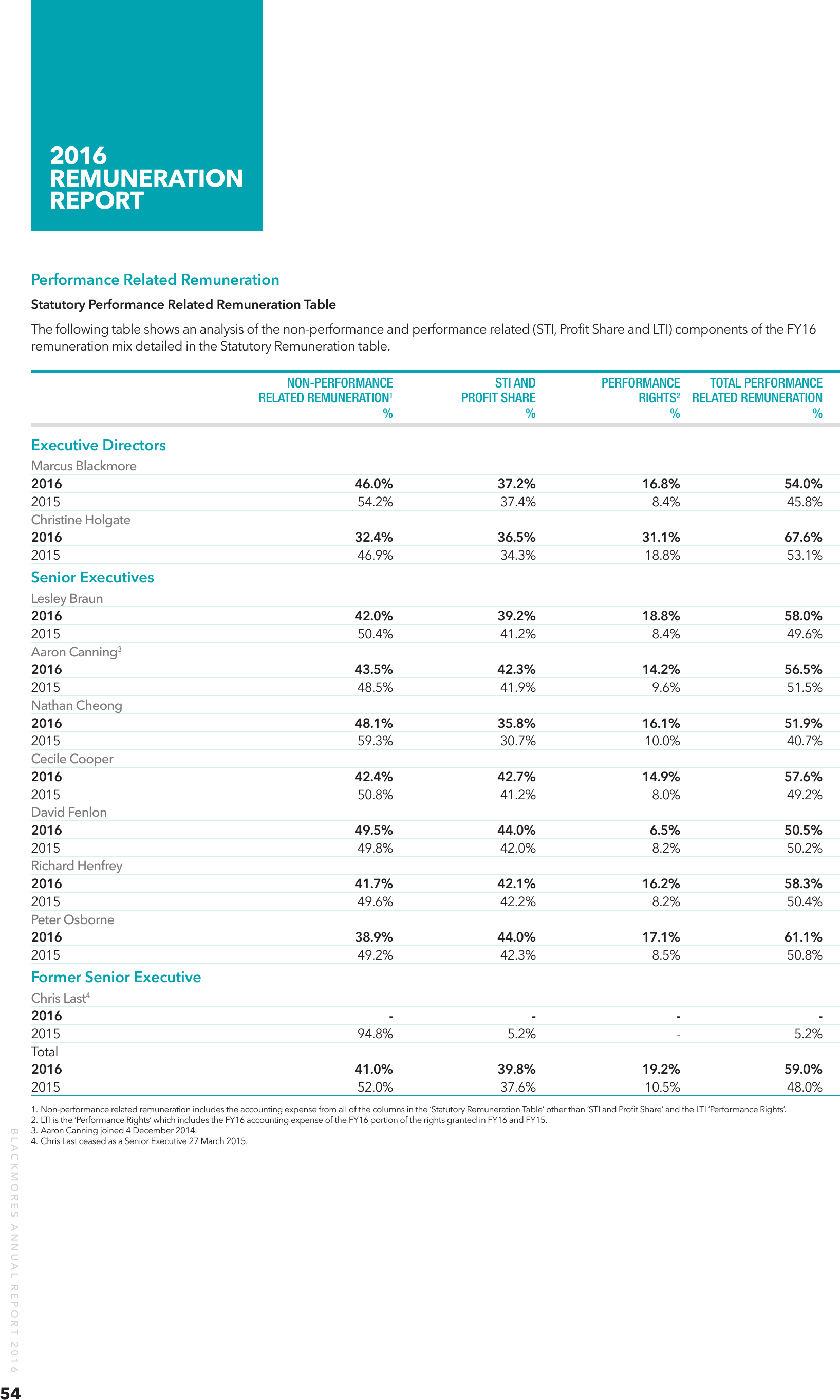

Performance Related Remuneration

Statutory Performance Related Remuneration Table

The following table shows an analysis of the non-performance and performance related (STI, Profit Share and LTI) components of the FY16

remuneration mix detailed in the Statutory Remuneration table.

NON-PERFORMANCE

STI AND

PERFORMANCE

TOTAL PERFORMANCE

RELATED REMUNERATION1

PROFIT SHARE

RIGHTS2 RELATED REMUNERATION

% % % %

Executive Directors

Marcus Blackmore

2016

46.0% 37.2% 16.8% 54.0%

2015

54.2% 37.4% 8.4% 45.8%

Christine Holgate

2016

32.4% 36.5% 31.1% 67.6%

2015

46.9% 34.3% 18.8% 53.1%

Senior Executives

Lesley Braun

2016

42.0% 39.2% 18.8% 58.0%

2015

50.4% 41.2% 8.4% 49.6%

Aaron Canning3

2016

43.5% 42.3% 14.2% 56.5%

2015

48.5% 41.9% 9.6% 51.5%

Nathan Cheong

2016

48.1% 35.8% 16.1% 51.9%

2015

59.3% 30.7% 10.0% 40.7%

Cecile Cooper

2016

42.4% 42.7% 14.9% 57.6%

2015

50.8% 41.2% 8.0% 49.2%

David Fenlon

2016

49.5% 44.0% 6.5% 50.5%

2015

49.8% 42.0% 8.2% 50.2%

Richard Henfrey

2016

41.7% 42.1% 16.2% 58.3%

2015

49.6% 42.2% 8.2% 50.4%

Peter Osborne

2016

38.9% 44.0% 17.1% 61.1%

2015

49.2% 42.3% 8.5% 50.8%

Former Senior Executive

Chris Last4

2016

- - - 2015

94.8% 5.2%

- 5.2%

Total

2016

41.0% 39.8% 19.2% 59.0%

2015

52.0% 37.6% 10.5% 48.0%

BLACKMORES ANNUAL REPORT 2016

54

1. Non-performance related remuneration includes the accounting expense from all of the columns in the ‘Statutory Remuneration Table’ other than ‘STI and Profit Share’ and the LTI ‘Performance Rights’.

2. LTI is the ‘Performance Rights’ which includes the FY16 accounting expense of the FY16 portion of the rights granted in FY16 and FY15.

3. Aaron Canning joined 4 December 2014.

4. Chris Last ceased as a Senior Executive 27 March 2015.

2016

REMUNERATION

REPORT

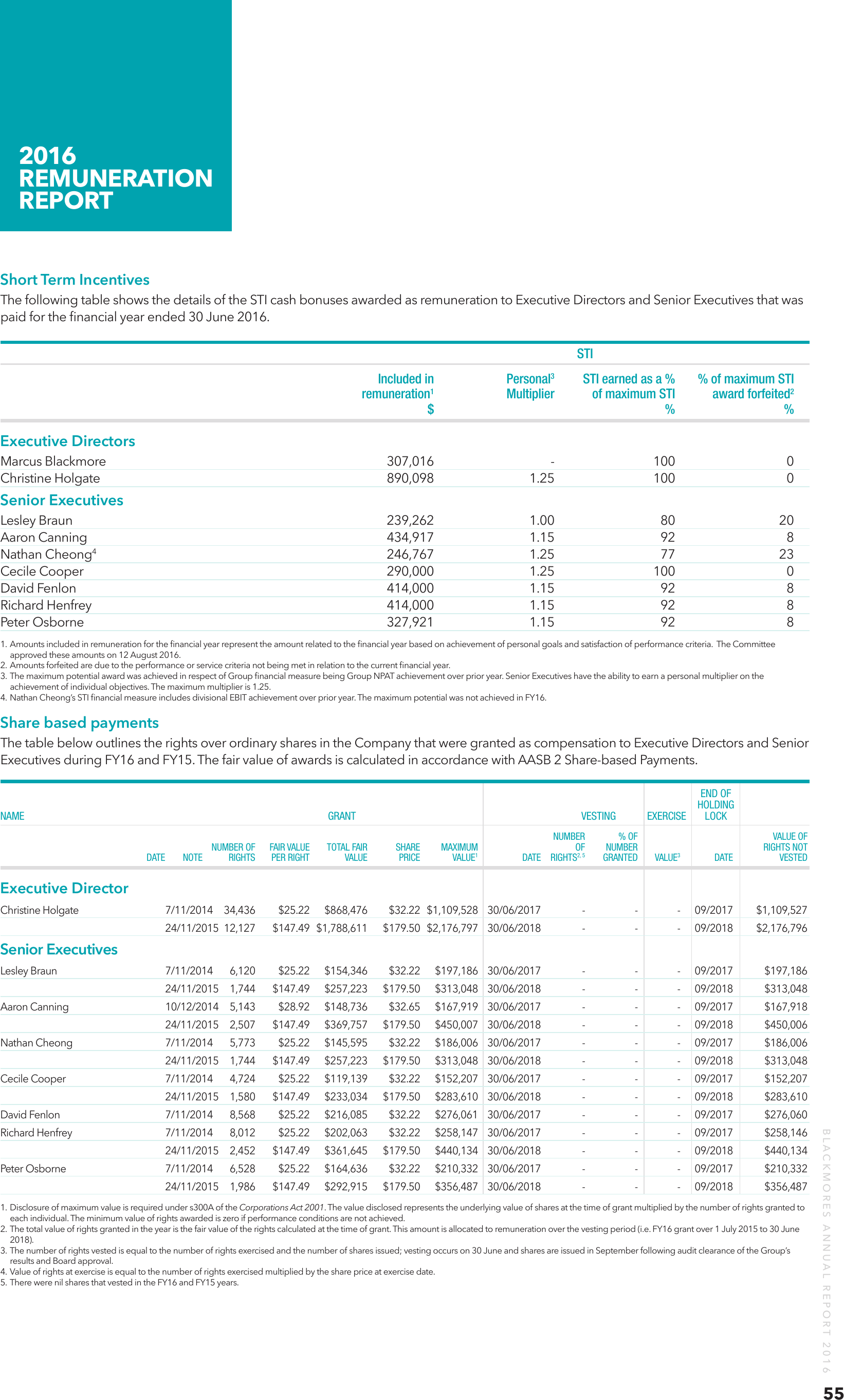

Short Term Incentives

The following table shows the details of the STI cash bonuses awarded as remuneration to Executive Directors and Senior Executives that was

paid for the financial year ended 30 June 2016.

STI

Included in

Personal

STI earned as a % % of maximum STI

remuneration1

Multiplier

of maximum STI

award forfeited2

$ % %

3

Executive Directors

Marcus Blackmore

Christine Holgate

307,016

890,098

-

1.25

100

100

0

0

Lesley Braun

Aaron Canning

Nathan Cheong4

Cecile Cooper

David Fenlon

Richard Henfrey

Peter Osborne

239,262

434,917

246,767

290,000

414,000

414,000

327,921

1.00

1.15

1.25

1.25

1.15

1.15

1.15

80

92

77

100

92

92

92

20

8

23

0

8

8

8

Senior Executives

1. Amounts included in remuneration for the financial year represent the amount related to the financial year based on achievement of personal goals and satisfaction of performance criteria. The Committee

approved these amounts on 12 August 2016.

2. Amounts forfeited are due to the performance or service criteria not being met in relation to the current financial year.

3. The maximum potential award was achieved in respect of Group financial measure being Group NPAT achievement over prior year. Senior Executives have the ability to earn a personal multiplier on the

achievement of individual objectives. The maximum multiplier is 1.25.

4. Nathan Cheong’s STI financial measure includes divisional EBIT achievement over prior year. The maximum potential was not achieved in FY16.

Share based payments

The table below outlines the rights over ordinary shares in the Company that were granted as compensation to Executive Directors and Senior

Executives during FY16 and FY15. The fair value of awards is calculated in accordance with AASB 2 Share-based Payments.

END OF

HOLDING

NAME

GRANT

VESTING EXERCISE LOCK

NUMBER

NUMBER OF

DATE

NOTE

RIGHTS

FAIR VALUE

PER RIGHT

TOTAL FAIR

VALUE

SHARE

PRICE

% OF

VALUE OF

MAXIMUM

OF

NUMBER

RIGHTS NOT

VALUE1

DATE RIGHTS2, 5 GRANTED VALUE3 DATE VESTED

Executive Director

Christine Holgate

7/11/2014 34,436

24/11/2015 12,127

$868,476

$32.22 $1,109,528 30/06/2017

-

-

- 09/2017

$1,109,527

$147.49 $1,788,611

$25.22

$179.50 $2,176,797 30/06/2018

-

-

- 09/2018

$2,176,796

$197,186

Senior Executives

Lesley Braun

7/11/2014

6,120

$25.22

$154,346

$32.22

$197,186 30/06/2017

-

-

- 09/2017

24/11/2015 1,744

$147.49

$257,223

$179.50

$313,048 30/06/2018

-

-

- 09/2018

$313,048

Aaron Canning

10/12/2014 5,143

$28.92

$148,736

$32.65

$167,919 30/06/2017

-

-

- 09/2017

$167,918

24/11/2015 2,507

$147.49

$369,757

$179.50

$450,007 30/06/2018

-

-

- 09/2018

$450,006

5,773

$25.22

$145,595

$32.22

$186,006 30/06/2017

-

-

- 09/2017

$186,006

24/11/2015 1,744

Nathan Cheong

7/11/2014

$257,223

$179.50

$313,048 30/06/2018

-

-

- 09/2018

$313,048

$25.22

$119,139

$32.22

$152,207 30/06/2017

-

-

- 09/2017

$152,207

24/11/2015 1,580

$147.49

$233,034

$179.50

$283,610 30/06/2018

-

-

- 09/2018

$283,610

$25.22

$216,085

$32.22

$276,061 30/06/2017

-

-

- 09/2017

$276,060

$258,146

David Fenlon

7/11/2014

8,568

Richard Henfrey

7/11/2014

8,012

$25.22

$202,063

$32.22

$258,147 30/06/2017

-

-

- 09/2017

24/11/2015 2,452

$147.49

$361,645

$179.50

$440,134 30/06/2018

-

-

- 09/2018

$440,134

6,528

$25.22

$164,636

$32.22

$210,332 30/06/2017

-

-

- 09/2017

$210,332

24/11/2015 1,986

$147.49

$292,915

$179.50

$356,487 30/06/2018

-

-

- 09/2018

$356,487

Peter Osborne

7/11/2014

1. Disclosure of maximum value is required under s300A of the Corporations Act 2001. The value disclosed represents the underlying value of shares at the time of grant multiplied by the number of rights granted to

each individual. The minimum value of rights awarded is zero if performance conditions are not achieved.

2. The total value of rights granted in the year is the fair value of the rights calculated at the time of grant. This amount is allocated to remuneration over the vesting period (i.e. FY16 grant over 1 July 2015 to 30 June

2018).

3. The number of rights vested is equal to the number of rights exercised and the number of shares issued; vesting occurs on 30 June and shares are issued in September following audit clearance of the Group’s

results and Board approval.

4. Value of rights at exercise is equal to the number of rights exercised multiplied by the share price at exercise date.

5. There were nil shares that vested in the FY16 and FY15 years.

BLACKMORES ANNUAL REPORT 2016

$147.49

4,724

Cecile Cooper

7/11/2014

55

2016

REMUNERATION

REPORT

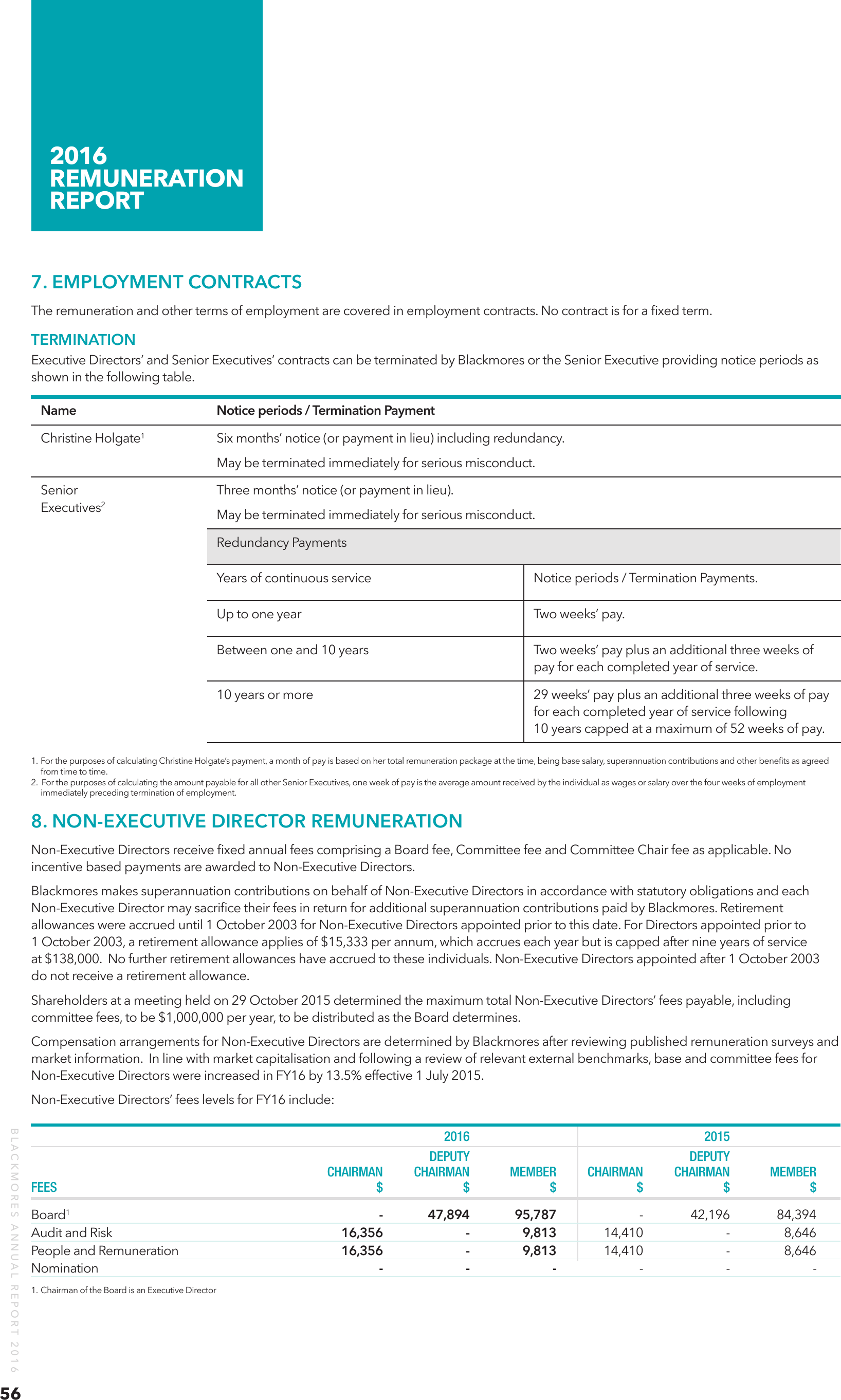

7. EMPLOYMENT CONTRACTS

The remuneration and other terms of employment are covered in employment contracts. No contract is for a fixed term.

TERMINATION

Executive Directors’ and Senior Executives’ contracts can be terminated by Blackmores or the Senior Executive providing notice periods as

shown in the following table.

Name

Notice periods / Termination Payment

Christine Holgate

1

Six months’ notice (or payment in lieu) including redundancy.

May be terminated immediately for serious misconduct.

Senior

Executives2

Three months’ notice (or payment in lieu).

May be terminated immediately for serious misconduct.

Redundancy Payments

Years of continuous service

Notice periods / Termination Payments.

Up to one year

Two weeks’ pay.

Between one and 10 years

Two weeks’ pay plus an additional three weeks of

pay for each completed year of service.

10 years or more

29 weeks’ pay plus an additional three weeks of pay

for each completed year of service following

10 years capped at a maximum of 52 weeks of pay.

1. For the purposes of calculating Christine Holgate’s payment, a month of pay is based on her total remuneration package at the time, being base salary, superannuation contributions and other benefits as agreed

from time to time.

2. For the purposes of calculating the amount payable for all other Senior Executives, one week of pay is the average amount received by the individual as wages or salary over the four weeks of employment

immediately preceding termination of employment.

8. NON-EXECUTIVE DIRECTOR REMUNERATION

Non-Executive Directors receive fixed annual fees comprising a Board fee, Committee fee and Committee Chair fee as applicable. No

incentive based payments are awarded to Non-Executive Directors.

Blackmores makes superannuation contributions on behalf of Non-Executive Directors in accordance with statutory obligations and each

Non-Executive Director may sacrifice their fees in return for additional superannuation contributions paid by Blackmores. Retirement

allowances were accrued until 1 October 2003 for Non-Executive Directors appointed prior to this date. For Directors appointed prior to

1 October 2003, a retirement allowance applies of $15,333 per annum, which accrues each year but is capped after nine years of service

at $138,000. No further retirement allowances have accrued to these individuals. Non-Executive Directors appointed after 1 October 2003

do not receive a retirement allowance.

Shareholders at a meeting held on 29 October 2015 determined the maximum total Non-Executive Directors’ fees payable, including

committee fees, to be $1,000,000 per year, to be distributed as the Board determines.

Compensation arrangements for Non-Executive Directors are determined by Blackmores after reviewing published remuneration surveys and

market information. In line with market capitalisation and following a review of relevant external benchmarks, base and committee fees for

Non-Executive Directors were increased in FY16 by 13.5% effective 1 July 2015.

Non-Executive Directors’ fees levels for FY16 include:

BLACKMORES ANNUAL REPORT 2016

56

2016

2015

DEPUTY

DEPUTY

CHAIRMAN CHAIRMAN MEMBER CHAIRMAN CHAIRMAN MEMBER

FEES $ $ $ $ $ $

Board1

Audit and Risk

People and Remuneration

Nomination

1. Chairman of the Board is an Executive Director

- 47,894 95,787

- 42,196 84,394

16,356

- 9,813 14,410

- 8,646

16,356

- 9,813 14,410

- 8,646

- - - - - -

2016

REMUNERATION

REPORT

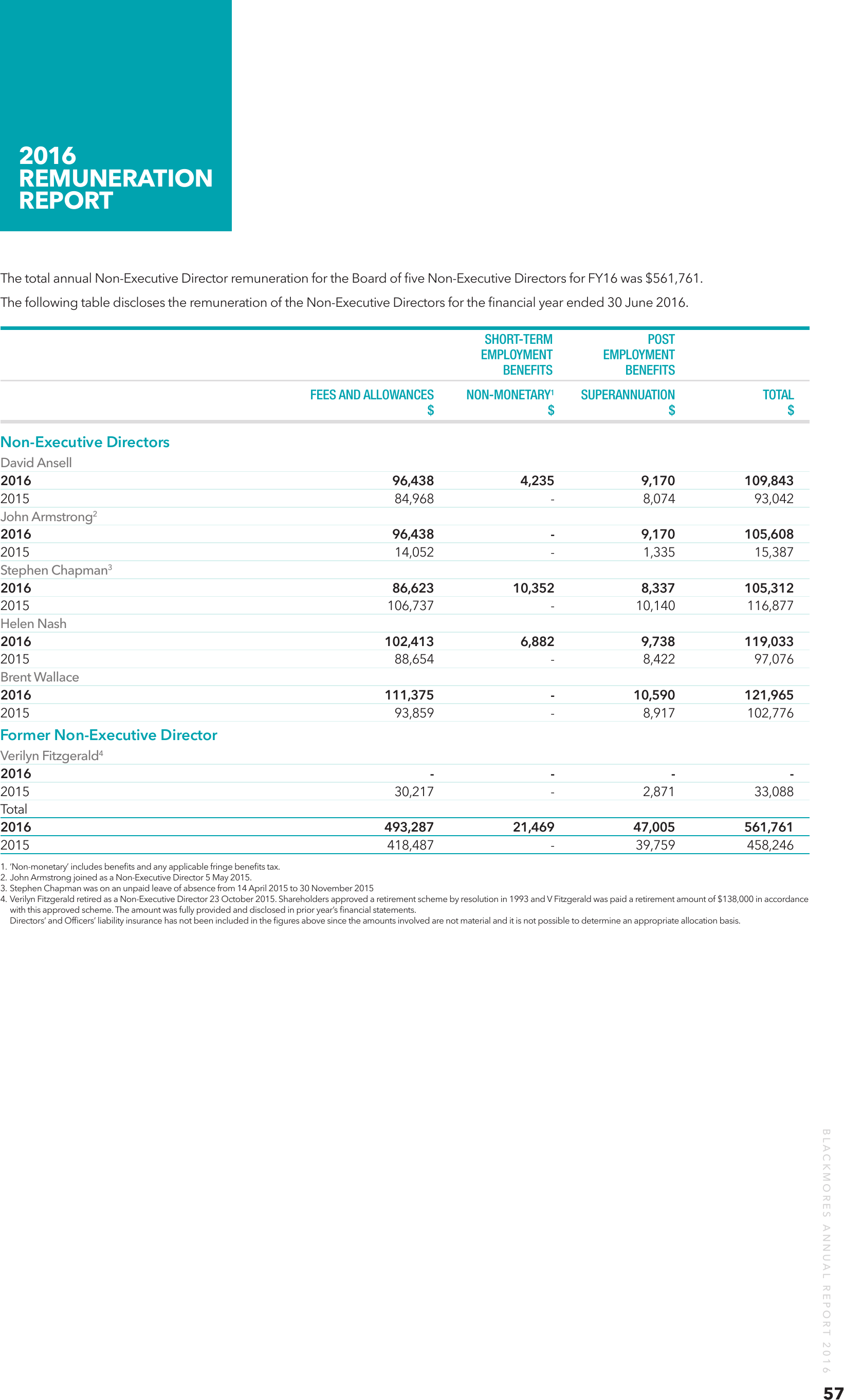

The total annual Non-Executive Director remuneration for the Board of five Non-Executive Directors for FY16 was $561,761.

The following table discloses the remuneration of the Non-Executive Directors for the financial year ended 30 June 2016.

SHORT-TERM POST

EMPLOYMENT EMPLOYMENT

BENEFITS BENEFITS

FEES AND ALLOWANCES

NON-MONETARY1 SUPERANNUATION

TOTAL

$ $ $ $

Non-Executive Directors

David Ansell

2016

2015

John Armstrong2

2016

2015

Stephen Chapman3

2016

2015

Helen Nash

2016

2015

Brent Wallace

2016

2015

Former Non-Executive Director

96,438

84,968

4,235

-

9,170 109,843

8,074

93,042

96,438

14,052

-

-

9,170 105,608

1,335

15,387

86,623 10,352 8,337 105,312

106,737

- 10,140 116,877

102,413

88,654

111,375

93,859

6,882

-

9,738 119,033

8,422

97,076

- 10,590 121,965

- 8,917 102,776

Verilyn Fitzgerald4

2016

- - - 2015

30,217

- 2,871 33,088

Total

2016

493,287 21,469 47,005 561,761

2015

418,487

- 39,759 458,246

1. ‘Non-monetary’ includes benefits and any applicable fringe benefits tax.

2. John Armstrong joined as a Non-Executive Director 5 May 2015.

3. Stephen Chapman was on an unpaid leave of absence from 14 April 2015 to 30 November 2015

4. Verilyn Fitzgerald retired as a Non-Executive Director 23 October 2015. Shareholders approved a retirement scheme by resolution in 1993 and V Fitzgerald was paid a retirement amount of $138,000 in accordance

with this approved scheme. The amount was fully provided and disclosed in prior year’s financial statements.

Directors’ and Officers’ liability insurance has not been included in the figures above since the amounts involved are not material and it is not possible to determine an appropriate allocation basis.

BLACKMORES ANNUAL REPORT 2016

57

2016

REMUNERATION

REPORT

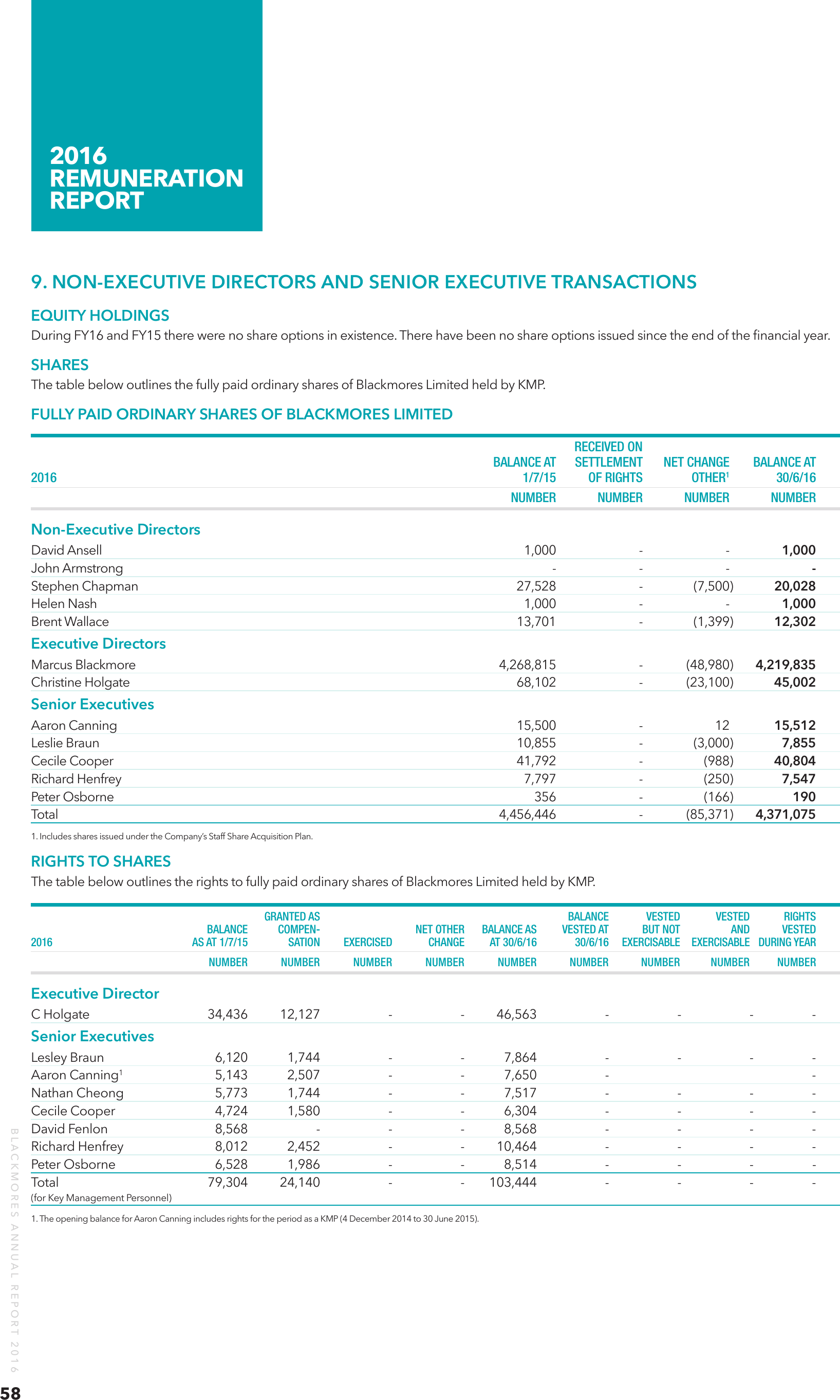

9. NON-EXECUTIVE DIRECTORS AND SENIOR EXECUTIVE TRANSACTIONS

EQUITY HOLDINGS

During FY16 and FY15 there were no share options in existence. There have been no share options issued since the end of the financial year.

SHARES

The table below outlines the fully paid ordinary shares of Blackmores Limited held by KMP.

FULLY PAID ORDINARY SHARES OF BLACKMORES LIMITED

RECEIVED ON

BALANCE AT SETTLEMENT NET CHANGE

BALANCE AT

2016

1/7/15

OF RIGHTS

OTHER1 30/6/16

NUMBER NUMBER NUMBER NUMBER

Non-Executive Directors

David Ansell

John Armstrong

Stephen Chapman

Helen Nash

Brent Wallace

1,000

-

27,528

1,000

13,701

Executive Directors

-

1,000

20,028

1,000

12,302

-

-

(7,500)

-

(1,399)

Marcus Blackmore

Christine Holgate

4,268,815

68,102

-

-

(48,980)

(23,100)

4,219,835

45,002

Aaron Canning

Leslie Braun

Cecile Cooper

Richard Henfrey

Peter Osborne

Total

15,500

10,855

41,792

7,797

356

4,456,446

-

12

(3,000)

(988)

(250)

(166)

(85,371)

15,512

7,855

40,804

7,547

190

4,371,075

Senior Executives

1. Includes shares issued under the Company’s Staff Share Acquisition Plan.

RIGHTS TO SHARES

The table below outlines the rights to fully paid ordinary shares of Blackmores Limited held by KMP.

GRANTED AS

BALANCE

VESTED

VESTED

RIGHTS

BALANCE

COMPEN-

NET OTHER BALANCE AS

VESTED AT

BUT NOT

AND

VESTED

2016

AS AT 1/7/15

SATION

EXERCISED

CHANGE

AT 30/6/16

30/6/16 EXERCISABLE EXERCISABLE DURING YEAR

NUMBER NUMBER NUMBER NUMBER NUMBER NUMBER NUMBER

NUMBER

NUMBER

Executive Director

C Holgate

34,436

12,127

-

-

Lesley Braun

Aaron Canning1

Nathan Cheong

Cecile Cooper

David Fenlon

Richard Henfrey

Peter Osborne

Total

6,120

5,143

5,773

4,724

8,568

8,012

6,528

79,304

1,744

2,507

1,744

1,580

-

2,452

1,986

24,140

-

-

46,563

-

-

Senior Executives

BLACKMORES ANNUAL REPORT 2016

58

(for Key Management Personnel)

7,864

7,650

7,517

6,304

8,568

10,464

8,514

103,444

1. The opening balance for Aaron Canning includes rights for the period as a KMP (4 December 2014 to 30 June 2015).

-

-

-

-

-

-

-

-

-

-

-

-

2016

REMUNERATION

REPORT

LOAN DISCLOSURES

There were no loan balances exceeding $100,000 due from KMP during or at the end of the financial year (2015: $nil).

OTHER TRANSACTIONS WITH KEY MANAGEMENT

Transactions entered into during the year with KMP of Blackmores Limited and the Group are on the same basis as normal employee, supplier

or customer relationship on the same terms and conditions and those dealings on an arm’s length basis which include:

• the receipt of dividends on their shareholdings, whether held privately or through related entities or through the employee share plans in

the same manner as all ordinary shareholders

• terms and conditions of employment

• purchases of goods and services

• expense reimbursement.

No interest was paid to or received from KMP.

Signed in accordance with a Resolution of the Directors made pursuant to s298(2) of the Corporations Act 2001.

On behalf of the Directors

Marcus C Blackmore AM

Director

Dated in Sydney, 24 August 2016

BLACKMORES ANNUAL REPORT 2016

59