OPERATING

+ FINANCIAL

REVIEW

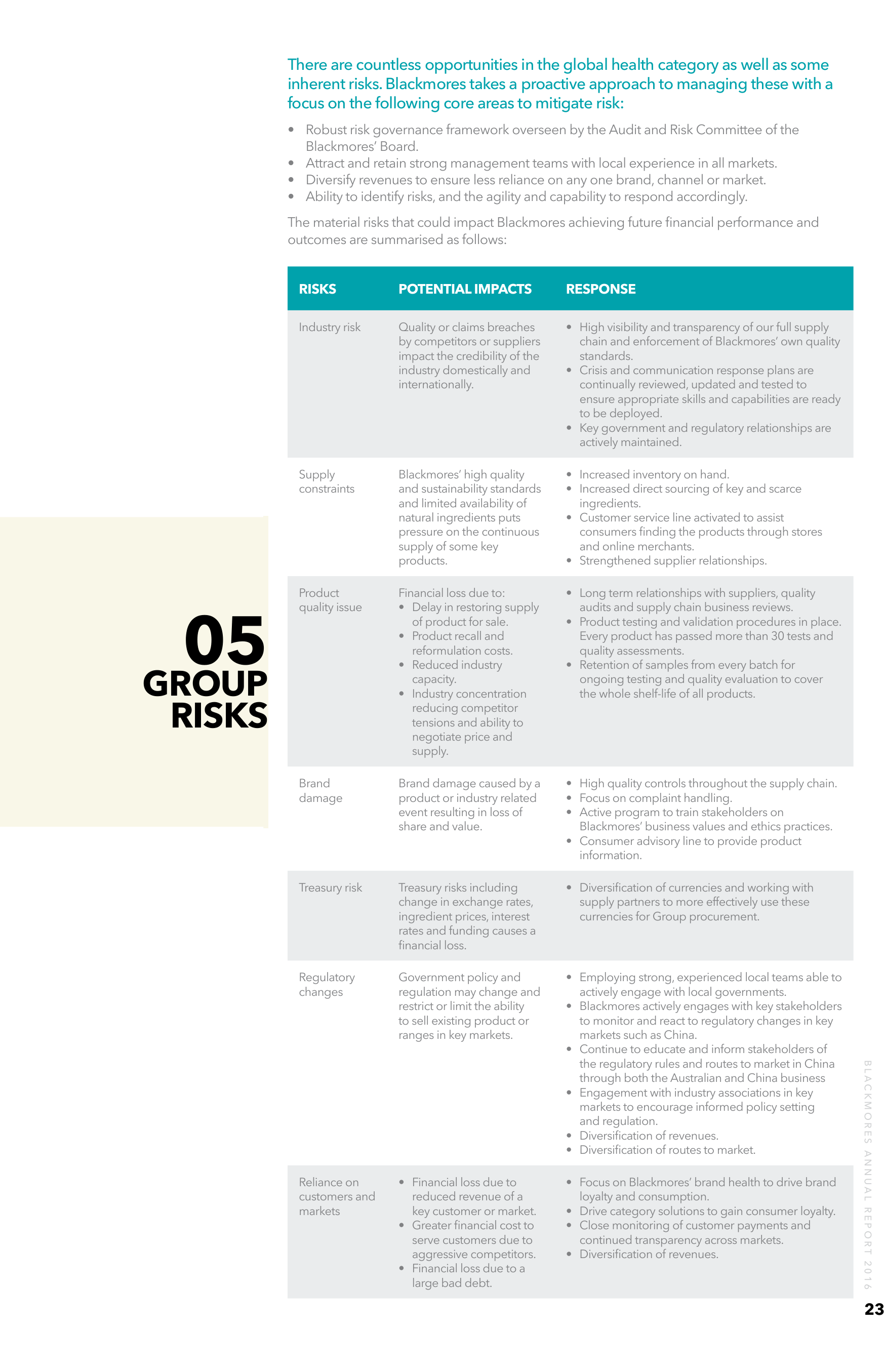

There are countless opportunities in the global health category as well as some

inherent risks. Blackmores takes a proactive approach to managing these with a

focus on the following core areas to mitigate risk:

• Robust risk governance framework overseen by the Audit and Risk Committee of the

Blackmores’ Board.

• Attract and retain strong management teams with local experience in all markets.

• Diversify revenues to ensure less reliance on any one brand, channel or market.

• Ability to identify risks, and the agility and capability to respond accordingly.

The material risks that could impact Blackmores achieving future financial performance and

outcomes are summarised as follows:

RESPONSE

Industry risk

Quality or claims breaches

by competitors or suppliers

impact the credibility of the

industry domestically and

internationally.

• High visibility and transparency of our full supply

chain and enforcement of Blackmores’ own quality

standards.

• Crisis and communication response plans are

continually reviewed, updated and tested to

ensure appropriate skills and capabilities are ready

to be deployed.

• Key government and regulatory relationships are

actively maintained.

Supply

constraints

05

GROUP

POTENTIAL IMPACTS

Blackmores’ high quality

and sustainability standards

and limited availability of

natural ingredients puts

pressure on the continuous

supply of some key

products.

• Increased inventory on hand.

• Increased direct sourcing of key and scarce

ingredients.

• Customer service line activated to assist

consumers finding the products through stores

and online merchants.

• Strengthened supplier relationships.

Product

quality issue

Financial loss due to:

• Delay in restoring supply

of product for sale.

• Product recall and

reformulation costs.

• Reduced industry

capacity.

• Industry concentration

reducing competitor

tensions and ability to

negotiate price and

supply.

• Long term relationships with suppliers, quality

audits and supply chain business reviews.

• Product testing and validation procedures in place.

Every product has passed more than 30 tests and

quality assessments.

• Retention of samples from every batch for

ongoing testing and quality evaluation to cover

the whole shelf-life of all products.

Brand

damage

Brand damage caused by a

product or industry related

event resulting in loss of

share and value.

• High quality controls throughout the supply chain.

• Focus on complaint handling.

• Active program to train stakeholders on

Blackmores’ business values and ethics practices.

• Consumer advisory line to provide product

information.

Treasury risk

Treasury risks including

change in exchange rates,

ingredient prices, interest

rates and funding causes a

financial loss.

• Diversification of currencies and working with

supply partners to more effectively use these

currencies for Group procurement.

Regulatory

changes

Government policy and

regulation may change and

restrict or limit the ability

to sell existing product or

ranges in key markets.

• Employing strong, experienced local teams able to

actively engage with local governments.

• Blackmores actively engages with key stakeholders

to monitor and react to regulatory changes in key

markets such as China.

• Continue to educate and inform stakeholders of

the regulatory rules and routes to market in China

through both the Australian and China business

• Engagement with industry associations in key

markets to encourage informed policy setting

and regulation.

• Diversification of revenues.

• Diversification of routes to market.

Reliance on

customers and

markets

• Financial loss due to

reduced revenue of a

key customer or market.

• Greater financial cost to

serve customers due to

aggressive competitors.

• Financial loss due to a

large bad debt.

• Focus on Blackmores’ brand health to drive brand

loyalty and consumption.

• Drive category solutions to gain consumer loyalty.

• Close monitoring of customer payments and

continued transparency across markets.

• Diversification of revenues.

RISKS

BLACKMORES ANNUAL REPORT 2016

RISKS

23