OPERATINGFINANCIAL REVIEW

OPERATING + FINANCIAL REVIEW

+ + FINANCIALREVIEW

OPERATING

$6.7

3%

$6.7

3%

$53.1

$53.1

20% $53.1 20%

20%

2012 2012

2012

55

5

$201

77%

YEAR

YEAR

YEAR

BLACKMORES ANNUAL REPORT 2016

BL C POR RES 6

B L A C K M O R E S A N N U A LAR EK M OT 2 0 1 A N N U A L R E P O R T 2 0 1 6

16

16

$69.2 $69.2

10% 10%

$81.4

$48.0 11% $81.4

11%

7%

$48.0

7% $48.0

7%

2015

$76.4

16%

$7.6

2%

$7.6

2%

$23.2 $23.2

3%

3%

2015

2015

$316.7

67%

$7.6

2%

GROUP $316.7

67%

SALES

$471.6M

2016

$15.4

3%

$55.5

12%

$55.5

12%

$76.4

16%

$69.2

10%

$15.4

3%

$201

$201 77%

$55.5

77% 12%

SALES

SALES$76.4

16%

$260.8M

$260.8M

OF REVENUE BYBY

OF REVENUE

$23.2

SEGMENT ($M)

SEGMENT ($M)

3%

$81.4

11%

$15.4

3%

GROUP

SALES

GROUP

$260.8M GROUP

DIVERSIFICATION

OF REVENUE BY

DIVERSIFICATION

SEGMENT ($M)

DIVERSIFICATION

16

$6.7

3%

$316.7

67%

GROUP

GROUP

SALES

SALES

$471.6M

$471.6M

2016

2016

$495.4

69%

AUSTRALIA

GROUP SALES

$717.2M

$495.4 CHINA

69% $495.4

OTHER ASIA

69%

BIOCEUTICALS

OTHER

GROUP SALES

GROUP SALES

$717.2M

$717.2M

AUSTRALIA

AUSTRALIA

CHINA

CHINA

OTHER ASIA

OTHER ASIA

BIOCEUTICALS

OTHER

BIOCEUTICALS

OTHER

02

GROUP AND

DIVISIONAL

RESULTS

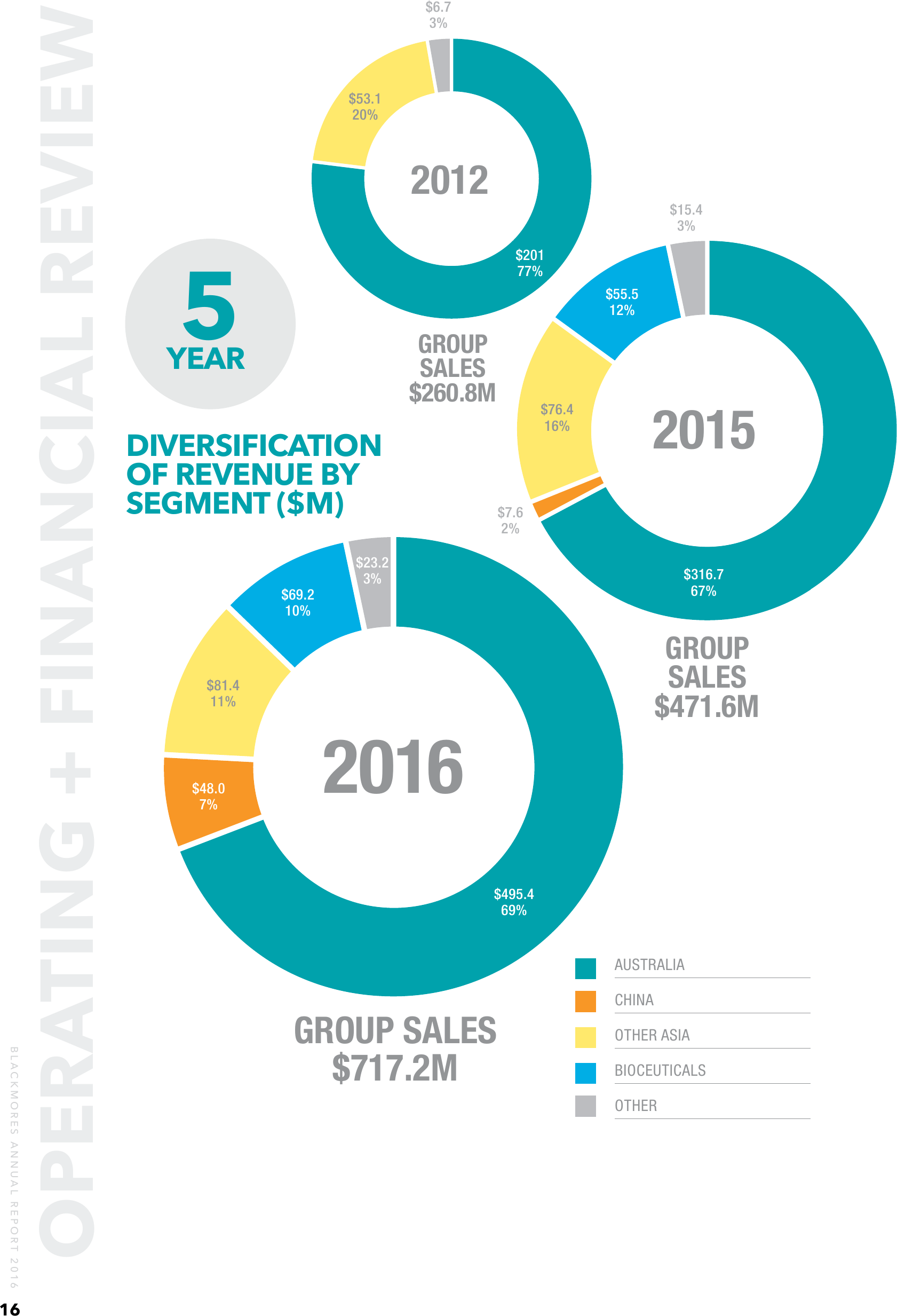

GROUP AND DIVISIONAL RESULTS

Group Sales for the year were $717.2 million

(2015: $471.6 million), an increase of 52%

compared with the prior year and our 14th

consecutive year of sales growth.

Sales in Australia, our heartland market,

were up 56% compared to the prior

year and were stimulated by a growing

consumer demand for high quality, natural

wellness products. We have launched new

products and improved our service of retail

customers while investing in our brand

through integrated marketing activity. The

Australian business continued to benefit from

increased sales through Chinese tourists and

entrepreneurs shopping in Australia and

Chinese Australian consumers purchasing for

relatives and friends and shipping to China.

Excluding the impact of these sales, the

Australian consumer business remains very

healthy with sales up approximately 10%.

By combining the contribution from these

consumers with our in-country revenues

from Asia, the Asian consumer accounts for

almost 50% of Group sales. This demonstrates

the growing demand for our brand outside

Australia and highlights the importance of

our Asia growth strategy.

Increased sales to China have been

supported by the Wholly Foreign-Owned

Enterprise (WFOE) established in recent years.

The opening of free trade zones in 2014 and

further expansion across the current year

has created a substantial opportunity for the

company, especially as Blackmores is one of

only a few companies in this category to secure

a licence to directly trade within the zones.

We are encouraged by the Australian

Government’s commitment to improved

trade relations within the Asian region, which

we believe will continue to support further

growth. Asia is a key region for Blackmores,

providing an important platform to secure

long-term profitable growth.

Blackmores Asia achieved record sales,

with full year sales up 54% to $129.4 million

and EBIT up 79% to $14.9 million. In-country

sales from Asia now comprise 18% of

Group revenue.

Blackmores Korea experienced sales

challenge. This, coupled with the investment

in Blackmores’ upcoming launch into

Indonesia, resulted in a reduction in

earnings for the ‘Other Asia’ segment

compared to the prior year.

Our growing revenue from Asia has

helped create a natural hedge whereby the

impact of changes to off-shore revenues as

a result of foreign exchange fluctuations are

partially offset by the procurement benefits

to the Group. Our growing businesses in

Asia have afforded the Group many scale

benefits which have improved our operating

efficiencies. We have grown our workforce

considerably to support the growth, creating

new jobs in Australia and Asia. Overall this

has bolstered the returns we have delivered

to our shareholders.

BioCeuticals sales grew 25%, with strong

growth in the practitioner-only range. This

performance, combined with successful new

product launches and a close management

of the cost base, delivered EBIT growth of

9% on the prior year. This EBIT result includes

the payment of incentives and profit share

to BioCeuticals employees following their

adoption of the Blackmores Enterprise

Agreement. Excluding this, underlying

BioCeuticals EBIT is up 28%. BioCeuticals

represents approximately 10% of Group

revenue.

Blackmores New Zealand, Global

Therapeutics and Blackmores’ proportion

of our Nutritional Foods partnership with

Bega are reported as part of the ‘Other’

segment. These businesses have contributed

$23 million in sales, up from $15 million the

prior year.

BLACKMORES ANNUAL REPORT 2016

17