NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

1

GENERAL INFORMATION

Blackmores Limited (the Company) is a public company listed on

the Australian Securities Exchange (trading under the symbol ‘BKL’),

incorporated in Australia and operating in Australia, Asia and New

Zealand.

Blackmores Limited’s registered office and its principal place of

business is as follows:

20 Jubilee Avenue

Warriewood NSW 2102

Telephone +61 2 9910 5000

The Group’s principal activity is the development, sales and

marketing of health products for humans and animals including

vitamins, herbal and mineral nutritional supplements.

2 SIGNIFICANT ACCOUNTING

POLICIES

2.1

REPORTING ENTITY

Blackmores Limited (the Company) is domiciled in Australia. The

Consolidated Financial Report (Financial Report) of Blackmores

as at and for the twelve months ended 30 June 2016 comprises

Blackmores and its subsidiaries (the Group).

The Consolidated Annual Financial Report of the Group as at and

for the year ended 30 June 2016 is available upon request from the

registered office of Blackmores at 20 Jubilee Avenue, Warriewood,

NSW 2102 or online at blackmores.com.au

2.2

STATEMENT OF COMPLIANCE

These Financial Statements are General Purpose Financial

Statements which have been prepared in accordance with the

Corporations Act 2001, Accounting Standards and Interpretations

and comply with other requirements of the law.

The Financial Statements comprise the Consolidated Financial

Statements of the Group. For the purposes of preparing the

Consolidated Financial Statements, the Company is a for-profit entity.

Accounting Standards include Australian Accounting Standards.

Compliance with Australian Accounting Standards ensures that the

Financial Statements and notes of the Company and the Group

comply with International Financial Reporting Standards (‘IFRS’).

The Financial Statements were authorised for issue by the Directors

on 24 August 2016.

2.3

BASIS OF PREPARATION

The Consolidated Financial Statements have been prepared on the

basis of historical cost, except for certain non-current assets and

financial instruments that are measured at revalued amounts or fair

values, as explained in the following accounting policies. Historical

cost is generally based on the fair values of the consideration given in

exchange for assets. All amounts are presented in Australian dollars,

unless otherwise noted.

The Company is a company of the kind referred to in ASIC Class

Order 98/100, dated 10 July 1998, and in accordance with that Class

Order amounts in the Financial Statements are rounded off to the

nearest thousand dollars, unless otherwise indicated.

2.4

BASIS OF CONSOLIDATION

The Consolidated Financial Statements incorporate the Financial

Statements of the Company and entities (including structured

entities) controlled by the Company and its subsidiaries. Control is

achieved when the Company:

• is exposed, or has rights, to variable returns from its involvement

with the investee; and

• has the ability to use its power to affect its returns.

The Company reassesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control listed above.

Where necessary, adjustments are made to the Financial Statements

of subsidiaries to bring their accounting policies into line with those

used by other members of the Group.

All intragroup assets and liabilities, equity, income, expenses and

cash flows relating to transactions between members of the Group

are eliminated in full on consolidation.

2.5

CASH AND CASH EQUIVALENTS

Cash is comprised of cash on hand and cash at bank. Cash

equivalents are short-term, highly liquid investments that are readily

convertible to known amounts of cash, which are subject to an

insignificant risk of changes in value and have a maturity of three

months or less at the date of acquisition. Bank overdrafts are shown

within borrowings in current liabilities in the Consolidated Statement

of Financial Position.

2.6

FINANCIAL INSTRUMENTS

Financial assets and financial liabilities are recognised when a

Group entity becomes a party to the contractual provisions of the

instrument.

Financial assets and financial liabilities are initially measured at fair

value. Transaction costs that are directly attributable to the acquisition

or issue of financial assets and financial liabilities (other than financial

assets and financial liabilities at fair value through profit or loss) are

added to or deducted from the fair value of the financial assets or

financial liabilities, as appropriate, on initial recognition. Transaction

costs directly attributable to the acquisition of financial assets or

financial liabilities at fair value through profit or loss are recognised

immediately in profit or loss.

2.6.1

Financial Assets

Financial assets are classified into the following specified categories:

financial assets at ‘fair value through profit or loss’ (FVTPL), ‘availablefor-sale’ (AFS) financial assets and ‘loans and receivables’. The

classification depends on the nature and purpose of the financial

assets and is determined at the time of initial recognition. All regular

way purchases or sales of financial assets are recognised and

derecognised on a trade date basis. Regular way purchases or sales

are purchases or sales of financial assets that require delivery of

assets within the time frame established by regulation or convention

in the marketplace.

2.6.1.1 Effective Interest Method

The effective interest method is a method of calculating the

amortised cost of a debt instrument and of allocating interest income

over the relevant period. The effective interest rate is the rate that

exactly discounts estimated future cash receipts (including all fees

on points paid or received that form an integral part of the effective

interest rate, transaction costs and other premiums or discounts)

through the expected life of the debt instrument, or (where

appropriate) a shorter period, to the net carrying amount on initial

recognition.

Income is recognised on an effective interest basis for debt

instruments other than those financial assets classified as at FVTPL.

2.6.1.2 Financial Assets at FVTPL

Financial assets are classified as at FVTPL when the financial asset is

either held for trading or it is designated as at FVTPL.

A financial asset is classified as held for trading if:

• has been acquired principally for the purpose of selling it in the

it

near term; or

BLACKMORES ANNUAL REPORT 2016

The accounting policies and methods of computation in the

preparation of the Consolidated Financial Statements are consistent

with those adopted and disclosed in the Consolidated Financial

Statements for the year ended 30 June 2015.

• has power over the investee;

69

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

2

SIGNIFICANT ACCOUNTING POLICIES (CONT.)

• on initial recognition it is part of a portfolio of identified financial

instruments that the Group manages together and has a recent

actual pattern of short-term profit-taking; or

• it is a derivative that is not designated and effective as a hedging

instrument.

A financial asset other than a financial asset held for trading may be

designated as at FVTPL upon initial recognition if:

• such designation eliminates or significantly reduces a

measurement or recognition inconsistency that would otherwise

arise; or

• the financial asset forms part of a group of financial assets or

financial liabilities or both, which is managed and its performance

is evaluated on a fair value basis, in accordance with the Group’s

documented risk management or investment strategy, and

information about the grouping is provided internally on that

basis; or

• it forms part of a contract containing one or more embedded

derivatives, and AASB 139 ‘Financial Instruments: Recognition

and Measurement’ permits the entire combined contract (asset or

liability) to be designated as at FVTPL.

Financial assets at FVTPL are stated at fair value, with any gains or

losses arising on remeasurement recognised in profit or loss. The net

gain or loss recognised in profit or loss incorporates any dividend

or interest earned on the financial asset and is included in the ‘other

gains and losses’ line item in the statement of comprehensive

income. Fair value is determined in the manner described in note 36.

2.6.1.3 Loans and Receivables

Trade receivables, loans and other receivables that have fixed or

determinable payments that are not quoted in an active market

are classified as ‘loans and receivables’. Loans and receivables are

measured at amortised cost using the effective interest method less

impairment. Interest income is recognised by applying the effective

interest rate, except for short-term receivables when the recognition

of interest would be immaterial.

2.6.2

Financial Liabilities and Equity Instruments

2.6.2.1 Classification as Debt or Equity

Debt and equity instruments are classified as either liabilities or

as equity in accordance with the substance of the contractual

arrangement.

2.6.2.2 Equity Instruments

An equity instrument is any contract that evidences a residual interest

in the assets of an entity after deducting all of its liabilities. Equity

instruments issued by the Group are recorded at the proceeds

received, net of direct issue costs.

2.6.2.3 Financial Liabilities

BLACKMORES ANNUAL REPORT 2016

70

Financial liabilities are classified as either financial liabilities ‘at FVTPL’

or ‘other financial liabilities’.

2.6.2.4 Financial Liabilities at FVTPL

Financial liabilities are classified as at FVTPL when the financial

liability is either held for trading or it is designated as at FVTPL.

A financial liability is classified as held for trading if:

• it has been acquired principally for the purpose of repurchasing it

in the near term; or

• on initial recognition it is part of a portfolio of identified financial

instruments that the Group manages together and has a recent

actual pattern of short-term profit-taking; or

• it is a derivative that is not designated and effective as a hedging

instrument.

A financial liability other than a financial liability held for trading may

be designated as at FVTPL upon initial recognition if:

• such designation eliminates or significantly reduces a

measurement or recognition inconsistency that would otherwise

arise; or

• the financial liability forms part of a group of financial assets or

financial liabilities or both, which is managed and its performance

is evaluated on a fair value basis, in accordance with the Group’s

documented risk management or investment strategy, and

information about the grouping is provided internally on that

basis; or

• it forms part of a contract containing one or more embedded

derivatives, and AASB 139 ‘Financial Instruments: Recognition

and Measurement’ permits the entire combined contract (asset or

liability) to be designated as at FVTPL.

Financial liabilities at FVTPL are stated at fair value, with any gains or

losses arising on remeasurement recognised in profit or loss. The

net gain or loss recognised in profit or loss incorporates any interest

paid on the financial liability and is included in the ‘other income’

line item in the Consolidated Statement of Profit or Loss and Other

Comprehensive Income. Fair value is determined in the manner

described in note 36.

2.6.2.5 Other Financial Liabilities

Other financial liabilities, including borrowings, are initially measured

at fair value, net of transaction costs.

Other financial liabilities are subsequently measured at amortised

cost using the effective interest method, with interest expense

recognised on an effective yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is the

rate that exactly discounts estimated future cash payments through

the expected life of the financial liability, or (where appropriate) a

shorter period, to the net carrying amount on initial recognition.

2.6.3

Derivative Financial Instruments

The Group enters into a variety of derivative financial instruments

to manage its exposure to interest rate and foreign exchange rate

risk, including forward foreign exchange contracts and interest

rate swaps. Further details of derivative financial instruments are

disclosed in note 36 to the Consolidated Financial Statements.

Derivatives are initially recognised at fair value on the date a

derivative contract is entered into and are subsequently remeasured

to their fair value at each reporting date. The resulting gain or loss

is recognised in profit or loss immediately unless the derivative is

designated and effective as a hedging instrument, in which event, the

timing of the recognition in profit or loss depends on the nature of

the hedge relationship.

2.6.3.1 Hedge Accounting

The Group designates certain hedging instruments, which include

derivatives and non-derivatives in respect of foreign currency risk,

as either fair value hedges, cash flow hedges or hedges of net

investments in foreign operations. Hedges of foreign exchange risk

on firm commitments are accounted for as cash flow hedges.

At the inception of the hedge relationship the entity documents

the relationship between the hedging instrument and the hedged

item, along with its risk management objectives and its strategy

for undertaking various hedge transactions. Furthermore, at the

inception of the hedge and on an ongoing basis, the Group

documents whether the hedging instrument is highly effective in

offsetting changes in fair values or cash flows of the hedged item

attributable to the hedged risk.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

2

SIGNIFICANT ACCOUNTING POLICIES (CONT.)

Note 36 sets out details of the fair values of the derivative instruments

used for hedging purposes. Movements in the hedge reserve in

equity are also detailed in the Consolidated Statement of Changes

in Equity.

from the continued use of the asset. Any gain or loss arising on the

disposal or retirement of an item of property, plant and equipment

is determined as the difference between the sales proceeds and the

carrying amount of the asset and is recognised in profit or loss.

2.6.3.2 Cash Flow Hedges

Freehold land is not depreciated. The following estimated useful lives

are used in the calculation of depreciation:

The effective portion of changes in the fair value of derivatives that

are designated and qualify as cash flow hedges is recognised in

other comprehensive income and accumulated under the heading

of cash flow hedging reserve. The gain or loss relating to the

ineffective portion is recognised immediately in profit or loss, and is

included in the ‘other gains and losses’ line item.

Amounts previously recognised in other comprehensive income

and accumulated in equity are reclassified to profit or loss in the

periods when the hedged item is recognised in profit or loss, in the

same line of the Consolidated Statement of Profit or Loss and Other

Comprehensive Income as the recognised hedged item. However,

when the hedged forecast transaction results in the recognition

of a non-financial asset or a non-financial liability, the gains and

losses previously recognised in other comprehensive income and

accumulated in equity are transferred from equity and included in

the initial measurement of the cost of the non-financial asset or

non -financial liability.

Hedge accounting is discontinued when the Group revokes the

hedging relationship, when the hedging instrument expires or

is sold, terminated, or exercised, or when it no longer qualifies

for hedge accounting. Any gain or loss recognised in other

comprehensive income and accumulated in equity at that time

remains in equity and is recognised when the forecast transaction is

ultimately recognised in profit or loss. When a forecast transaction is

no longer expected to occur, the gain or loss accumulated in equity

is recognised immediately in profit or loss.

2.7

INVENTORIES

Inventories are stated at the lower of cost and net realisable value.

Costs, including an appropriate portion of fixed and variable

overhead expenses, are assigned to inventory on hand by the

method most appropriate to each particular class of inventory, with

the majority being valued on a first-in-first-out basis. Net realisable

value represents the estimated selling price less all estimated costs of

completion and costs necessary to make the sale.

2.8

PROPERTY, PLANT AND EQUIPMENT

Property, and associated land, in the course of construction for

production or administrative purposes, is carried at cost, less any

recognised impairment loss. Cost includes professional fees and, for

qualifying assets, borrowing costs capitalised in accordance with the

Group’s accounting policy. Depreciation of these assets, on the same

basis as other property assets, commences when the assets are ready

for their intended use.

Depreciation is provided on property, plant and equipment,

including freehold buildings but excluding land. Depreciation is

calculated on a straight-line basis so as to write off the net cost of

each asset over its expected useful life to its estimated residual

value. Leasehold improvements are depreciated over the period

of the lease or estimated useful life, whichever is the shorter, using

the straight-line method. The estimated useful lives, residual values

and depreciation method are reviewed at the end of each annual

reporting period, with the effect of any changes recognised on a

prospective basis.

An item of property, plant and equipment is derecognised upon

disposal or when no future economic benefits are expected to arise

25-40 years

• Leasehold improvements

3-13 years

• Plant and equipment

3-20 years

• Motor vehicles

4-5 years

2.9

IMPAIRMENT OF NON-CURRENT ASSETS

At the end of each reporting period, the Group reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an impairment

loss. If any such indication exists, the recoverable amount of the asset

is estimated in order to determine the extent of the impairment loss

(if any). Where it is not possible to estimate the recoverable amount

of an individual asset, the Group estimates the recoverable amount

of the cash-generating unit to which the asset belongs. Where a

reasonable and consistent basis of allocation can be identified,

corporate assets are also allocated to individual cash-generating

units, or otherwise they are allocated to the smallest group of cash

generating units for which a reasonable and consistent allocation

basis can be identified.

Recoverable amount is the higher of fair value less costs to sell and

value in use. In assessing value in use, the estimated future cash flows

are discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset for which the estimates of future

cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is

estimated to be less than its carrying amount, the carrying amount of

the asset (cash-generating unit) is reduced to its recoverable amount.

An impairment loss is recognised immediately in profit or loss.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit), other than goodwill,

is increased to the revised estimate of its recoverable amount, but

so that the increased carrying amount does not exceed the carrying

amount that would have been determined had no impairment loss

been recognised for the asset (or cash-generating unit) in prior years.

A reversal of an impairment loss is recognised immediately in profit

or loss.

2.10

BORROWING COSTS

Borrowing costs directly attributable to the acquisition, construction

or production of qualifying assets, which are assets that necessarily

take a substantial period of time to get ready for their intended use

or sale, are added to the cost of those assets, until such time as the

assets are substantially ready for their intended use or sale.

Investment income earned on the temporary investment of specific

borrowings pending their expenditure on qualifying assets is

deducted from the borrowing costs eligible for capitalisation. All

other borrowing costs are recognised in profit or loss in the period in

which they are incurred.

2.11

LEASING

Leases are classified as finance leases whenever the terms of the

lease transfer substantially all the risks and rewards of ownership to

the lessee. All other leases are classified as operating leases.

2.11.1 The Group as Lessee

Operating lease payments are recognised as an expense on

a straight-line basis over the lease term, except where another

systematic basis is more representative of the time pattern in which

BLACKMORES ANNUAL REPORT 2016

Plant and equipment and leasehold improvements are measured at

cost less accumulated depreciation and impairment. Construction in

progress is stated at cost. Cost includes expenditure that is directly

attributable to the acquisition or construction of the item.

• Buildings

71

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

2

SIGNIFICANT ACCOUNTING POLICIES (CONT.)

economic benefits from the leased asset are consumed. Contingent

rentals arising under operating leases are recognised as an expense

in the period in which they are incurred.

2.12

PROVISIONS

Provisions are recognised when the Group has a present obligation

(legal or constructive) as a result of a past event, it is probable that

the Group will be required to settle the obligation, and a reliable

estimate can be made of the amount of the obligation.

The amount recognised as a provision is the best estimate of the

consideration required to settle the present obligation at the end of

the reporting period, taking into account the risks and uncertainties

surrounding the obligation. Where a provision is measured using

the cash flows estimated to settle the present obligation, its carrying

amount is the present value of those cash flows (where the effect of

the time value of money is material).

When some or all of the economic benefits required to settle a

provision are expected to be recovered from a third party, the

receivable is recognised as an asset if it is virtually certain that

reimbursement will be received and the amount of the receivable

can be measured reliably.

2.12.1 Onerous Contracts

Present obligations arising under onerous contracts are recognised

and measured as provisions. An onerous contract is considered to

exist where the Group has a contract under which the unavoidable

cost of meeting the obligations under the contract exceeds the

economic benefits estimated to be received from the contract.

2.13

EMPLOYEE BENEFITS

A liability is recognised for benefits accruing to employees in respect

of wages and salaries, annual leave and long service leave when it

is probable that settlement will be required and they are capable of

being measured reliably.

Liabilities recognised in respect of short-term employee benefits

are measured at their nominal values using the remuneration rate

expected to apply at the time of settlement.

Liabilities recognised in respect of long-term employee benefits

are measured as the present value of the estimated future cash

outflows to be made by the Group in respect of services provided by

employees up to reporting date.

2.14

REVENUE RECOGNITION

Revenue is measured at the fair value of the consideration received

or receivable. Revenue is reduced for estimated customer returns.

2.14.1 Sale of Goods

Revenue from the sale of goods is recognised when all the following

conditions are satisfied:

• the Group has transferred to the buyer the significant risks and

rewards of ownership of the goods;

BLACKMORES ANNUAL REPORT 2016

72

• the Group retains neither continuing managerial involvement

to the degree usually associated with ownership nor effective

control over the goods sold;

• the amount of the revenue can be measured reliably;

• it is probable that the economic benefits associated with the

transaction will flow to the Group; and

• the costs incurred or expected to be incurred in respect of the

transaction can be measured reliably.

Specifically, revenue from the sale of goods is recognised when

goods are delivered and legal title is passed.

2.14.2 Dividend and Interest Income

Dividend income from investments is recognised when the Group’s

right to receive payment has been established (provided that it is

probable that the economic benefits will flow to the Group and the

amount of income can be measured reliably).

Interest income from a financial asset is recognised when it is

probable that the economic benefits will flow to the Group and the

amount of revenue can be measured reliably. Interest income is

accrued on a time basis, by reference to the principal outstanding

and at the effective interest rate applicable, which is the rate that

exactly discounts estimated future cash receipts through the

expected life of the financial asset to that asset’s net carrying amount

on initial recognition.

2.14.3 Government Grants

Government grants are not recognised until there is reasonable

assurance that the Group will comply with the conditions attaching

to them and that the grants will be received. Government grants are

recognised in profit or loss on a systematic basis over the periods in

which the Group recognises as expenses the related costs for which

the grants are intended to compensate.

2.15

FOREIGN CURRENCIES

2.15.1 Individual Controlled Entities

The individual Financial Statements of each Group entity are

presented in the currency of the primary economic environment in

which the entity operates (its functional currency). For the purpose

of the Consolidated Financial Statements, the financial results and

financial position of each Group entity are expressed in Australian

Dollars (‘$’), which is the functional currency of the Company, and the

presentation currency for the Consolidated Financial Statements.

2.15.2 Foreign Currency Transactions

In preparing the Financial Statements of the individual entities,

transactions in currencies other than the entity’s functional currency

(foreign currencies) are recognised at the rates of exchange

prevailing on the dates of the transactions. At the end of each

reporting period, monetary items denominated in foreign currencies

are retranslated at the rates prevailing at that date. Non-monetary

items carried at fair value that are denominated in foreign currencies

are retranslated at the rates prevailing on the date when the fair value

was determined. Non-monetary items that are measured in terms of

historical cost in a foreign currency are not retranslated.

2.15.3 Foreign Operations

For the purpose of presenting Consolidated Financial Statements,

the assets and liabilities of the Group’s foreign operations are

translated at exchange rates prevailing at the end of the reporting

period. Income and expense items are translated at the average

exchange rates for the period, unless exchange rates fluctuate

significantly, in which case the exchange rates at the dates of the

transactions are used. Exchange differences arising, if any, are

recognised in other comprehensive income and accumulated in

equity (attributed to non-controlling interests as appropriate).

2.16

SHARE-BASED PAYMENTS

Equity-settled share-based payments to employees and others

providing similar services are measured at the fair value of the

equity instrument at the grant date. Fair value is measured by use

of a binomial model. The expected life used in the model has

been adjusted, based on management’s best estimate, for the

effects of non-transferability, exercise restrictions and behavioural

considerations.

The fair value determined at the grant date of the equity-settled

share-based payments is expensed on a straight-line basis over the

vesting and holding lock periods, based on the Group’s estimate

of equity instruments that will eventually vest with a corresponding

increase in equity. At the end of each reporting period, the Group

revises its estimate of the number of equity instruments expected

to vest. The impact of the revision of the original estimates, if any, is

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

2

SIGNIFICANT ACCOUNTING POLICIES (CONT.)

recognised in profit or loss over the remaining vesting period, with

corresponding adjustment to the equity-settled employee benefits

reserve.

each reporting period and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow all or

part of the asset to be recovered.

For cash-settled share-based payments, a liability is recognised for

the goods or services acquired, measured initially at the fair value

of the liability. At the end of each reporting period until the liability

is settled, and at the date of settlement, the fair value of the liability

is remeasured, with any changes in fair value recognised in profit or

loss for the year.

Deferred tax assets and liabilities are measured at the tax rates that

are expected to apply in the period in which the liability is settled or

the asset realised, based on tax rates (and tax laws) that have been

enacted or substantively enacted by the end of the reporting period.

The measurement of deferred tax liabilities and assets reflects the

tax consequences that would follow from the manner in which the

Group expects, at the end of the reporting period, to recover or

settle the carrying amount of its assets and liabilities.

2.17

GOODS AND SERVICE TAX

Revenues, expenses and assets are recognised net of the amount of

goods and services tax (GST), except:

• where the amount of GST incurred is not recoverable from the

taxation authority, it is recognised as part of the cost of acquisition

of an asset or as part of an item of expense; or

• for receivables and payables which are recognised inclusive of

GST.

The net amount of GST recoverable from, or payable to, the taxation

authority is included as part of receivables or payables.

Cash flows are included in the Consolidated Statement of Cash

Flows on a gross basis. The GST component of cash flows arising

from investing and financing activities which is recoverable from, or

payable to, the taxation authority is classified within operating cash

flows.

2.18

TAXATION

Income tax expense represents the sum of the tax currently payable

and the movement in deferred tax.

2.18.1 Current Tax

The tax currently payable is based on taxable profit for the year.

Taxable profit differs from profit for the year as reported in the

Consolidated Statement of Profit or Loss and Other Comprehensive

Income because of items of income or expense that are taxable

or deductible in other years and items that are never taxable or

deductible. The Group’s liability for current tax is calculated using tax

rates that have been enacted or substantively enacted by the end of

the reporting period.

2.18.2 Deferred Tax

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and

associates, and interests in joint ventures, except where the Group

is able to control the reversal of the temporary difference and it

is probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and interests

are only recognised to the extent that it is probable that there will

be sufficient taxable profits against which to utilise the benefits of

the temporary differences and they are expected to reverse in the

foreseeable future.

The carrying amount of deferred tax assets is reviewed at the end of

2.18.3 Current and Deferred Tax for the Year

Current and deferred tax are recognised in profit or loss,

except when they relate to items that are recognised in other

comprehensive income or directly in equity, in which case the current

and deferred tax are also recognised in other comprehensive income

or directly in equity, respectively. Where current tax or deferred tax

arises from the initial accounting for a business combination, the tax

effect is included in the accounting for the business combination.

2.18.4 Tax Consolidated Group

Blackmores Ltd has formed a consolidated group for Australian

income tax purposes. Blackmores Ltd is the head company of its Tax

Consolidated Group and is liable for income tax liabilities of all its

members.

Members of the Blackmores Ltd Tax Consolidated Group are

Blackmores Ltd and all its 100% owned Australian subsidiaries.

2.19

INVESTMENT PROPERTY

Investment property, which is property held to earn rentals and/

or for capital appreciation is measured initially at its cost, including

transaction costs. Subsequent to initial recognition, investment

property will continue to be measured on a cost basis. Investment

property will be depreciated where applicable.

Depreciation is provided on investment property, including freehold

buildings but excluding land. Depreciation is calculated on a

straight-line basis so as to write off the net cost of each asset over

its expected useful life to its estimated residual value. The estimated

useful lives, residual values and depreciation method are reviewed

at the end of each annual reporting period, with the effect of any

changes recognised on a prospective basis.

An investment property is derecognised upon disposal or when

the investment property is permanently withdrawn from use and

no future economic benefits are expected from the disposal. Any

gain or loss arising on derecognition of the property (calculated as

the difference between the net disposal proceeds and the carrying

amount of the asset) is included in profit or loss in the period in which

the property is derecognised.

2.20

INTANGIBLE ASSETS

2.20.1 Intangible Assets Acquired Separately

Intangible assets with finite lives acquired separately are carried at

cost less accumulated amortisation and accumulated impairment

losses. Amortisation is recognised on a straight-line basis over their

estimated useful lives. The estimated useful life and amortisation

method are reviewed at the end of each reporting period, with

the effect of any changes in estimate being accounted for on a

prospective basis. Intangible assets with indefinite useful lives

that are acquired separately are carried at cost less accumulated

impairment losses.

BLACKMORES ANNUAL REPORT 2016

Deferred tax is recognised on temporary differences between

the carrying amounts of assets and liabilities in the Consolidated

Financial Statements and the corresponding tax bases used in the

computation of taxable profit. Deferred tax liabilities are generally

recognised for all taxable temporary differences. Deferred tax assets

are generally recognised for all deductible temporary differences

to the extent that it is probable that taxable profits will be available

against which those deductible temporary differences can be

utilised. Such deferred tax assets and liabilities are not recognised

if the temporary difference arises from goodwill or from the initial

recognition (other than in a business combination) of other assets

and liabilities in a transaction that affects neither the taxable profit nor

the accounting profit.

Deferred tax assets and liabilities are offset when there is a legally

enforceable right to set off current tax assets against current tax

liabilities and when they relate to income taxes levied by the same

taxation authority and the Group intends to settle its current tax

assets and liabilities on a net basis.

73

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

2

SIGNIFICANT ACCOUNTING POLICIES (CONT.)

2.20.2 Internally generated Intangible Assets

2.20.2.1 Research and Development Expenditure

Expenditure on research activities is recognised as an expense in the

period in which it is incurred.

An internally generated intangible asset arising from development

(or from the development phase of an internal project) is recognised

if, and only if, all of the following have been demonstrated:

• the technical feasibility of completing the intangible asset so that

it will be available for use or sale

• the intention to complete the intangible asset and use or sell it;

• the ability to use or sell the intangible asset;

• how the intangible asset will generate probable future economic

benefits;

• the availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset; and

• the ability to measure reliably the expenditure attributable to the

intangible asset during its development.

Subsequent to initial recognition, internally generated intangible

assets are reported at cost less accumulated amortisation and

accumulated impairment losses, on the same basis as intangible

assets that are acquired separately.

Brand names recognised by the Company have an indefinite useful

life and are not amortised. Each period, the useful life of this asset is

reviewed to determine whether events and circumstances continue

to support an indefinite useful life assessment for the asset. Such

assets are tested for impairment in accordance with the policy stated

in note 2.9.

2.20.2.2 Website Development Expenditure

Website development expenditure is recognised as an intangible

asset to the extent that the above recognition criteria is met and the

website will generate probable future economic benefits. Otherwise,

it is expensed as incurred.

2.20.3 Intangible Assets Acquired in a Business Combination

Intangible assets acquired in a business combination and recognised

separately from goodwill are initially recognised at their fair value at

the acquisition date (which is regarded as their cost).

Subsequent to initial recognition, intangible assets acquired in

a business combination are reported at cost less accumulated

amortisation and accumulated impairment losses, on the same basis

as intangible assets that are acquired separately.

2.20.4 Derecognition of Intangible Assets

BLACKMORES ANNUAL REPORT 2016

74

An intangible asset is derecognised on disposal, or when no future

economic benefits are expected from use or disposal. Gains or

losses arising from derecognition of an intangible asset, measured as

the difference between the net disposal proceeds and the carrying

amount of the asset are recognised in profit or loss when the asset is

derecognised.

2.21

BUSINESS COMBINATIONS

Acquisitions of businesses are accounted for using the acquisition

method. The consideration transferred in a business combination

is measured at fair value which is calculated as the sum of the

acquisition-date fair values of assets transferred by the Group,

liabilities incurred by the Group to the former owners of the acquire

and the equity instruments issued by the Group in exchange for

control of the acquiree. Acquisition-related costs are recognised in

profit or loss as incurred.

Goodwill is measured as the excess of the sum of the consideration

transferred over the net of the acquisition-date amounts of the

identifiable assets acquired and the liabilities assumed. If, after

reassessment, the net of the acquisition-date amounts of the

identifiable assets acquired and liabilities assumed exceeds the sum

of the consideration transferred, the amount of any non-controlling

interests in the acquiree and the fair value of the acquirer’s previously

held interest in the acquiree (if any), the excess is recognised

immediately in profit or loss as a bargain purchase gain.

Where the consideration transferred by the Group in a business

combination includes assets or liabilities resulting from a contingent

consideration arrangement, the contingent consideration is

measured at its acquisition-date fair value, with corresponding

adjustments against goodwill. Measurement period adjustments are

adjustments that arise from additional information obtained during

the ‘measurement period’ (which cannot exceed one year from the

acquisition date) about facts and circumstances that existed at the

acquisition date.

The subsequent accounting for changes in the fair value of

contingent consideration that do not qualify as measurement

period adjustments depends on how the contingent consideration

is classified. Contingent consideration that is classified as equity is

not remeasured at subsequent reporting dates and its subsequent

settlement is accounted for within equity. Contingent consideration

that is classified as an asset or liability is remeasured at subsequent

reporting dates in accordance with AASB 139, or AASB 137

‘Provisions, Contingent Liabilities and Contingent Assets’, as

appropriate, with the corresponding gain or loss being recognised in

profit or loss.

2.22

GOODWILL

Goodwill arising on an acquisition of a business is carried at cost as

established at the date of the acquisition of the business (see note

2.21 above) less accumulated impairment losses, if any.

For the purposes of impairment testing, goodwill is allocated

to each of the Group’s cash-generating units (or groups of cash

generating units) that is expected to benefit from the synergies of the

combination.

A cash-generating unit to which goodwill has been allocated is

tested for impairment annually, or more frequently when there is

indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than its carrying amount, the

impairment loss is allocated first to reduce the carrying amount of

any goodwill allocated to the unit and then to the other assets of the

unit pro rata based on the carrying amount of each asset in the unit.

2.23

INTERESTS IN JOINT OPERATIONS

A joint operation is a joint arrangement whereby the parties that

have joint control of the arrangement have rights to the assets,

and obligations for the liabilities, relating to the arrangement.

Joint control is the contractually agreed sharing of control of an

arrangement, which exists only when decisions about the relevant

activities require unanimous consent of the parties sharing control.

When a group entity undertakes its activities under joint operations,

the Group as a joint operator recognises in relation to its interest in a

joint operation:

• its assets, including its share of any assets held jointly;

• its liabilities, including its share of any liabilities incurred jointly;

• its revenue from the sale of its share of the output arising from the

joint operation;

• its share of the revenue from the sale of the output by the joint

operation; and

• its expenses, including its share of any expenses incurred jointly.

The Group accounts for the assets, liabilities, revenues and expenses

relating to its interest in a joint operation in accordance with the

AASBs applicable to the particular assets, liabilities, revenues and

expenses.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

3

APPLICATION OF NEW AND REVISED ACCOUNTING STANDARDS

3.1

STANDARDS AND INTERPRETATIONS AFFECTING AMOUNTS REPORTED IN THE CURRENT PERIOD

(AND/OR PRIOR PERIODS)

Standards affecting presentation and disclosure

There are no new and/or revised Standards and Interpretations adopted in these Financial Statements affecting presentation or disclosure.

Standards and Interpretations affecting the reported results or financial position

There are no new and revised Standards and Interpretations adopted in these Financial Statements affecting the reported results or financial

position.

3.2

STANDARDS AND INTERPRETATIONS ADOPTED WITH NO EFFECT ON THE FINANCIAL STATEMENTS

The are no new Standards and Interpretations adopted in these Financial Statements.

3.3

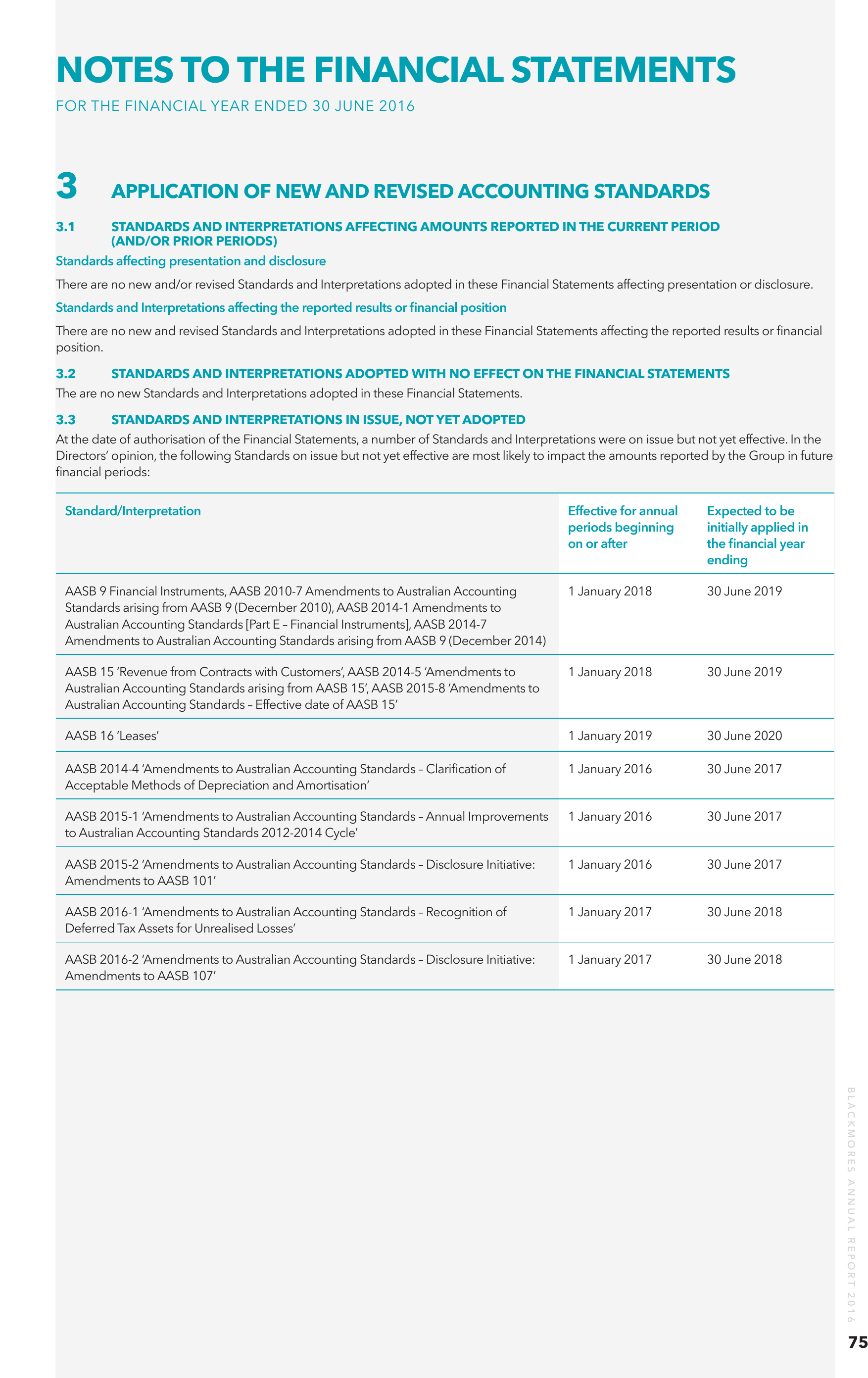

STANDARDS AND INTERPRETATIONS IN ISSUE, NOT YET ADOPTED

At the date of authorisation of the Financial Statements, a number of Standards and Interpretations were on issue but not yet effective. In the

Directors’ opinion, the following Standards on issue but not yet effective are most likely to impact the amounts reported by the Group in future

financial periods:

Standard/Interpretation

Effective for annual

periods beginning

on or after

Expected to be

initially applied in

the financial year

ending

AASB 9 Financial Instruments, AASB 2010-7 Amendments to Australian Accounting

Standards arising from AASB 9 (December 2010), AASB 2014-1 Amendments to

Australian Accounting Standards [Part E – Financial Instruments], AASB 2014-7

Amendments to Australian Accounting Standards arising from AASB 9 (December 2014)

1 January 2018

30 June 2019

AASB 15 ‘Revenue from Contracts with Customers’, AASB 2014-5 ‘Amendments to

Australian Accounting Standards arising from AASB 15’, AASB 2015-8 ‘Amendments to

Australian Accounting Standards – Effective date of AASB 15’

1 January 2018

30 June 2019

AASB 16 ‘Leases’

1 January 2019

30 June 2020

AASB 2014-4 ‘Amendments to Australian Accounting Standards – Clarification of

Acceptable Methods of Depreciation and Amortisation’

1 January 2016

30 June 2017

AASB 2015-1 ‘Amendments to Australian Accounting Standards – Annual Improvements

to Australian Accounting Standards 2012-2014 Cycle’

1 January 2016

30 June 2017

AASB 2015-2 ‘Amendments to Australian Accounting Standards – Disclosure Initiative:

Amendments to AASB 101’

1 January 2016

30 June 2017

AASB 2016-1 ‘Amendments to Australian Accounting Standards – Recognition of

Deferred Tax Assets for Unrealised Losses’

1 January 2017

30 June 2018

AASB 2016-2 ‘Amendments to Australian Accounting Standards – Disclosure Initiative:

Amendments to AASB 107’

1 January 2017

30 June 2018

BLACKMORES ANNUAL REPORT 2016

75

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

4

CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

In the application of the accounting policies, which are described in note 2, management is required to make judgements, estimates

and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from

these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects

both current and future periods.

4.1

INVENTORY

Inventories are stated at the lower of cost and net realisable value. The Directors assess slow moving or obsolete inventory on a regular basis

and a provision is raised to write down inventory to net realisable value as described in note 2.7.

4.2

IMPAIRMENT OF GOODWILL

Determining whether goodwill is impaired requires an estimation of the value in use of the cash generating unit to which goodwill has been

allocated. The value in use calculation requires the directors to estimate the future cash flows expected to arise from the cash-generating unit

and a suitable discount rate in order to calculate present value.

The carrying amount of goodwill at 30 June 2016 was $20,032 thousand (30 June 2015: $16,863 thousand).

4.3

IMPAIRMENT OF NON-CURRENT ASSETS

The Directors considered the recoverability of the Group’s non-current assets, including property, plant and equipment and other intangible

assets. Based on the Group’s performance, there are no indicators of impairment for non-current assets.

4.4

USEFUL LIVES OF PROPERTY PLANT AND EQUIPMENT

As described in note 2.8, the Group reviews the useful lives of property, plant and equipment at the end of each financial year. No changes

were made during the current year.

BLACKMORES ANNUAL REPORT 2016

76

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

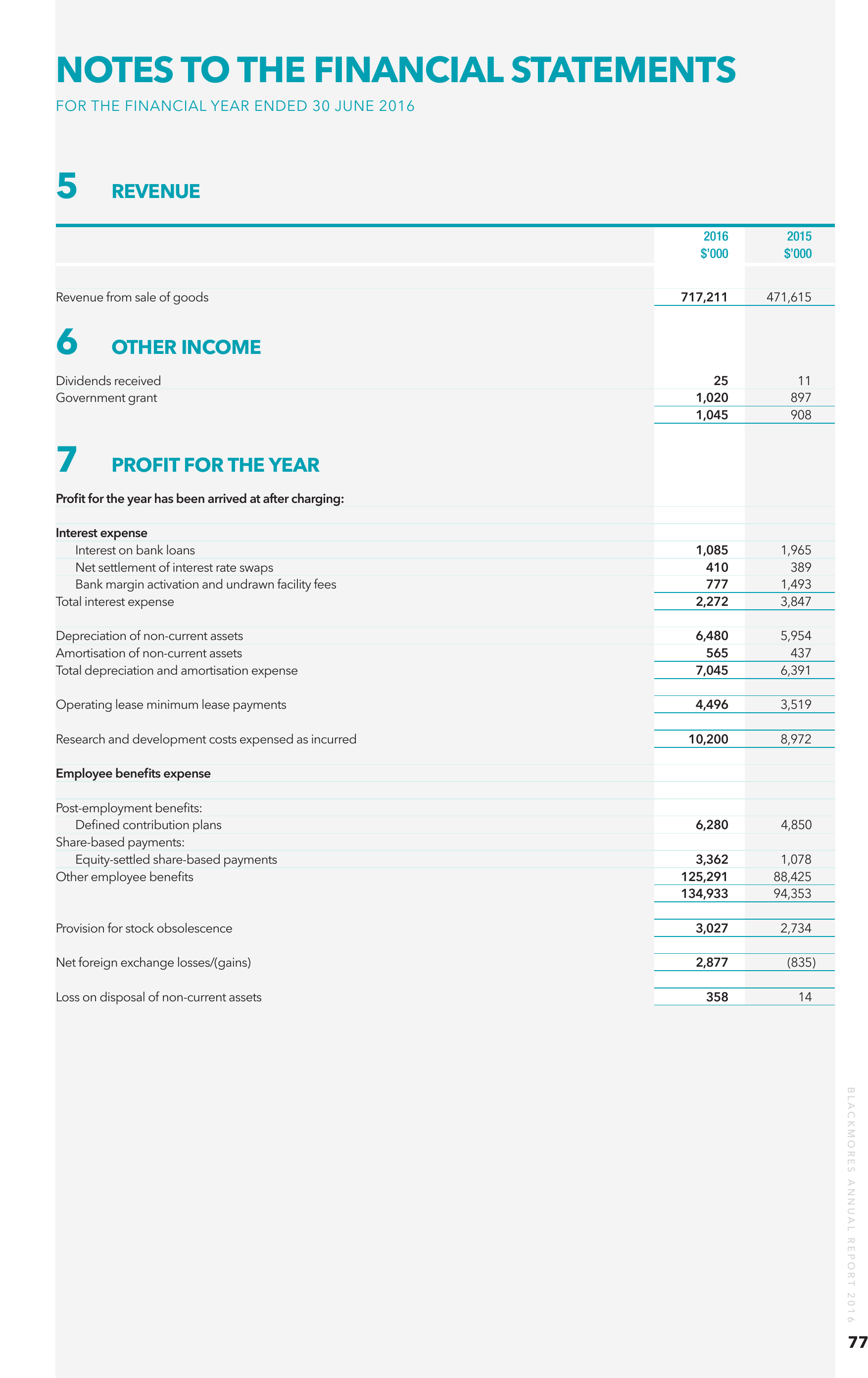

5 REVENUE

2016 2015

$’000

$’000

Revenue from sale of goods

6 INCOME

OTHER

717,211

471,615

25

1,020

1,045

11

897

908

Dividends received

Government grant

7

PROFIT FOR THE YEAR

Profit for the year has been arrived at after charging:

Interest expense

Interest on bank loans

1,085

1,965

Net settlement of interest rate swaps

410

389

Bank margin activation and undrawn facility fees

777

1,493

Total interest expense

2,272

3,847

Depreciation of non-current assets

6,480

5,954

Amortisation of non-current assets

565

437

Total depreciation and amortisation expense

7,045

6,391

Operating lease minimum lease payments

4,496

3,519

Research and development costs expensed as incurred

10,200

8,972

Employee benefits expense

Post-employment benefits:

Defined contribution plans

6,280

4,850

Share-based payments:

Equity-settled share-based payments

3,362

1,078

Other employee benefits

125,291

88,425

134,933

94,353

Provision for stock obsolescence

3,027

2,734

Net foreign exchange losses/(gains)

2,877

(835)

Loss on disposal of non-current assets

358

14

BLACKMORES ANNUAL REPORT 2016

77

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

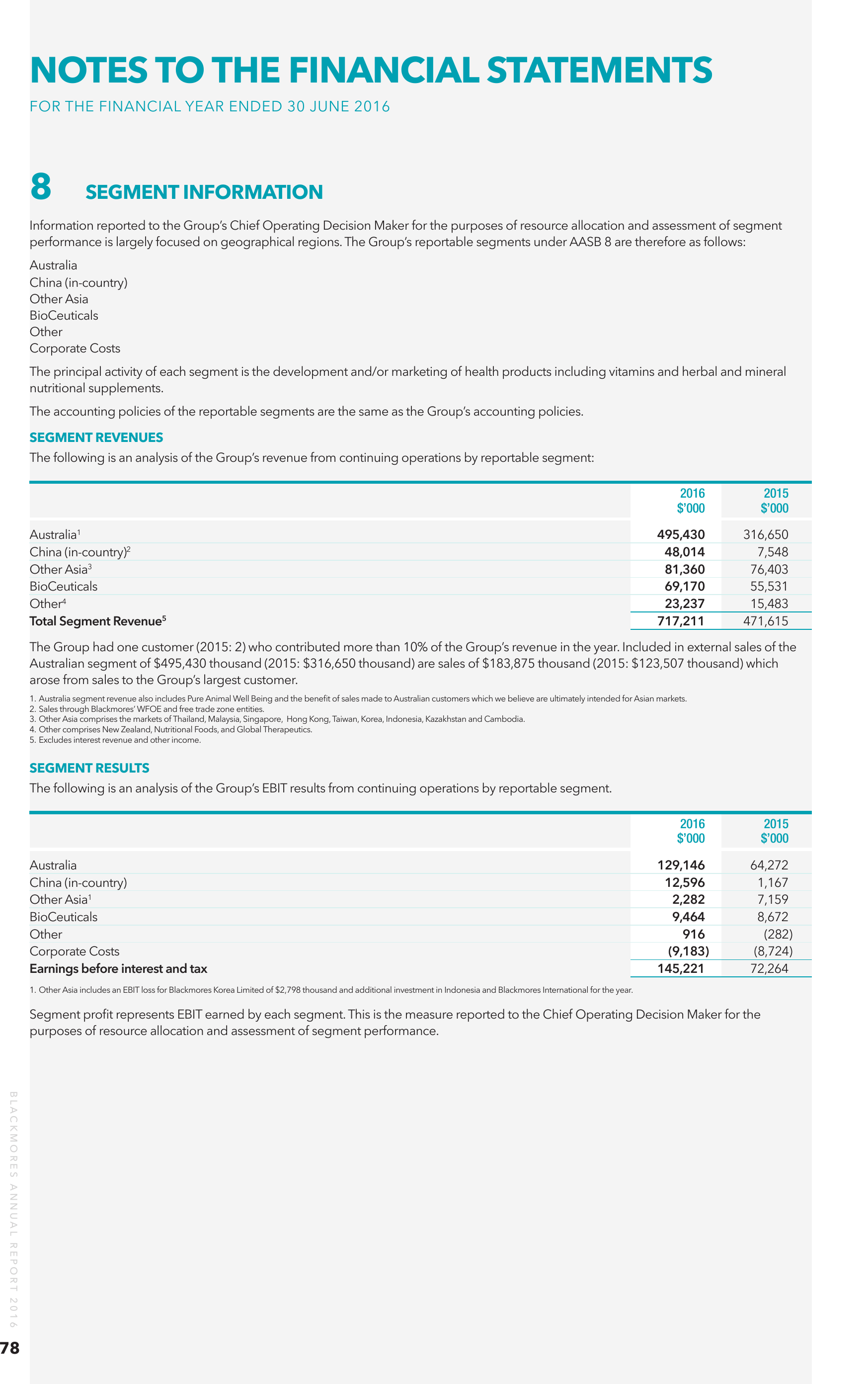

8

SEGMENT INFORMATION

Information reported to the Group’s Chief Operating Decision Maker for the purposes of resource allocation and assessment of segment

performance is largely focused on geographical regions. The Group’s reportable segments under AASB 8 are therefore as follows:

Australia

China (in-country)

Other Asia

BioCeuticals

Other

Corporate Costs

The principal activity of each segment is the development and/or marketing of health products including vitamins and herbal and mineral

nutritional supplements.

The accounting policies of the reportable segments are the same as the Group’s accounting policies.

SEGMENT REVENUES

The following is an analysis of the Group’s revenue from continuing operations by reportable segment:

2016 2015

$’000

$’000

Australia1

495,430

316,650

China (in-country)2

48,014

7,548

Other Asia3

81,360

76,403

BioCeuticals

69,170

55,531

Other4

23,237

15,483

Total Segment Revenue5

717,211

471,615

The Group had one customer (2015: 2) who contributed more than 10% of the Group’s revenue in the year. Included in external sales of the

Australian segment of $495,430 thousand (2015: $316,650 thousand) are sales of $183,875 thousand (2015: $123,507 thousand) which

arose from sales to the Group’s largest customer.

1. Australia segment revenue also includes Pure Animal Well Being and the benefit of sales made to Australian customers which we believe are ultimately intended for Asian markets.

2. Sales through Blackmores’ WFOE and free trade zone entities.

3. Other Asia comprises the markets of Thailand, Malaysia, Singapore, Hong Kong, Taiwan, Korea, Indonesia, Kazakhstan and Cambodia.

4. Other comprises New Zealand, Nutritional Foods, and Global Therapeutics.

5. Excludes interest revenue and other income.

SEGMENT RESULTS

The following is an analysis of the Group’s EBIT results from continuing operations by reportable segment.

2016 2015

$’000

$’000

Australia

China (in-country)

Other Asia1

BioCeuticals

Other

Corporate Costs

Earnings before interest and tax

129,146

12,596

2,282

9,464

916

(9,183)

145,221

64,272

1,167

7,159

8,672

(282)

(8,724)

72,264

1. Other Asia includes an EBIT loss for Blackmores Korea Limited of $2,798 thousand and additional investment in Indonesia and Blackmores International for the year.

Segment profit represents EBIT earned by each segment. This is the measure reported to the Chief Operating Decision Maker for the

purposes of resource allocation and assessment of segment performance.

BLACKMORES ANNUAL REPORT 2016

78

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

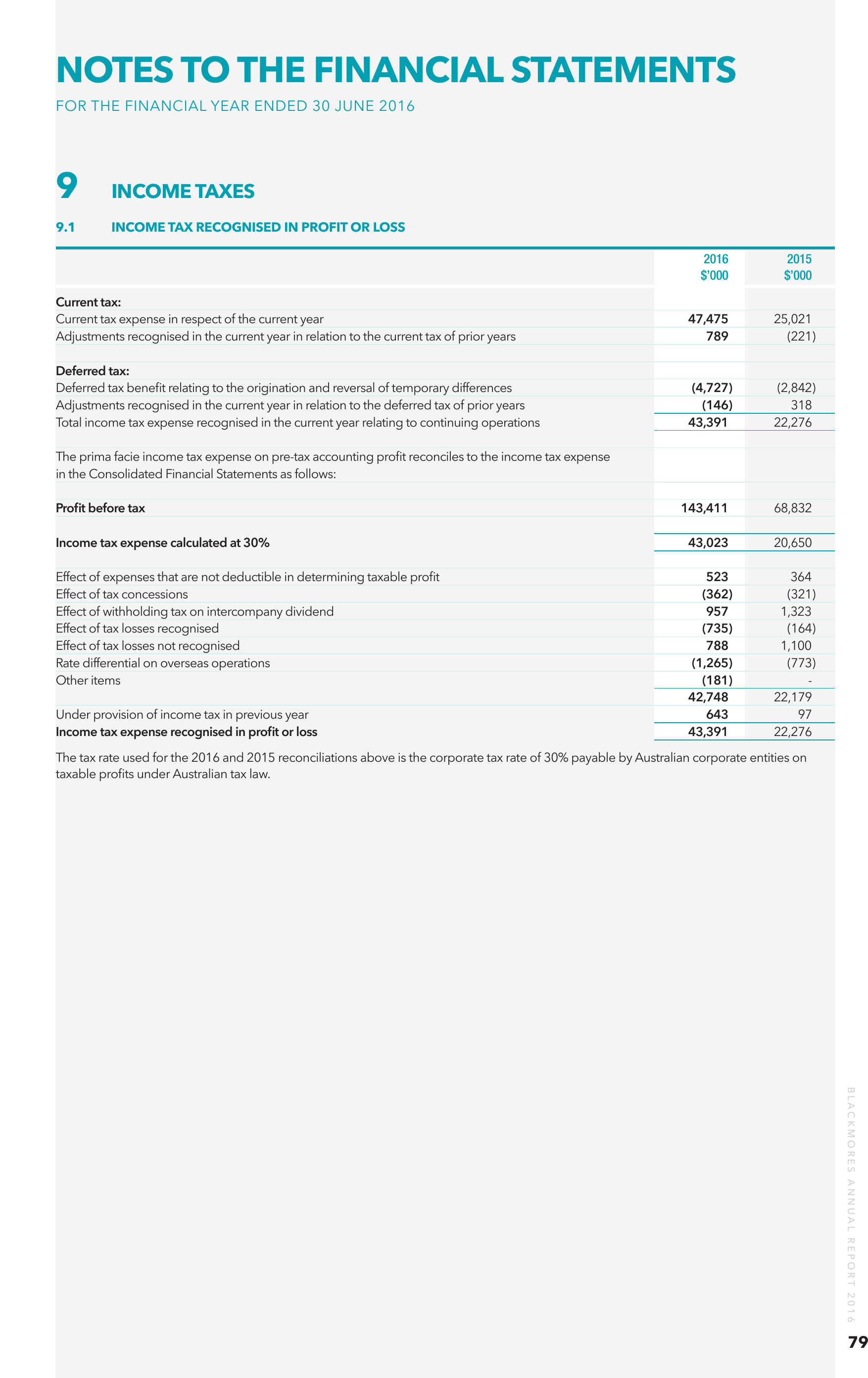

9

INCOME TAXES

9.1

INCOME TAX RECOGNISED IN PROFIT OR LOSS

2016 2015

$’000

$’000

Current tax:

Current tax expense in respect of the current year

Adjustments recognised in the current year in relation to the current tax of prior years

47,475

789

25,021

(221)

Deferred tax:

Deferred tax benefit relating to the origination and reversal of temporary differences

(4,727)

(2,842)

Adjustments recognised in the current year in relation to the deferred tax of prior years

(146)

318

Total income tax expense recognised in the current year relating to continuing operations

43,391

22,276

The prima facie income tax expense on pre-tax accounting profit reconciles to the income tax expense

in the Consolidated Financial Statements as follows:

Profit before tax

143,411

68,832

Income tax expense calculated at 30%

43,023

20,650

Effect of expenses that are not deductible in determining taxable profit

523

364

Effect of tax concessions

(362)

(321)

Effect of withholding tax on intercompany dividend

957

1,323

Effect of tax losses recognised

(735)

(164)

Effect of tax losses not recognised

788

1,100

Rate differential on overseas operations

(1,265)

(773)

Other items

(181)

-

42,748

22,179

Under provision of income tax in previous year

643

97

Income tax expense recognised in profit or loss

43,391

22,276

The tax rate used for the 2016 and 2015 reconciliations above is the corporate tax rate of 30% payable by Australian corporate entities on

taxable profits under Australian tax law.

BLACKMORES ANNUAL REPORT 2016

79

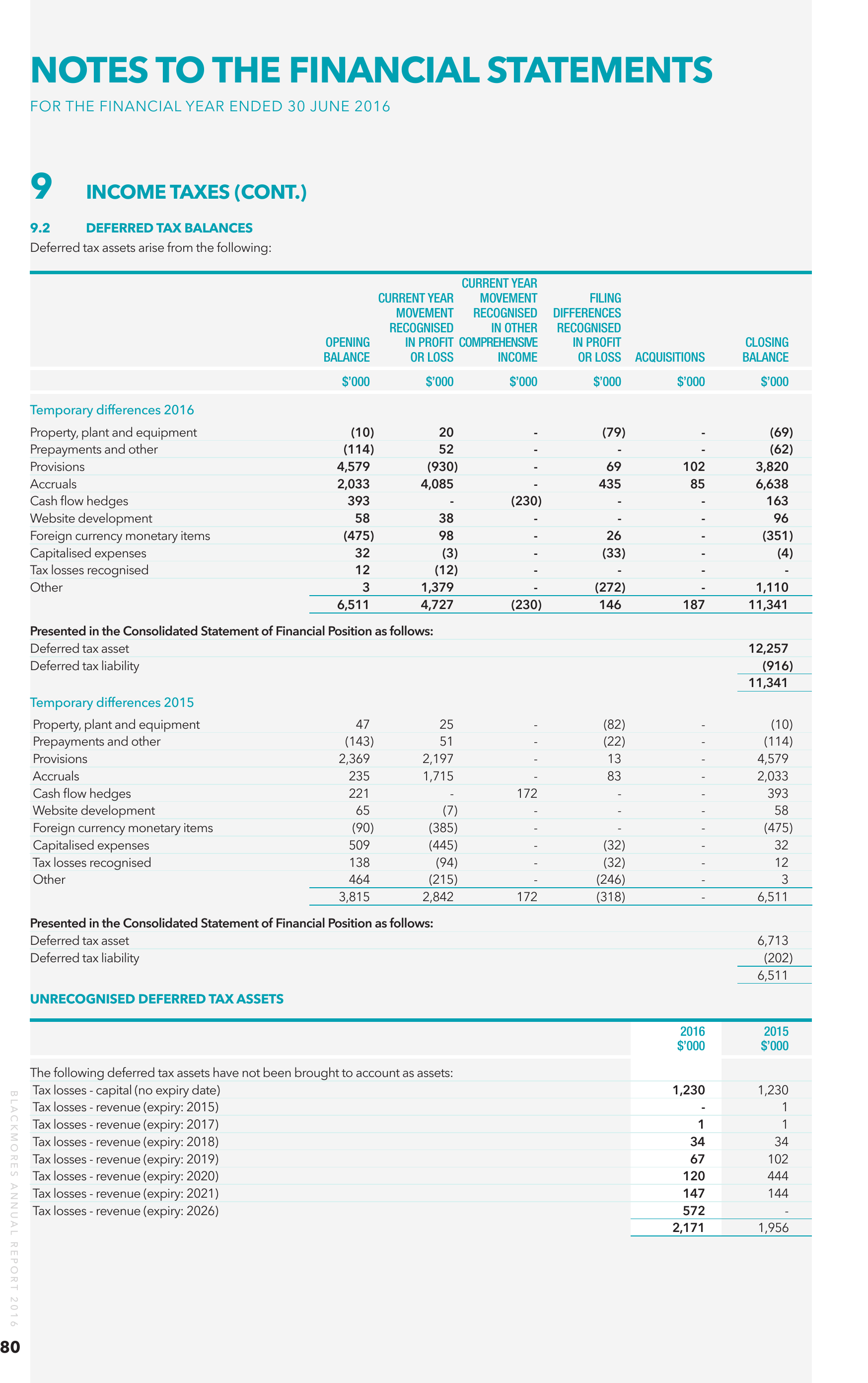

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

9

INCOME TAXES (CONT.)

9.2

DEFERRED TAX BALANCES

Deferred tax assets arise from the following:

CURRENT YEAR

CURRENT YEAR

MOVEMENT

FILING

RECOGNISED

MOVEMENT DIFFERENCES

RECOGNISED

IN OTHER RECOGNISED

OPENING

IN PROFIT COMPREHENSIVE

IN PROFIT

CLOSING

BALANCE

OR LOSS

INCOME

OR LOSS ACQUISITIONS

BALANCE

$’000 $’000 $’000 $’000 $’000 $’000

Temporary differences 2016

Property, plant and equipment

Prepayments and other

Provisions

Accruals

Cash flow hedges

Website development

Foreign currency monetary items

Capitalised expenses

Tax losses recognised

Other

(10)

(114)

4,579

2,033

393

58

(475)

32

12

3

6,511

20

52

(930)

4,085

-

38

98

(3)

(12)

1,379

4,727

-

-

-

-

(230)

-

-

-

-

-

(230)

(79)

-

69

435

-

-

26

(33)

-

(272)

146

-

-

102

85

-

-

-

-

-

-

187

(69)

(62)

3,820

6,638

163

96

(351)

(4)

1,110

11,341

P

resented in the Consolidated Statement of Financial Position as follows:

Deferred tax asset

12,257

Deferred tax liability

(916)

11,341

Temporary differences 2015

Property, plant and equipment

Prepayments and other

Provisions

Accruals

Cash flow hedges

Website development

Foreign currency monetary items

Capitalised expenses

Tax losses recognised

Other

47

(143)

2,369

235

221

65

(90)

509

138

464

3,815

25

51

2,197

1,715

-

(7)

(385)

(445)

(94)

(215)

2,842

-

-

-

-

172

-

-

-

-

-

172

(82)

(22)

13

83

-

-

-

(32)

(32)

(246)

(318)

-

-

-

-

-

-

-

-

-

-

-

(10)

(114)

4,579

2,033

393

58

(475)

32

12

3

6,511

P

resented in the Consolidated Statement of Financial Position as follows:

Deferred tax asset

6,713

Deferred tax liability

(202)

6,511

UNRECOGNISED DEFERRED TAX ASSETS

2016 2015

$’000

$’000

BLACKMORES ANNUAL REPORT 2016

80

The following deferred tax assets have not been brought to account as assets:

Tax losses - capital (no expiry date)

1,230

1,230

Tax losses - revenue (expiry: 2015)

-

1

Tax losses - revenue (expiry: 2017)

1

1

Tax losses - revenue (expiry: 2018)

34

34

Tax losses - revenue (expiry: 2019)

67

102

Tax losses - revenue (expiry: 2020)

120

444

Tax losses - revenue (expiry: 2021)

147

144

Tax losses - revenue (expiry: 2026)

572

2,171

1,956