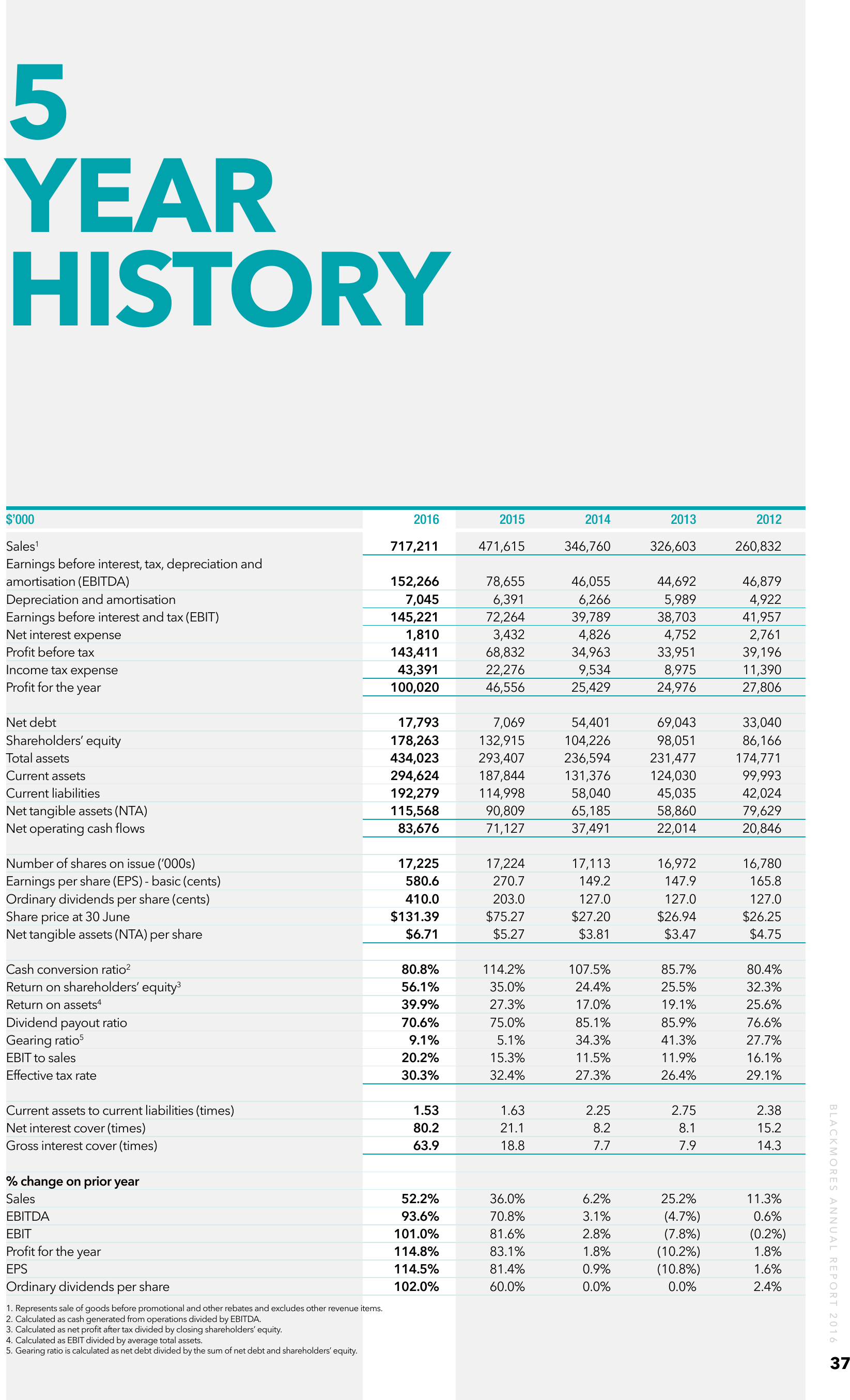

5

5

YEAR

YEAR

HISTORY

HISTORY

2016

2016

717,211

717,211

2015

2015

471,615

471,615

2014

2014

346,760

346,760

2013

2013

326,603

326,603

2012

2012

260,832

260,832

152,266

152,266

7,045

7,045

145,221

145,221

1,810

1,810

143,411

143,411

43,391

43,391

100,020

100,020

78,655

78,655

6,391

6,391

72,264

72,264

3,432

3,432

68,832

68,832

22,276

22,276

46,556

46,556

46,055

46,055

6,266

6,266

39,789

39,789

4,826

4,826

34,963

34,963

9,534

9,534

25,429

25,429

44,692

44,692

5,989

5,989

38,703

38,703

4,752

4,752

33,951

33,951

8,975

8,975

24,976

24,976

46,879

46,879

4,922

4,922

41,957

41,957

2,761

2,761

39,196

39,196

11,390

11,390

27,806

27,806

NetNet debt

debt

Shareholders’ equity

Shareholders’ equity

Total assets

Total assets

Current assets

Current assets

Current liabilities

Current liabilities

NetNet tangible assets (NTA)

tangible assets (NTA)

NetNet operating cash flows

operating cash flows

17,793

17,793

178,263

178,263

434,023

434,023

294,624

294,624

192,279

192,279

115,568

115,568

83,676

83,676

7,069

7,069

132,915

132,915

293,407

293,407

187,844

187,844

114,998

114,998

90,809

90,809

71,127

71,127

54,401

54,401

104,226

104,226

236,594

236,594

131,376

131,376

58,040

58,040

65,185

65,185

37,491

37,491

69,043

69,043

98,051

98,051

231,477

231,477

124,030

124,030

45,035

45,035

58,860

58,860

22,014

22,014

33,040

33,040

86,166

86,166

174,771

174,771

99,993

99,993

42,024

42,024

79,629

79,629

20,846

20,846

Number of shares on issue (’000s)

Number of shares on issue (’000s)

Earnings perper share (EPS) - basic (cents)

Earnings share (EPS) - basic (cents)

Ordinary dividends perper share (cents)

Ordinary dividends share (cents)

Share price at 30 June

Share price at 30 June

NetNet tangible assets (NTA) per share

tangible assets (NTA) per share

17,225

17,225

580.6

580.6

410.0

410.0

$131.39

$131.39

$6.71

$6.71

17,224

17,224

270.7

270.7

203.0

203.0

$75.27

$75.27

$5.27

$5.27

17,113

17,113

149.2

149.2

127.0

127.0

$27.20

$27.20

$3.81

$3.81

16,972

16,972

147.9

147.9

127.0

127.0

$26.94

$26.94

$3.47

$3.47

16,780

16,780

165.8

165.8

127.0

127.0

$26.25

$26.25

$4.75

$4.75

80.8%

80.8%

56.1%

56.1%

39.9%

39.9%

70.6%

70.6%

9.1%

9.1%

20.2%

20.2%

30.3%

30.3%

114.2%

114.2%

35.0%

35.0%

27.3%

27.3%

75.0%

75.0%

5.1%

5.1%

15.3%

15.3%

32.4%

32.4%

107.5%

107.5%

24.4%

24.4%

17.0%

17.0%

85.1%

85.1%

34.3%

34.3%

11.5%

11.5%

27.3%

27.3%

85.7%

85.7%

25.5%

25.5%

19.1%

19.1%

85.9%

85.9%

41.3%

41.3%

11.9%

11.9%

26.4%

26.4%

80.4%

80.4%

32.3%

32.3%

25.6%

25.6%

76.6%

76.6%

27.7%

27.7%

16.1%

16.1%

29.1%

29.1%

1.53

1.53

80.2

80.2

63.9

63.9

1.63

1.63

21.1

21.1

18.8

18.8

2.25

2.25

8.2

8.2

7.7

7.7

2.75

2.75

8.1

8.1

7.9

7.9

2.38

2.38

15.2

15.2

14.3

14.3

52.2%

52.2%

93.6%

93.6%

101.0%

101.0%

114.8%

114.8%

114.5%

114.5%

102.0%

102.0%

36.0%

36.0%

70.8%

70.8%

81.6%

81.6%

83.1%

83.1%

81.4%

81.4%

60.0%

60.0%

6.2%

6.2%

3.1%

3.1%

2.8%

2.8%

1.8%

1.8%

0.9%

0.9%

0.0%

0.0%

25.2%

25.2%

(4.7%)

(4.7%)

(7.8%)

(7.8%)

(10.2%)

(10.2%)

(10.8%)

(10.8%)

0.0%

0.0%

11.3%

11.3%

0.6%

0.6%

(0.2%)

(0.2%)

1.8%

1.8%

1.6%

1.6%

2.4%

2.4%

Cash conversion ratio2 2

Cash conversion ratio

Return on shareholders’ equity3 3

Return on shareholders’ equity

Return on assets4 4

Return on assets

Dividend payout ratio

Dividend payout ratio

Gearing ratio5 5

Gearing ratio

EBIT to sales

EBIT to sales

Effective tax tax rate

Effective rate

Current assets to current liabilities (times)

Current assets to current liabilities (times)

NetNet interest cover (times)

interest cover (times)

Gross interest cover (times)

Gross interest cover (times)

% change on prior year

% change on prior year

Sales

Sales

EBITDA

EBITDA

EBIT

EBIT

Profit for thethe year

Profit for year

EPS

EPS

Ordinary dividends perper share

Ordinary dividends share

1. Represents sale of goods before promotional and other rebates and excludes other revenue items.

1. Represents sale of goods before promotional and other rebates and excludes other revenue items.

2. Calculated as cash cash generated from operations divided by EBITDA.

2. Calculated as generated from operations divided by EBITDA.

3. Calculated as net profit after after tax divided by closing shareholders’ equity.

3. Calculated as net profit tax divided by closing shareholders’ equity.

4. Calculated as EBIT EBIT divided by average total assets.

4. Calculated as divided by average total assets.

5. Gearing ratio is calculated as net debt debt divided by the sum ofdebtdebt shareholders’ equity.

5. Gearing ratio is calculated as net divided by the sum of net net and and shareholders’ equity.

BLACKMORES ANNUAL REPORT 2016

BLACKMORES ANNUAL REPORT 2016

$’000

$’000

Sales1 1

Sales

Earnings before interest, tax, depreciation and

Earnings before interest, tax, depreciation and

amortisation (EBITDA)

amortisation (EBITDA)

Depreciation and amortisation

Depreciation and amortisation

Earnings before interest and tax (EBIT)

Earnings before interest and tax (EBIT)

Net interest expense

Net interest expense

Profit before tax

Profit before tax

Income tax expense

Income tax expense

Profit for the year

Profit for the year

37

37