NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

30 OPERATING LEASES

Leasing Arrangements

Operating leases relate to business premises and the Group’s motor vehicle fleet with lease terms of between three and six years. All

operating lease contracts contain market review clauses in the event that the Group exercises its option to renew. The Group does not have an

option to purchase the leased asset at the expiry of the lease period.

Non-cancellable Operating Lease Payments

2016 2015

$’000 $’000

Not later than 1 year

5,414

Later than 1 year and not later than 5 years

12,389

Later than 5 years

-

17,803

2,269

2,543

4,812

No liabilities have been recognised in respect of non-cancellable operating leases.

31 CONTINGENT LIABILITIES

The Directors do not believe there are any contingent liabilities as at 30 June 2016.

32 SUBSIDIARIES AND OTHER RELATED COMPANIES

Details of the Group’s subsidiaries at the end of the financial year are as follows.

INTEREST

2015

%

PRINCIPAL ACTIVITY

Australia

Australia

100

50

Blackmores Nominees Pty Limited4

Pat Health Limited

Blackmores Beijing Co., Limited

Blackmores (Shanghai)

Trading Co., Limited

Blackmores (Taiwan) Limited

Pure Animal Wellbeing Pty Limited4

92

OWNERSHIP

2016

%

Blackmores SPV Co Pty Limited4

Bemore Partnership Pty Limited2

BLACKMORES ANNUAL REPORT 2016

COUNTRY OF

NAME OF ENTITY

INCORPORATION

Australia

Hong Kong

China

100

100

100

-

Holding company

-

Marketing of infant and life stage

nutritional powders

100

Management of employee share plans

100

Marketing of natural health products

100

Marketing of natural health products

China

Taiwan

Australia

100

100

100

Blackmores (New Zealand) Limited

Blackmores (Singapore) Pte Limited

Blackmores (Malaysia) Sdn Bhd

Blackmores Holdings Limited

Blackmores Limited

Blackmores Korea Limited

Blackmores International Pte. Limited

PT Kalbe Blackmores Nutrition3

FIT-BioCeuticals Limited4

FIT-BioCeuticals (NZ) Limited1

PharmaFoods Pty Limited4

FIT-BioCeuticals Limited

FIT-BioCeuticals (HK) Limited

Hall Drug Technologies Pty Limited4

New Century Herbals Pty Limited4

Global Therapeutics Pty Limited1,4

New Zealand

Singapore

Malaysia

Thailand

Thailand

Korea

Singapore

Indonesia

Australia

New Zealand

Australia

United Kingdom

Hong Kong

Australia

Australia

Australia

100

100

100

100

100

100

100

50

100

100

100

100

100

100

100

100

100

Marketing of natural health products

100

Marketing of natural health products

100

Holder of intellectual property for

Animal Health Division

100

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

100

Holding company

100

Marketing of natural health products

100

Marketing of natural health products

100

Regional head office

-

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

100

Marketing of natural health products

-

Holding company

-

Marketing of natural health products

1. These wholly owned subsidiaries have entered into a deed of cross guarantee with Blackmores Limited pursuant to ASIC class order 98/1418 and are relieved from the requirement to prepare and lodge an

audited financial report.

2. Companies incorporated during the year ended 30 June 2016 for the purpose of the newly formed partnership with Bega Cheese Limited. Bemore Parternership Pty Limited represents 50% of shares issue and is a

joint operation owned and managed equally by Bega Cheese Limited and Blackmores Limited.

3. PT Kalbe Blackmores Nutrition was incorporated during the year ended 30 June 2016. Blackmores International Pte Limited’s shareholding in PT Kalbe Blackmores Nutrition represents 50%+1 of shares issued.

4. These subsidiaries are members of Blackmores Limited’s Australian Tax Consolidated Group.

Companies incorporated outside Australia carry on business in the country of incorporation. All overseas entities have been audited by

overseas firms of Deloitte Touche Tohmatsu, except the overseas entities owned by FIT-BioCeuticals Limited.

Economic Dependency

The Group is not significantly dependent upon any other entity.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

32 SUBSIDIARIES AND OTHER RELATED COMPANIES (CONT.)

32.1

FINANCIAL SUPPORT

The Consolidated Statement of Profit or Loss and Other Comprehensive Income and the Consolidated Statement of Financial Position of the

entities party to the deed of cross guarantee are:

Statement of Profit or Loss and Other Comprehensive Income

2016

2015

$’000 $’000

Sales

620,937

409,721

Other income

11,079

18,267

Promotional and other rebates

(86,744)

(65,877)

Revenue and other income

545,272

362,111

Raw materials and consumables used

213,207

144,692

Employee benefits expense

112,303

79,918

Selling and marketing expenses

31,685

24,119

Depreciation and amortisation expenses

6,544

6,156

Operating lease rental expenses

3,262

2,721

Professional and consulting expenses

7,390

5,440

Repairs and maintenance expenses

3,886

3,176

Freight expenses

8,431

5,992

Bank charges

2,041

1,316

Other expenses

16,367

13,661

Total expenses

405,116

287,191

Earnings before interest and tax

140,156

74,920

Interest revenue

252

297

Interest expense

(2,231)

(3,914)

Net interest expense

(1,979)

(3,617)

Profit before tax

138,177

71,303

Income tax expense

(39,744)

(17,767)

Profit for the year

98,433

53,536

Other comprehensive income

Items that may be reclassified subsequently to profit or loss

Net gain/(loss) on hedging instruments entered into for cash flow hedges, net of tax

537

(572)

Other comprehensive income for the year, net of tax

537

(572)

Total comprehensive income for the year

98,970

53,136

Profit attributable to:

Owners of the parent

98,433

53,536

Non-controlling interests

-

98,433

53,536

Total comprehensive income attributable to:

Owners of the parent

98,970

53,136

Non-controlling interests

-

98,970

53,136

BLACKMORES ANNUAL REPORT 2016

93

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

32 SUBSIDIARIES AND OTHER RELATED COMPANIES (CONT.)

32.1

FINANCIAL SUPPORT (CONT.)

Statement of Financial Position

2016 2015

$’000 $’000

ASSETS

CURRENT ASSETS

Cash and cash equivalents

10,512

15,957

Receivables

129,554

101,273

Inventories

99,429

29,902

Other assets

4,493

3,582

Total current assets

243,988

150,713

NON-CURRENT ASSETS

Property, plant and equipment

66,126

60,030

Investment property

2,160

2,160

Other intangible assets

31,450

17,429

Goodwill

19,374

16,205

Deferred tax assets

8,864

6,550

Other financial assets

15,588

5,584

Total non-current assets

143,562

107,957

Total assets

387,550

258,670

LIABILITIES

CURRENT LIABILITIES

Trade and other payables

147,012

80,221

Current tax payable

21,902

11,629

Other financial liabilities

-

1,348

Provisions

8,844

5,942

Other

-

3,751

Total current liabilities

177,758

102,892

NON-CURRENT LIABILITIES

Interest-bearing liabilities

52,000

44,000

Provisions

1,134

1,274

Other financial liabilities

1,139

109

Other

1,160

226

Total non-current liabilities

55,433

45,609

Total liabilities

233,191

148,501

Net assets 154,359

110,169

EQUITY

CAPITAL AND RESERVES

BLACKMORES ANNUAL REPORT 2016

94

Issued capital

37,753

Reserves

3,419

Retained earnings

113,187

Total equity 154,359

37,753

5,813

66,603

110,169

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

33 JOINT OPERATIONS

The Group has the following interest in joint operations:

Bemore Partnership Pty Ltd

The following amounts are included in the Group’s Financial Statements in relation to the joint operation, representing the Group’s 50% share

of Bemore Partnership Pty Ltd:

2016

$’000

Sales

4,329

Promotional and other rebates

(1,075)

Revenue and other income

3,254

Raw materials and consumables

1,945

Operating expenses

2,123

Net loss for the period ended 30 June 2016

(814)

30 June 2016

$’000

Cash and cash equivalents

822

Receivables

626

Inventory

5,029

Total assets

6,477

Other payables

510

Payables to Joint operators1

1,781

Loans from Joint operators1

5,000

Total liabilities

7,291

Net liabilities

(814)

1. Included in these balances are amounts owing to the Blackmores Group of $3,960 thousand.

34 RELATED PARTY AND KEY MANAGEMENT PERSONNEL DISCLOSURES

34.1

EQUITY INTERESTS IN RELATED PARTIES

Equity interests in subsidiaries

Details of the percentage of ordinary shares held in controlled entities are disclosed in note 32 to the Consolidated Financial Statements.

34.2 DISCLOSURES

LOAN

There were no loan balances exceeding $100,000 due from Key Management Personnel during or at the end of the financial year (2015: nil).

34.3

OTHER TRANSACTIONS WITH KEY MANAGEMENT PERSONNEL

Key Management Personnel received dividends on their shareholdings, whether held privately or through related entities or through the

employee share plans on fully vested shares in the same manner as all ordinary shareholders.

No interest was paid to or received from Key Management Personnel.

34.4

RELATED PARTY TRANSACTIONS

The immediate parent and ultimate controlling party of the Group is Blackmores Limited (incorporated in Australia).

Balances and transactions between the Company and its subsidiaries, which are related parties of the Company, have been eliminated on

consolidation and are not disclosed in this note. Details of transactions between the Group and other related parties are disclosed below.

During the year, group entities did not enter into any trading transactions with related parties that are not members of the Group (2015: $nil).

Other related party transactions

During the financial year ended 30 June 2016, the following transactions occurred between the Group and its other related parties:

• alileo Kaleidoscope Pty Ltd, a company of which Brent Wallace is a Director, performed certain consulting services for the Company for

G

which fees of $100,675 (2015: $259,246) were charged.

Balances with related parties

No balances outstanding at the end of the financial year with related parties that are not members of the Group (2015: $nil).

BLACKMORES ANNUAL REPORT 2016

Trading transactions

95

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

35 NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS

35.1

CASH AND CASH EQUIVALENTS

For the purposes of the Consolidated Statement of Cash Flows, cash and cash equivalents includes cash on hand and in banks and

investments in money market instruments, net of outstanding bank overdrafts. Cash and cash equivalents at the end of the financial year as

shown in the Consolidated Statement of Cash Flows is reconciled to the related items in the Consolidated Statement of Financial Position as

follows:

2016 2015

$’000 $’000

Cash and bank balances

Cash and cash equivalents

35.2

37,653

37,653

36,931

36,931

570

4,430

5,000

5,000

5,000

-

-

-

44,000

69,000

113,000

FINANCING FACILITIES

Unsecured bank overdraft facility, reviewed annually and payable at call:

Amount used

Amount unused

Unsecured bank bill acceptance facility, reviewed annually:

Amount used

Amount unused

Unsecured revolving term debt facility under Common Terms Deed:

Amount used

Amount unused

55,446 82,060 137,506 -

The Group restructured borrowings during the year to unsecured debt under a Common Terms Deed with three banks.

The Group has access to financing facilities at reporting date as indicated above. The Group expects to meet its other obligations from

operating cash flows and proceeds of maturing financial assets.

35.3

RECONCILIATION OF PROFIT FOR THE YEAR TO NET CASH FLOWS FROM OPERATING ACTIVITIES

2016 2015

$’000 $’000

BLACKMORES ANNUAL REPORT 2016

96

Profit for the year

100,020

46,556

Loss on disposal of non-current assets

358

14

Interest revenue disclosed as investing cash flow

(462)

(415)

Dividend income disclosed as investing cash flow

(25)

(11)

Depreciation and amortisation of non-current assets

7,045

6,391

Revaluation of investments

(67)

(26)

Share-based payments

3,362

1,078

Other

1,308

(295)

Increase in current tax liability

11,330

9,057

Increase in deferred tax balances

(4,830)

(2,668)

Decrease in deferred tax balances related to hedge reserve in equity

(230)

172

Movements in working capital:

Current receivables

(24,212)

(34,055)

Current inventories

(73,845)

6,459

Other debtors and prepayments

(415)

(1,714)

Current trade payables

62,927

39,943

Provisions

1,412

641

Net cash flows from operating activities

83,676

71,127

35.4

NON-CASH TRANSACTIONS

During the current year, the Group entered into the following non-cash investing and financing activity which is not reflected in the

Consolidated Statement of Cash Flows:

During the year no shares (2015: 109,252) were issued under the Dividend Reinvestment Plan. Dividends settled in shares rather than cash

during the year totalled nil (2015: $3,251 thousand).

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

36 FINANCIAL INSTRUMENTS

36.1

CAPITAL MANAGEMENT

The Group manages its capital to ensure that entities in the Group will be able to continue as a going concern while maximising the return to

stakeholders through optimisation of the debt and equity balance. The Group’s overall strategy remains unchanged from 2015.

The capital structure of the Group consists of net debt (borrowings as disclosed in note 21 offset by cash and cash equivalents as disclosed in

note 35) and equity of the Group (comprising issued capital, reserves and retained earnings as disclosed in notes 23, 24 and 25 respectively).

The Group operates globally, primarily through the Company and subsidiary companies established in the markets in which the Group trades.

None of the entities within the Group are subject to externally imposed capital requirements.

Operating cash flows are used to maintain and expand the Group’s production and distribution assets, as well as make the routine outflows

of tax, dividends and repayment of maturing debt. The Group’s policy is to borrow centrally, using a variety of capital market issues and

borrowing facilities, to meet anticipated funding requirements. The Group established a debt facility in Singapore during 2016 to assist with

Asian funding.

The Group’s Audit and Risk Committee reviews the capital structure of the Group on a semi-annual basis. Based upon recommendations of

the Committee, the Group will balance its overall capital structure through the payment of dividends, new share issues and share buy-backs as

well as the issue of new debt or redemption of existing debt with third parties and, if appropriate, related parties.

Gearing ratio

The gearing ratio at the end of the year was as follows:

2016 2015

$’000 $’000

Debt1

Cash and bank balances

Net debt

Equity2

Net debt divided by the sum of net debt and shareholders’ equity

55,446

44,000

(37,653)

(36,931)

17,793

7,069

178,263

132,915

9.1% 5.1%

1. Debt is defined as long and short-term borrowings, as detailed in note 21.

2. Equity includes all capital and reserves that are managed as capital.

Categories of financial instruments

Financial Assets

Cash and bank balances

Loans and receivables

Other financial assets

37,653

134,636

471

172,760

36,931

107,076

391

144,398

Derivative instruments in designated hedge accounting relationships

Loans and payables

834

215,924

216,758

424

138,908

139,332

Financial Liabilities

36.2

FINANCIAL RISK MANAGEMENT OBJECTIVES

The Group’s Corporate Treasury function provides services to the business, coordinates access to domestic and international financial markets

and monitors and manages the financial risks relating to the operations of the Group.

The Group seeks to minimise the effects of currency risk and interest rate risk by using derivative financial instruments to hedge these risk

exposures. The use of financial derivatives is governed by the Group’s policies approved by the Board of Directors, which provide written

principles on foreign exchange risk, interest rate risk and the use of financial derivatives. Compliance with policies and exposure limits

is reviewed internally on a continuous basis. The Group does not enter into or trade financial instruments, including derivative financial

instruments, for speculative purposes.

BLACKMORES ANNUAL REPORT 2016

36.3

SIGNIFICANT ACCOUNTING POLICIES

Details of the significant accounting policies and methods adopted, including the criteria for recognition, the basis of measurement and the

basis on which revenues and expenses are recognised, in respect of each class of financial asset and financial liability, are disclosed in note 2.6

to the Consolidated Financial Statements.

97

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

36 FINANCIAL INSTRUMENTS (CONT.)

36.4

FOREIGN CURRENCY RISK MANAGEMENT

The Group undertakes transactions denominated in foreign currencies; consequently exposures to exchange rate fluctuations arise. Exchange

rate exposures are managed within approved policy parameters utilising forward exchange contracts.

The Group is mainly exposed to New Zealand Dollar (NZD), United States Dollar (USD), and Canadian Dollar (CAD).

The Australian Dollar carrying amount of the Group’s foreign currency denominated monetary assets and monetary liabilities at the end of the

reporting period are as follows:

LIABILITIES

ASSETS

2016 2015 2016 2015

$’000

$’000

$’000

$’000

United States Dollar (USD)

New Zealand Dollar (NZD)

Euro (EUR)

Canadian Dollar (CAD)

Swiss Franc (CHF)

Chinese (CNY)

Japanese Yen (JPY)

South Korean Won (KRW)

Thai Baht (THB)

Singapore Dollars (SGD)

Malaysian Ringgit (MYR)

19,363

10,917

832

690

93

4

17

47

5

2

7

4,759

7,678

79

226

(13)

-

-

-

-

-

-

3,045

297

-

-

-

57

-

-

12

-

-

1,158

19

-

Foreign currency sensitivity analysis

The following table details the Group’s sensitivity to a 10% increase and decrease in the Australian Dollar against the relevant foreign

currencies. 10% is the sensitivity rate used when reporting foreign currency risk internally to Key Management Personnel and represents

management’s assessment of the possible change in foreign exchange rates. The sensitivity analysis includes only outstanding foreign

currency denominated monetary items and adjusts their translation at the period end for a 10% change in foreign currency rates. A positive

number below indicates an increase in profit or equity where the Australian Dollar strengthens 10% against the relevant currency. For a

10% weakening of the Australian Dollar against the relevant currency, there would be a comparable impact on the profit or equity, and the

balances below would be negative.

PROFIT/ (LOSS)

10% INCREASE

10% DECREASE

2016 2015 2016 2015

$’000

$’000

$’000

$’000

USD impact

NZD impact

EUR impact

CAD impact

CHF impact

CNY impact

JPY impact

KRW impact

1,483

965

75

63

9

(5)

2

4

327

694

7

21

(1)

-

-

-

(1,813)

(1,180)

(93)

(76)

(10)

6

(2)

(5)

(400)

(851)

(9)

(25)

1

-

This is mainly attributable to the exposure outstanding on foreign currency payables in the Group at the end of the reporting period.

BLACKMORES ANNUAL REPORT 2016

98

EQUITY

10% INCREASE

10% DECREASE

2016 2015 2016 2015

$’000

$’000

$’000

$’000

USD impact

NZD impact

(2,499)

(24)

-

(2,273)

2,098

73

819

From time to time during the year, the Group entered into NZD, USD and CAD forward exchange contracts in order to reduce foreign

currency risk.

Option contracts

The Group did not utilise any option contracts during the year, so there were no open contracts at 30 June 2016 (2015: $nil).

Forward foreign exchange contracts

The Group utilised forward foreign exchange contracts during the year. At 30 June 2016 there were open contracts of NZD2.0m, USD18.5m

and MYR 1.2m (2015: NZD19.4m, USD3.1m and CAD 0.5m). These contracts are a partial hedge for upcoming raw material purchases.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

36 FINANCIAL INSTRUMENTS (CONT.)

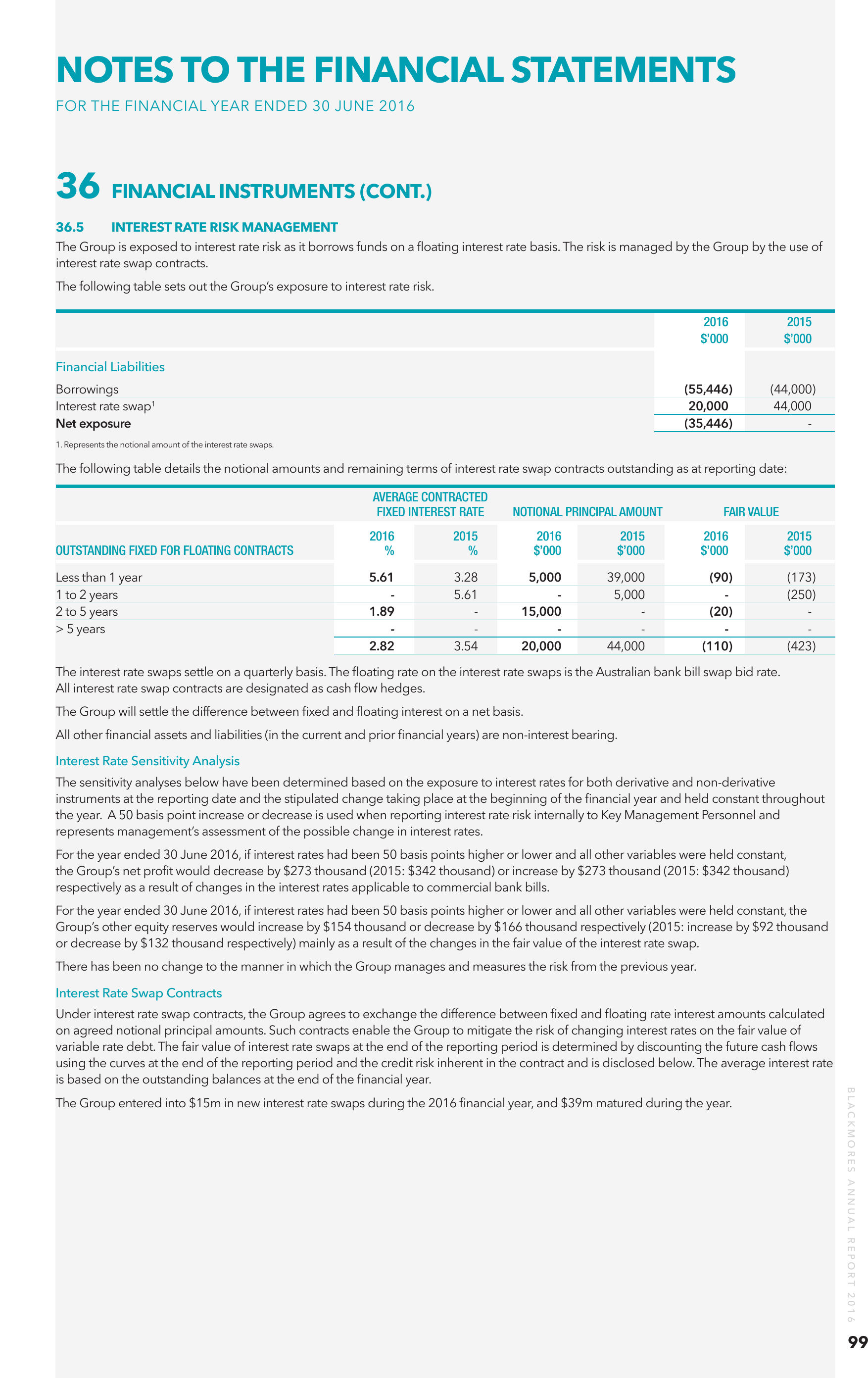

36.5

INTEREST RATE RISK MANAGEMENT

The Group is exposed to interest rate risk as it borrows funds on a floating interest rate basis. The risk is managed by the Group by the use of

interest rate swap contracts.

The following table sets out the Group’s exposure to interest rate risk.

2016 2015

$’000 $’000

Financial Liabilities

Borrowings

(55,446)

(44,000)

Interest rate swap1

20,000

44,000

Net exposure

(35,446)

1. Represents the notional amount of the interest rate swaps.

The following table details the notional amounts and remaining terms of interest rate swap contracts outstanding as at reporting date:

AVERAGE CONTRACTED

FIXED INTEREST RATE

OUTSTANDING FIXED FOR FLOATING CONTRACTS

2016 2015 2016 2015 2016 2015

%

%

$’000

$’000

$’000

$’000

Less than 1 year

1 to 2 years

2 to 5 years

> 5 years

5.61

-

1.89

-

2.82

3.28

5.61

-

-

3.54

NOTIONAL PRINCIPAL AMOUNT

5,000

-

15,000

-

20,000

39,000

5,000

-

-

44,000

FAIR VALUE

(90)

-

(20)

-

(110)

(173)

(250)

(423)

The interest rate swaps settle on a quarterly basis. The floating rate on the interest rate swaps is the Australian bank bill swap bid rate.

All interest rate swap contracts are designated as cash flow hedges.

The Group will settle the difference between fixed and floating interest on a net basis.

All other financial assets and liabilities (in the current and prior financial years) are non-interest bearing.

Interest Rate Sensitivity Analysis

The sensitivity analyses below have been determined based on the exposure to interest rates for both derivative and non-derivative

instruments at the reporting date and the stipulated change taking place at the beginning of the financial year and held constant throughout

the year. A 50 basis point increase or decrease is used when reporting interest rate risk internally to Key Management Personnel and

represents management’s assessment of the possible change in interest rates.

For the year ended 30 June 2016, if interest rates had been 50 basis points higher or lower and all other variables were held constant,

the Group’s net profit would decrease by $273 thousand (2015: $342 thousand) or increase by $273 thousand (2015: $342 thousand)

respectively as a result of changes in the interest rates applicable to commercial bank bills.

For the year ended 30 June 2016, if interest rates had been 50 basis points higher or lower and all other variables were held constant, the

Group’s other equity reserves would increase by $154 thousand or decrease by $166 thousand respectively (2015: increase by $92 thousand

or decrease by $132 thousand respectively) mainly as a result of the changes in the fair value of the interest rate swap.

There has been no change to the manner in which the Group manages and measures the risk from the previous year.

Interest Rate Swap Contracts

The Group entered into $15m in new interest rate swaps during the 2016 financial year, and $39m matured during the year.

BLACKMORES ANNUAL REPORT 2016

Under interest rate swap contracts, the Group agrees to exchange the difference between fixed and floating rate interest amounts calculated

on agreed notional principal amounts. Such contracts enable the Group to mitigate the risk of changing interest rates on the fair value of

variable rate debt. The fair value of interest rate swaps at the end of the reporting period is determined by discounting the future cash flows

using the curves at the end of the reporting period and the credit risk inherent in the contract and is disclosed below. The average interest rate

is based on the outstanding balances at the end of the financial year.

99

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

36 FINANCIAL INSTRUMENTS (CONT.)

36.6 RISK MANAGEMENT

CREDIT

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to the Group. The Group has

adopted a policy of only dealing with creditworthy counterparties. The Group only transacts with entities that have a positive credit history.

The information used to determine creditworthiness is supplied by independent rating agencies where available and, if not available, the

Group uses publicly available financial information, trade references and their own trading record to rate their major customers.

Ongoing credit evaluation is performed on the financial condition of accounts receivable and, where appropriate, credit guarantee insurance.

The credit risk on liquid funds and derivative financial instruments is limited because the counterparties are banks with sound credit ratings

assigned by international credit-rating agencies.

The carrying amount of financial assets recorded in the consolidated Financial Statements, net of any allowances for losses, represents the

Group’s maximum exposure to credit risk.

There has been no change to the Group’s exposure to credit risk or the manner in which it manages and measures the risk from the previous

year.

36.7

LIQUIDITY RISK MANAGEMENT

Ultimate responsibility for liquidity risk management rests with the Board of Directors, which has established an appropriate liquidity

risk management framework for the management of the Group’s short-, medium- and long-term funding and liquidity management

requirements. The Group manages liquidity risk by maintaining adequate reserves and banking facilities and through the continual

monitoring of forecast and actual cash flows.

Liquidity and Interest Risk

The following tables detail the Group’s remaining contractual maturity for its non-derivative financial liabilities with agreed repayment periods.

The tables have been drawn up based on the undiscounted cash flows of financial liabilities based on the earliest date on which the Group

can be required to pay. The tables include both interest and principal cash flows.

WEIGHTED AVERAGE

3 MONTHS

EFFECTIVE INTEREST

<1 MONTH 1-3 MONTHS

TO 1 YEAR

1-5 YEARS

5 YEARS

TOTAL

RATE % $’000 $’000 $’000 $’000 $’000 $’000

2016

Trade and other payables

0.00 -

Borrowings

2.82 -

-

160,478

-

160,478

-

-

-

-

55,446

55,446

-

-

-

160,478

55,446

215,924

94,908

-

94,908

-

-

-

-

44,000

44,000

-

-

-

94,908

44,000

138,908

2015

Trade and other payables

0.00

Borrowings

3.54

-

-

-

There has been no change to the Group’s exposure to liquidity risks or the manner in which it manages and measures the risk from the

previous year.

The following table details the Group’s liquidity analysis for its derivative financial instruments. The table has been drawn up based on the

undiscounted net cash inflows/(outflows) on the derivative instrument that settle on a net basis and the undiscounted gross inflows/(outflows)

on those derivatives that require gross settlement. When the amount payable or receivable is not fixed, the amount disclosed has been

determined by reference to the projected interest rates as illustrated by the yield curves existing at the reporting date.

3 MONTHS

<1 MONTH 1-3 MONTHS

TO 1 YEAR

1-5 YEARS

5 YEARS

TOTAL

$’000 $’000 $’000 $’000 $’000 $’000

2016

BLACKMORES ANNUAL REPORT 2016

100

Net settled:

Interest rate swaps

(84) - (74) 40 -

(118)

(84)

-

(74)

40

-

(118)

2015

Net settled:

Interest rate swaps

(89)

-

(257)

(84)

-

(430)

(89)

-

(257)

(84)

-

(430)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

36 FINANCIAL INSTRUMENTS (CONT.)

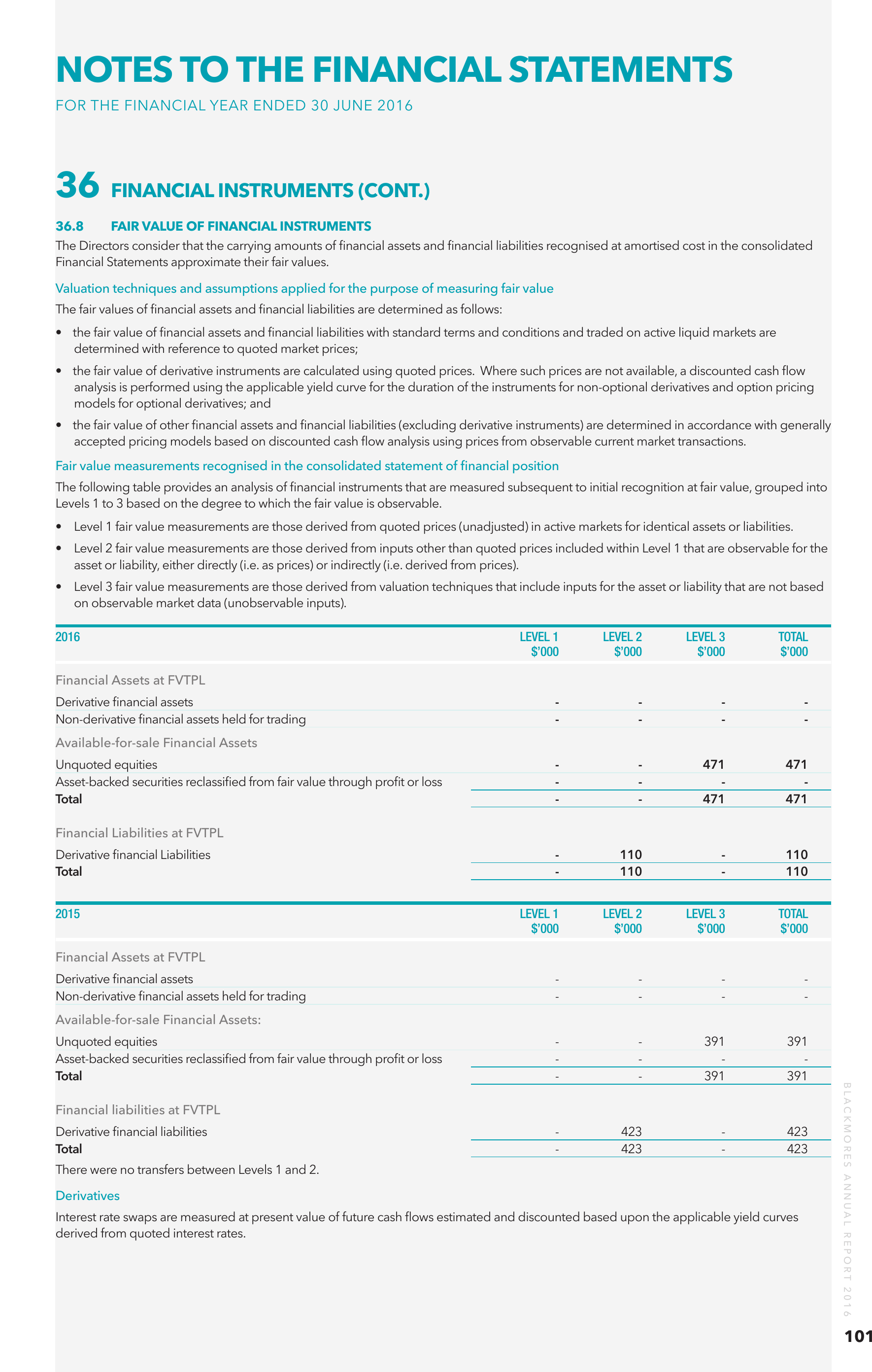

36.8

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Directors consider that the carrying amounts of financial assets and financial liabilities recognised at amortised cost in the consolidated

Financial Statements approximate their fair values.

Valuation techniques and assumptions applied for the purpose of measuring fair value

The fair values of financial assets and financial liabilities are determined as follows:

• the fair value of financial assets and financial liabilities with standard terms and conditions and traded on active liquid markets are

determined with reference to quoted market prices;

• the fair value of derivative instruments are calculated using quoted prices. Where such prices are not available, a discounted cash flow

analysis is performed using the applicable yield curve for the duration of the instruments for non-optional derivatives and option pricing

models for optional derivatives; and

• the fair value of other financial assets and financial liabilities (excluding derivative instruments) are determined in accordance with generally

accepted pricing models based on discounted cash flow analysis using prices from observable current market transactions.

Fair value measurements recognised in the consolidated statement of financial position

The following table provides an analysis of financial instruments that are measured subsequent to initial recognition at fair value, grouped into

Levels 1 to 3 based on the degree to which the fair value is observable.

• Level 1 fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities.

• Level 2 fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are observable for the

asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

• Level 3 fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

2016

LEVEL 1

LEVEL 2

LEVEL 3

TOTAL

$’000 $’000 $’000 $’000

Financial Assets at FVTPL

-

-

-

-

-

-

-

Unquoted equities

-

Asset-backed securities reclassified from fair value through profit or loss

-

Total

-

-

-

-

471

-

471

471

471

110

110

-

-

110

110

Derivative financial assets

Non-derivative financial assets held for trading

Available-for-sale Financial Assets

Financial Liabilities at FVTPL

Derivative financial Liabilities

-

Total

-

2015

LEVEL 1

LEVEL 2

LEVEL 3

TOTAL

$’000 $’000 $’000 $’000

Financial Assets at FVTPL

Derivative financial assets

Non-derivative financial assets held for trading

-

-

-

-

-

-

-

-

-

-

-

-

-

391

-

391

391

391

-

-

423

423

Available-for-sale Financial Assets:

Financial liabilities at FVTPL

Derivative financial liabilities

Total

-

-

423

423

There were no transfers between Levels 1 and 2.

Derivatives

Interest rate swaps are measured at present value of future cash flows estimated and discounted based upon the applicable yield curves

derived from quoted interest rates.

BLACKMORES ANNUAL REPORT 2016

Unquoted equities

Asset-backed securities reclassified from fair value through profit or loss

Total

101

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

37 ASSETS PLEDGED AS SECURITY

In accordance with the security arrangements of liabilities, as disclosed in note 21 to the Consolidated Financial Statements, all assets of the

Parent Entity have been pledged as security. The holder of the security does not have the right to sell or repledge the assets.

38 BUSINESS COMBINATIONS

38.1

SUBSIDIARIES ACQUIRED

On 10 May 2016 Blackmores Limited acquired 100% of Global Therapeutics Pty Limited and 100% of New Century Herbals Pty Limited.

38.2

CONSIDERATION TRANSFERRED

2016

$’000

Cash

Total

22,880

22,880

38.3

ASSETS ACQUIRED AND LIABILITIES ASSUMED AT THE DATE OF ACQUISITION

10 MAY 2016

Current assets

Cash and cash equivalents

219

Trade and other receivables

3,349

Inventories

3,976

Other assets

262

Non-current assets

Deferred tax assets

Plant and equipment

Intangible assets

187

209

14,460

Current liabilities

Trade and other payables

(2,642)

Tax liabilities

(12)

Provisions

(297)

19,711

38.4

GOODWILL ARISING ON ACQUISITION

38.5

NET CASH OUTFLOW ON ACQUISITION OF SUBSIDIARIES

Consideration transferred

Less: fair value of identifiable net assets acquired

Goodwill arising on acquisition

22,880

(19,711)

3,169

Consideration paid in cash

Less: cash and cash equivalent balances acquired

22,880

(219)

22,661

38.6

IMPACT OF ACQUISITION ON THE RESULTS OF THE GROUP

Included in profit for the year is $300 thousand attributable to the additional business generated by Global Therapeutics Limited. Revenue for

the year includes $3,100 thousand.

Had this business combination been effected on 1 July 2015, the revenue of the Group from continuing operations would have been $20,627

thousand and the profit for the year from continuing operations would have been $1,781 thousand. The directors of the Group consider these

‘pro-forma’ numbers to represent an approximate measure of the performance of the combined group on an annualised basis and to provide

a reference point for comparison in future periods.

BLACKMORES ANNUAL REPORT 2016

102

In determining the ‘pro-forma’ revenue and profit of the Group had Global Therapeutics been acquired at the beginning of the current year,

the directors have calculated depreciation of plant and equipment acquired on the basis of the fair values arising in the initial accounting for

the business combination rather than the carrying amounts recognised in the pre-acquisition financial statements.

2015

No subsidiaries were acquired during the financial year ended 30 June 2015.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016

39 PARENT ENTITY INFORMATION

The accounting policies of the Parent Entity, which have been applied in determining the financial information shown below, are the same as those

applied in the consolidated Financial Statements. Refer to note 2 for a summary of the significant accounting policies relating to the Group.

2016 2015

$’000 $’000

Financial position

Assets

Current assets

Non-current assets

Total assets

207,705

154,191

361,896

127,561

114,822

242,383

Liabilities

Current liabilities

Non-current liabilities

Total liabilities

160,735

61,096

221,831

138,209

1,041

139,250

Equity

Issued capital

37,753

37,753

Retained earnings

98,808

59,493

Reserves

3,504 5,887

Total equity

140,065

103,133

Financial performance

Profit for the year

Other comprehensive income

Total comprehensive income

91,164

537

91,701

57,313

(400)

56,913

Guarantees entered into by the parent entity in relation to the debts of its subsidiaries

The Company has provided Letters of Support in relation to Pat Health Ltd and Blackmores (Taiwan) Ltd, both wholly owned subsidiaries of

the Group.

The directors have a reasonable expectation that the Company will have sufficient financial accommodation to enable payment of the

subsidiaries' debts as and when they fall due for a period of at least 12 months from the date of signing the local Financial Statements of the

above mentioned entities.

Contingent liabilities

The Directors do not believe there are any contingent liabilities as at 30 June 2016 (2015: $nil).

Commitments for the acquisition of property, plant and equipment by the parent entity

Plant and equipment

Not longer than 1 year

40 EVENTS AFTER THE REPORTING PERIOD

3,906

3,906

9,800

9,800

Final dividend

The Directors declared a fully franked final dividend of 210 cents per share on 24 August 2016 as described in note 28.

41 APPROVAL OF FINANCIAL STATEMENTS

BLACKMORES ANNUAL REPORT 2016

The Consolidated Financial Statements were approved by the Board of Directors and authorised for issue on 24 August 2016.

103